Fortune News | Feb 25,2023

Jun 15 , 2024

By Abdulmenan M. Hamza

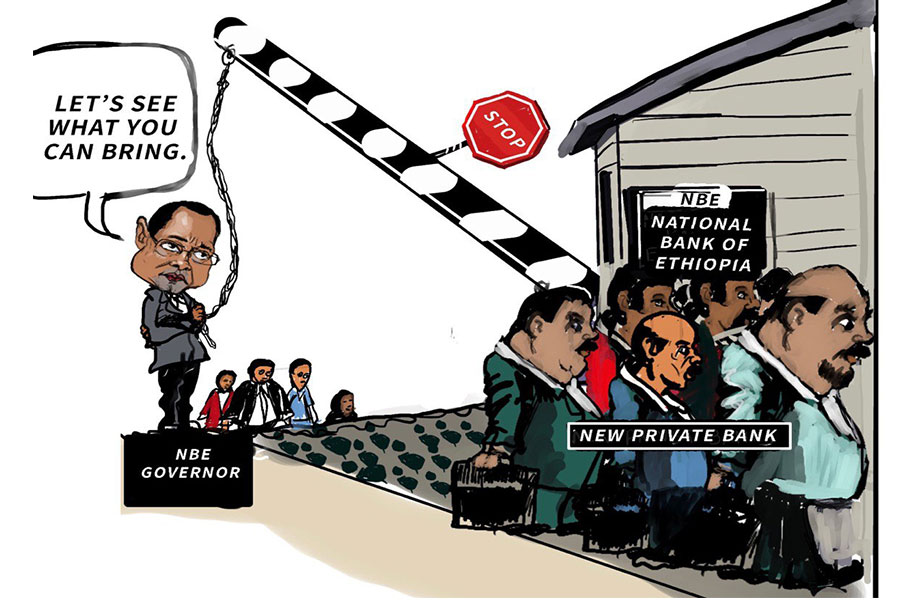

Central Bank's new draft directives aim to close loopholes and tighten the reins on credit exposures. Removing government guarantees as cash substitutes and including state-owned enterprises as related parties are set to curb unchecked borrowing. But will these changes be enough to steer CBE and the banking sector towards stability, asks Abdulmenan M. Hamza (abham2010@yahoo.co.uk), a financial analyst based in London.

The National Bank of Ethiopia (NBE) has issued several crucial reforms targeting the banking industry as part of its three-year strategic plan, starting in 2023. These reforms are encapsulated in various directives, addressing key issues like related parties and limits on larger exposures. Historically, the central bank's primary role has been to ensure the stability of the financial sector.

However, successive governments' ideological orientations have often influenced the central bank to align its regulatory approach with their economic policies, sidelining its primary responsibility and causing significant repercussions for the financial system.

The Commercial Bank of Ethiopia (CBE) is a prime example of this issue. Regarded as a crucial policy tool by the government, the state-owned bank has frequently been allowed to bypass NBE's regulations. The preferential treatment has led to severe problems, including substantial credit and systemic risks within the banking industry. Regulatory frameworks designed to curb credit concentration, encourage diversification, ensure adequate capital, and prevent related party transactions have been undermined by exceptions favouring government and public enterprises.

One significant issue has been the treatment of guarantees issued by the federal government as cash substitutes. Under existing directives, loans fully guaranteed by the federal government are excluded from limits on single borrowers and related counterparties. This exclusion has allowed the CBE to extend substantial credits to public enterprises with no regard for capital adequacy or credit serviceability, exposing the state bank to enormous credit risk and, by extension, increasing the systemic risk to the entire banking sector.

The situation is exacerbated because the CBE has extended credit to single borrowers in amounts far exceeding its capital. Many of these borrowers have questionable financial capacity to settle their debts, a situation known to central bank authorities. CBE's capital was also artificially inflated in 2017 by holding a 10-year government bond, which remains outstanding.

In response to the growing concerns, the government incorporated the Liabilities & Assets Management Corporation (LAMCO) a few years ago to absorb the debts of struggling public enterprises and address these issues. However, the recent parliamentary report by Minister of Finance Ahmed Shide unearthed the difficulties LAMCO faces in servicing its debts to the CBE due to a sluggish privatisation process.

Consequently, the CBE has found itself in a precarious financial position.

Recognising these problems, the NBE has released draft directives addressing the pitfalls of a directive issued in 2012 (No. SBB/53) governing credit exposures to single and related counterparties. The new draft directive on related parties introduces noteworthy changes, such as removing the "unconditional obligation or guarantee" issued by the federal government as a cash substitute. The definition of "related party" has been broadened to include state-owned banks and enterprises; the CBE and these enterprises are now treated as related parties.

The change mandates the CBE to apply the "Arm's Length Principle" in its dealings with these entities. These amendments, combined with the new limitations on the amount of credit the CBE can grant to related parties, are expected to curtail unchecked borrowing by public enterprises and government agencies, contributing to the financial sector's stability.

The central bank's draft directive on large exposures is another critical reform. Its Financial Stability Report released in April 2024 revealed that loans to the top 10 borrowers accounted for 23.5pc of the banking industry's credits as of June 2023. Such a high level of credit concentration poses a consequential risk to the banking industry. Hence, the draft directive sets several limits on larger exposures.

While this measure is commendable, there are some concerns.

The draft directive maintains the "cash substitute" definition from the 2012 directive, contradicting the draft directive on related party transactions. It opens a potential loophole for abuse, requiring immediate rectification to prevent further systemic risks.

The CBE's financial troubles have derived from undue state intervention. For the banking sector to thrive, the NBE needs regulatory autonomy, and the CBE must play by market rules. Increased supervision and adherence to new directives could address risks and restore confidence. These reforms are crucial, but success depends on a steadfast commitment to integrity and stability.

PUBLISHED ON

Jun 15,2024 [ VOL

25 , NO

1259]

Fortune News | Feb 25,2023

Fortune News | Mar 16,2019

Editorial | Jul 30,2022

Featured | Apr 26,2019

My Opinion | May 28,2022

Radar | Jan 25,2020

Sunday with Eden | Jun 17,2023

Agenda | Dec 21,2019

Fortune News | May 23,2025

Commentaries | Feb 12,2022

My Opinion | 131970 Views | Aug 14,2021

My Opinion | 128359 Views | Aug 21,2021

My Opinion | 126296 Views | Sep 10,2021

My Opinion | 123912 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jul 6 , 2025 . By BEZAWIT HULUAGER

The federal legislature gave Prime Minister Abiy Ahmed (PhD) what he wanted: a 1.9 tr...

Jul 6 , 2025 . By YITBAREK GETACHEW

In a city rising skyward at breakneck speed, a reckoning has arrived. Authorities in...

Jul 6 , 2025 . By NAHOM AYELE

A landmark directive from the Ministry of Finance signals a paradigm shift in the cou...

Jul 6 , 2025 . By NAHOM AYELE

Awash Bank has announced plans to establish a dedicated investment banking subsidiary...