Editorial | Oct 14,2023

Nov 23 , 2024.

The fiscal puzzle deepens as the Council of Ministers approved a supplementary budget of 581 billion Br last week, over half the federal budget ratified only months ago. Not even halfway through the fiscal year, Prime Minister Abiy Ahmed's (PhD) administration faces mounting pressure following the liberalisation of the foreign exchange market, which triggered an unprecedented erosion of the Birr against major currencies. Despite government ambitions to raise 1.5 trillion Br in domestic revenues next year, the budget deficit is set to widen.

Trying times loom for the government, and businesses are expected to shoulder the financial burden.

The tax system is transforming as authorities intensify efforts to boost revenues. Initiatives such as the crackdown on receipt issuance in Mercato, the largest open market in Africa, and heightened scrutiny on under-invoicing signal an urgent attempt to bridge the fiscal deficit and address inefficiencies in foreign exchange management. Yet, these reforms have ignited public discontent over their broader economic and social consequences.

In a country where small businesses constitute the backbone of the economy, and an increasing number of informal traders wrestle with taxation compliance, the fiscal authorities' approach should warrant closer examination. Economic recovery and growth depend on balancing taxation, regulation, and encouraging a thriving business environment. Addressing the root causes of economic malaise, including economic downturns and informal financial practices, should be imperative.

Trade practices remain largely dependent on basic import-export activities. Encouraging businesses to explore value-added industries and improve domestic productivity is essential. Pursuing long-term economic reforms is vital to modernise the tax systems and support sustainable trade practices. The current domestic revenue mobilisation mechanisms are inefficient and outdated, leading to lost revenues and unreported transactions. Overhauling these systems to ensure real-time revenue access and greater transparency would make tax collection more efficient and encourage businesses to operate within the formal economy.

Economic volatility is partly a consequence of political instability. Frequent shifts in government policies and priorities breed uncertainty, undermining business confidence and deterring investment. A more consistent, long-term vision for economic growth is needed, moving beyond reactive measures like tax hikes and shop closures. Revenue generation should stem from a balanced approach, ensuring taxes are neither too high to burden traders nor too low to restrict public services.

While enforcing tax compliance is important, policies could prioritise the population's well-being. Closing down small businesses and implementing harsh taxation measures may appear as solutions to fiscal issues, but such actions can erode public trust. Ethical governance involves creating systems that help companies to thrive and encourage voluntary compliance with regulations. The authorities should focus on improving citizens' livelihoods, especially small traders who are hardest hit by the stringent measures. This approach requires investing in training, education, and crafting a business-friendly environment that promotes the formalisation of the economy without penalising those striving to make a living.

Understandably, raising domestic revenues is the lifeblood of any state, funding schools, hospitals, roads, and other pillars of stability. Yet, even this basic function becomes a Sisyphean task for fragile and conflict-prone states like Ethiopia. Despite efforts to strengthen fiscal systems, these countries remain trapped in a cycle of fragility, unable to collect sufficient domestic revenues to sustain their economies, let alone promote long-term development.

According to the International Monetary Fund (IMF), fragile states, home to nearly half the world's poorest people by 2030, collect an average of 12pc of GDP in tax revenues, six percentage points below their non-fragile peers. Ethiopia's is even further down at eight percent. These gaps are beyond technical problems, reflecting broader institutional voids defining fragility such as corruption, weak governance, and political instability.

In some countries where insurgencies wreaked economic havoc, fragile states' reliance on external factors such as remittances uncovers the precariousness of domestic revenue streams. The data are sobering. According to the IMF, these states struggle particularly with taxes on goods and services, the bedrock of many modern tax systems. These taxes constitute two to three percent of GDP in fragile states, compared to six to eight percent in non-fragile developing countries. The reasons are manifold, including limited administrative capacity, fear of social unrest, and lack of political will to confront entrenched interests.

Institutional improvement and sustained political commitment are imperative. Even marginal gains in governance, such as reducing corruption or enhancing bureaucratic effectiveness, can lead to marked revenue increases. But these are precisely the areas where fragile states face the greatest difficulties.

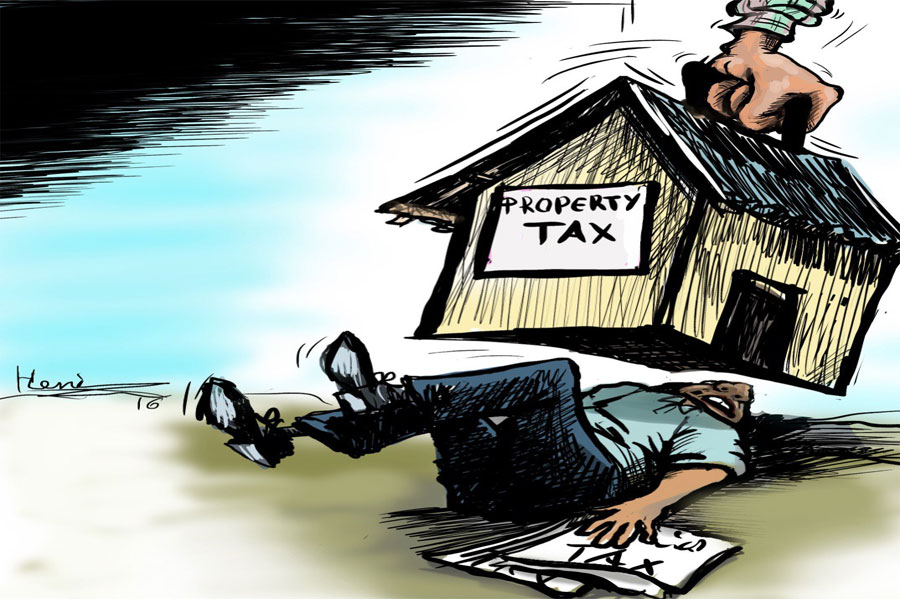

Global pandemics, such as COVID-19, added a new layer of complexity, decimating revenue bases as economies contracted and governments were compelled to provide emergency relief or forfeited domestic revenues. Fragile states saw their average tax-to-GDP ratios dip further, from an already low 12pc to 11.3pc in 2020. The long-term consequences could be devastating without aggressive measures to rebuild tax bases.

Targeting high-potential sectors, simplifying tax systems and focusing on large taxpayers can help fragile states build momentum. However, the larger lesson is that tax reforms require more than technical fixes. They demand political courage, a clear vision, domestic consensus and sustained support from international partners. Ultimately, the struggle to mobilise domestic revenues in fragile states is about more than budgets and balance sheets. It is a test of whether governments can deliver the stability, services, and opportunities their citizens deserve. The stakes could not be higher as these countries walk the tightrope to ensure law and order that offers businesses the mobility they seek.

Ethiopia's situation encapsulates this fragility. The administration's ongoing aggressive revenue-boosting measures risk stifling the very economic activities it pursues to tax. Balancing the immediate need for funds with the longer-term goal of economic growth is a delicate act. The authorities should ensure that their policies do not undermine small businesses and informal traders, who are vital to the economy.

The path forward demands reimagining the relationship between the state and its citizens. Governments should build trust by demonstrating commitment to competence, transparency, efficiency, and the welfare of the broader population.

PUBLISHED ON

Nov 23,2024 [ VOL

25 , NO

1282]

Editorial | Oct 14,2023

Viewpoints | Jul 07,2024

Fortune News | Jan 05,2019

Fortune News | May 27,2023

Radar | May 04,2025

Radar | Feb 15,2020

Digital First | Mar 13,2020

Editorial | Oct 28,2023

Fortune News | Sep 01,2024

Agenda | Apr 03,2021

My Opinion | 131970 Views | Aug 14,2021

My Opinion | 128359 Views | Aug 21,2021

My Opinion | 126297 Views | Sep 10,2021

My Opinion | 123912 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 6 , 2025 . By BEZAWIT HULUAGER

The federal legislature gave Prime Minister Abiy Ahmed (PhD) what he wanted: a 1.9 tr...

Jul 6 , 2025 . By YITBAREK GETACHEW

In a city rising skyward at breakneck speed, a reckoning has arrived. Authorities in...

Jul 6 , 2025 . By NAHOM AYELE

A landmark directive from the Ministry of Finance signals a paradigm shift in the cou...

Jul 6 , 2025 . By NAHOM AYELE

Awash Bank has announced plans to establish a dedicated investment banking subsidiary...