Fortune News | May 27,2023

Jan 7 , 2023

By Yehualashet Tamiru Tegegn

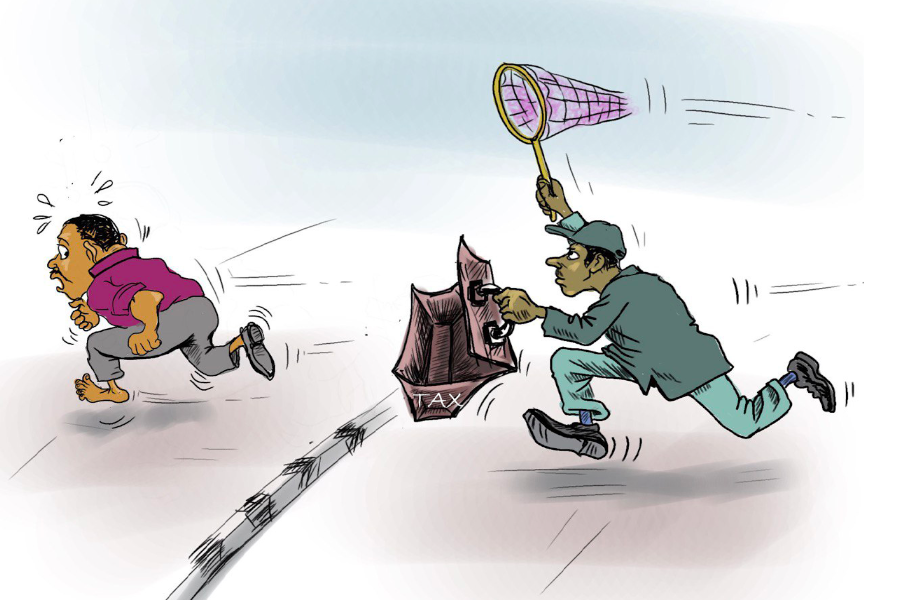

Tax is one of the major concerns for any foreign investor, and it is no surprise to see frequent conflicts between taxpayers and the authorities regarding treatment, writes Yehualashet Tegegn. He is an adjunct Lecturer at AAU, Associate MLA and can be reached (yehuala5779@gmail.com)

Over the decade, Ethiopia has been one of the top foreign investment destinations. As a country with immense potential, Ethiopia is trying to attract foreign direct investment (FDI), among others, through tax incentives with better dispute resolution mechanisms which emanate from Bilateral Investment Treaties (BITs). Ethiopia has BITs with 33 countries worldwide.

Tax is one of the major concerns for any foreign investor, and it is unsurprising to see frequent conflicts between taxpayers and the authorities regarding tax matters.

The power and function of the executive branch of the federal government include administering and enforcing tax laws. It is empowered to issue administrative rules such as regulations, directives, circulars, and tax guides. On top of this, under the Ethiopian tax regime, the executive bodies can also interpret and put exemptions while enforcing tax laws as it has a margin of appreciation.

For instance, under the Income Tax Proclamation, the Council of Ministers is mandated to exempt any income for economic, administrative, or social reasons. The Ministry of Finance is also empowered to issue exemptions and waivers.

The Ministry of Finance has the legal basis to agree to waive tax obligations or not be taxable, which translates to a contract between the tax authority and the taxpayer (in this context, would be the investor) to waive their tax responsibility. This, in most cases, is indicated under the contract.

In the eyes of the law, the contract provisions are binding as though they were laws with agreements obliged with the terms of the deal, a principle that is a basic tenet to which courts firmly adhere. An agreement between the investor and the tax authority is binding and enforceable. As a rule, a contract must be performed strictly with the agreed-upon terms and conditions. If the tax authority refuses to live up to its obligation under the contract, waiver of tax obligation can bring an actionable claim before the court. Following a default notice to the tax authority, the beneficiary can seek forced performance of the contract by waiver of the obligation and compensation.

At the initial stage, the agreement's enforceability and abidingness are not helpful for tax cases as the tax authority enforces its claim without filing an execution proceeding for the tax liability. As the assessment is against the taxpayer, the authority will look for payment from the taxpayer despite a legally binding and enforceable agreement.

Thus, what are the possible remedies for such a dispute between the taxpayer and the Ministry?

Under BITs, the standard clause for dispute resolution between the investor, in this case, would be the taxpayer and the host state; the investor can resort to international arbitration. According to the typical phrase of such dispute clause, any contracting parties concerning the interpretation and application shall be settled through arbitration or negotiation. If a dispute cannot be resolved within six months, it shall be submitted to an arbitration tribunal upon request of either contracting party. As per the Umbrella clause, any breach of the contract amounts to a breach of the BIT. Thus, the investor can drag the state to international arbitration for not respecting the agreement to waive or exempt from its tax obligations.

This, however, contradicts the existing tax dispute resolution mechanisms in Ethiopia. Under the existing tax regime, the available tax dispute resolution schema is a unified and singular path in any tax dispute. The taxpayers have a right to appeal grievances before the review committee if they are dissatisfied with its decision. They can also appeal to the Tax Appeal Commission (TAC) and the Federal High Court within 30 days of the decision date.

If the lower court's decision has any fundamental error of law, the taxpayer may appeal to the cassation bench of the Federal Supreme Court as the last resolution.

To this stand, no provision recognizes the settlement of tax disputes through arbitration. The very nature of tax indicated is that there is no room for extensive interpretation of the law, or it should be construed narrowly. The absence of an explicit provision about recognition of tax disputes through arbitration can be construed to mean it is prohibited as one means of tax dispute resolution mechanisms in Ethiopia.

Moreover, without any exception, the new Arbitration and Conciliation Working Procedure Proclamation makes it abundantly clear that tax cases are non-arbitrable matters in Ethiopia. This highly poses a massive problem in the enforceability of the arbitration award. Thus, any award given by international tribunals, usually from institutions arbitration, is highly unlikely to be recognized and enforced. This is because, first and foremost, the Ethiopian government can easily apply to the court to set aside the award as a matter non-arbitrable under Ethiopian law. In addition, there are various preconditions for the Ethiopian court to recognize and enforce arbitration awards. One of which is that the matter should be arbitrable under Ethiopian law.

In the same notion, Ethiopia has recently ratified the New York Convention on Recognition and Enforcement of Foreign Awards (The New York Convention). The New York Convention enables the Ethiopian courts to refuse recognition and enforcement of an award if they find that the subject matter of the difference which led to the award is not capable of settlement by arbitration under the law of the country where recognition and enforcement are sought. Thus, any dispute regarding tax assumed and entertained by an arbitration tribunal, whether domestic or foreign, is highly likely it would not be recognized and enforced in Ethiopia.

As one of the top priorities of foreign investors, tax treatment and the dispute arising thereof is well addressed under international investment agreements and private contracts between the investor and the Ministry of Finance. However, such clauses and agreements will not have any effect as tax is a non-arbitrable matter under Ethiopian law.

PUBLISHED ON

Jan 07,2023 [ VOL

23 , NO

1184]

Fortune News | May 27,2023

Editorial | Nov 23,2024

Fortune News | Mar 09,2024

Commentaries | Jun 15,2024

Radar | Nov 27,2018

Fortune News | May 17,2025

Fortune News | Aug 26,2023

Life Matters | Nov 23,2024

Fortune News | Jan 13,2024

Fortune News | Jun 08,2019

My Opinion | 132105 Views | Aug 14,2021

My Opinion | 128507 Views | Aug 21,2021

My Opinion | 126435 Views | Sep 10,2021

My Opinion | 124046 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jul 13 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Revenue Bureau has introduced a new directive set to reshape how...

Jul 13 , 2025 . By BEZAWIT HULUAGER

Addis Abeba has approved a record 350 billion Br budget for the 2025/26 fiscal year,...

Jul 13 , 2025 . By RUTH BERHANU

The Addis Abeba Revenue Bureau has scrapped a value-added tax (VAT) on unprocessed ve...

Jul 13 , 2025 . By NAHOM AYELE

Federal lawmakers have finally brought closure to a protracted and contentious tax de...