Radar | Sep 17,2022

Debre Birhan Natural Spring Water (DBNSW) S.C., the Company behind the AquaSafe bottled water brand, has suspended its operations amid a dispute with federal tax authorities, involving hundreds of millions of Birr.

The tax dispute, which unfolded over the past two years, followed an audit of the Company's finances, with federal tax authorities claiming over 600 million Br in tax liabilities. The audit questioned the Company's financial practices, leading to severe measures, including asset seizures and bank account freezes, significantly impacting its operations and workforce. Over 300 employees faced uncertainty as the Company battled the claims by federal authorities.

The Company has been a major player in the water bottling industry for over eight years. Its plant covers 10,000Sqm and has an hourly production capacity of 13,000 bottles. Located in the scenic town of Debre Birhan, 130Km north of Addis Abeba in the Amhara Regional State, DBNSW was incorporated in 1999 by Gebeyaw Takele and his family. It underwent several ownership changes before 54Capital acquired 98pc of the shares.

Trade registration documents revealed that 54Capital, a private equity firm registered in the United Kingdom (UK) in 2013, was dissolved in 2022. It has been acquired by SAMANU, a conglomerate overseeing various consumer brands, including Tena edible oil, 555 Household Care and Aura soap and detergents. Despite these changes, company representatives claim the legal relationship between DBNSW and SAMANU remains defined by specific agreements without direct shareholding ties.

According to Lemlem Fekadu, SAMANU's legal department head, the presence of the Aquasafe brand on the Company's website results from an agreement between the two companies that "cannot be publicly disclosed but with no shareholders relationship" between the two entities.

However, the ambiguous ownership structure has not spared the bottling company from ceasing production.

DBNSW's course took an unexpected turn when it acquired another plant after three years of operation as part of a strategic expansion. It triggered a three-year investigative audit by federal tax authorities on the first plant, as the audit findings led to a cascade of events that would alter the Company's fate. Claims by federal tax authorities put the Company and its employees in a precarious situation.

The executives of DBNSW sought to contest the audit's findings, appealing to the federal tax-appellate tribunal for relief.

The tribunal's requirement of a 50pc deposit of the tax assessed to proceed with the appeal, however, presented another obstacle. Company executives have voiced their frustrations with the audit process and the substantial financial burden it imposed, arguing that the process was flawed. Aziz Iraqi, members of the senior management team at the forefront of the tax battle, expressed deep disappointment in the process despite years of efforts to appeal and request a reevaluation of the audit findings.

"The findings were completely wrong," he told Fortune.

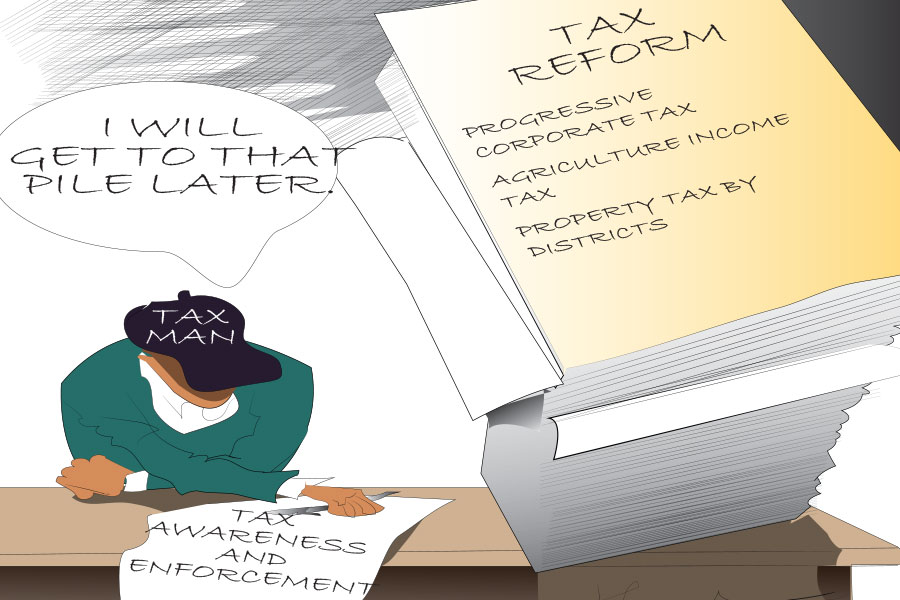

Most audits have led to prolonged disputes, particularly within the manufacturing sector. Experts call for reform in the auditing and taxation processes to ensure a fairer approach that supports growth and sustainability. With audit statements being inflated, a tax expert who requested anonymity has raised concerns about the legality of the auditing practices. He claimed an acute flaw in audit processes and tax assessments, failing to consider the potential losses in production.

"Tax authorities' mindset tends to focus on a company's revenue target rather than its actual performance," he said. "It should be centred on performance metrics."

Raising questions about the fairness and accuracy of the tax assessment process, the expert urged a reevaluation of current practices, emphasising the need to examine tax dues and prevent potential adverse effects on the manufacturing sector.

Reta Asefa is a director of the IT Development Administration at the Ministry of Revenues. He believes businesses are entrusted with declaring taxes, stressing the potential for discrepancies, and pointing out the possibility of companies underrepresenting revenues and overstating costs discovered during audits.

"Underreporting persists in some cases," he said.

The Ministry of Finance is mandated to consider waiving interests on taxes. According to Abraham Rega, the Ministry's legal advisor, the likelihood of this happening is rare. However, he acknowledged the exceptional measures, including interest exemptions and settlement reschedules, such as during the COVID-19 pandemic three years ago, conflict situations, and natural disaster relief measures.

The directives issued to provide fiscal relief to taxpayers were repealed last year, and according to Abraham, the reliefs were limited even during their existence.

The executives have made multiple appeals to the tax authorities and the Ministry of Finance, requesting a waiver of interest and penalties, reaching 372 million Br. They had offered to settle 221 million Br in the principal tax over time, contingent on the resumption of their operations. Firehwot Teka, the chief financial officer (CFO), bemoaned the lack of response from the authorities, leaving the Company in limbo. Three months ago, another round of appeals sought the waiver of penalties and the bank accounts unfrozen. It bore no fruit.

According to Aziz, settling excessive payments without the means of production is difficult. He disclosed that company executives were compelled to persuade shareholders for funds to address tax claims, to ensure the continuation of operations. He argued that settlements should consider the possibility of operational recovery, emphasising the need to operate to generate revenues.

"We've no choice," said Aziz. "Our hands are tied."

However, officials of the Ministry of Revenues maintained an uncompromising position, reflecting the government's ambitious tax mobilisation target at a time of economic hardship. They offered to waive penalties provided that 15pc of the total tax liability was deposited upfront, with the balance to be settled in 24 months.

"Despite the unusual considerations, they still didn't want to comply," said Yeruf Gemechu, an official at the Ministry's Medium Taxpayers Office.

He warned that failure to address the issue could lead to the auctioning of the Company's assets.

Ethiopia's manufacturing sector faces numerous hurdles, including foreign currency shortages and high input costs. Caught in the Ministry's ambitious target to collect 440 billion Br in tax revenues this fiscal year – a 35 billion Br increase from last year – businesses are under heightened pressures from the authorities.

DBNSW, operating at only 20pc capacity, illustrates the sector's struggles, as it is confronted with a competitive market and limited resources. According to industry sources, the Company needed no less than 300,000 dollars a month to operate at full capacity but struggled to secure even a fraction in the forex-strapped economy with a market share declining to less than 10pc.

The tax dispute has broader implications, affecting the livelihoods of its employees. The job security of 300 workers hangs in the balance. The Confederation of Ethiopian Trade Union (CETU) has appealed to the Ministry of Revenues on behalf of the Company. Leaders of CETU have intervened, advocating for the workers' rights amid the uncertainty. However, the Confederation's leaders acknowledge their limited influence over resolving the tax dispute.

Diribsa Legesse serves as CETU's head of industrial relations, trying to shield workers from the burdens of job losses. Despite the Confederation's efforts to secure adequate severance packages in the event of layoffs and preserve job security if operations were to resume, Diribsa acknowledged limits to its mandate.

"We can't do much to resolve tax issues," he told Fortune.

As the threat of termination looms, Tilaye Workneh, the deputy chairman of the trade union at the bottling company, remains anxious about the growing fear permeating the workforce. He described the situation as "unfortunate" where most employees have been unable to secure alternative employment, leaving them uncertain at home and apprehensive at work about what the future might hold.

Wendimu Abebayehu (PhD), who has worked for the Company for over eight years, is one of DBNSW's employees under stress. He tried to find another job for over a year but realised that opportunities are rare in the region due to ongoing conflicts.

"It's been hard," he told Fortune.

Firehiwot, the CFO, was also worried about the reality DBNSW faces, where difficult decisions could be made to steer through turbulent times. She warned of the likelihood of job terminations if the Company's problems remain unaddressed.

"It appears like there might be no other way," she told Fortune.

PUBLISHED ON

Mar 09,2024 [ VOL

24 , NO

1245]

Radar | Sep 17,2022

Editorial | Feb 23,2019

Radar | Sep 23,2023

Radar | Jun 22,2019

Commentaries | Jan 04,2020

Fortune News | Dec 10,2018

Radar | Dec 14,2019

Fortune News | Sep 04,2021

Exclusive Interviews | Jan 05,2020

Fortune News | Jul 13,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...