Editorial | Jul 18,2020

Nov 1 , 2025

By Vera Songwe

A new global SDR issuance, proportionate to the 20 billion dollars offered to Argentina, could mean over 200 billion dollars for Africa alone. In this commentary provided by Project Syndicate, Vera Songwe (PhD), a founder and chair of the Liquidity & Sustainability Facility and co-chair of the Expert Review on Debt, Nature, & Climate, argued that the potential to fight inflation, build infrastructure, invest in artificial intelligence, and move up the value chain in critical minerals, all without incurring crippling new debt, is immense.

President Donald Trump's Administration has offered a gift to finance ministers from developing countries. By proposing a 20 billion dollar currency swap line for Argentina, it has implicitly aligned itself with those arguing for a new issuance of special drawing rights (SDRs), the International Monetary Fund's (IMF) reserve asset.

Of course, many ministers, busy discussing their tight fiscal frameworks with the IMF, may have missed this. Fortunately, the gift is still on the table. The IMF and developing countries should endorse the US Treasury's offer to Argentina, but also ask for a global issuance of new SDRs. By taking up this idea, the United States could achieve a major strategic victory, even though Trump's reasons for offering help to Argentina are primarily to support an important US ally, President Javier Milei, and to strengthen ties with an ally.

Five years after the COVID-19 pandemic began, and four years since the last such issuance, developing countries have drawn down most of their SDRs. By January 2023, more than 23 low-income and 21 middle-income countries had used their entire 2021 allocation. In Africa, 19 countries were so desperate for liquidity that they drew down more than 100pc of their allocations.

The benefits of SDR allocations cannot be overstated. Though small and uneven, the 2021 issuance helped countries procure COVID-19 vaccines, provide relief to businesses, launch safety-net programs to sustain lives and livelihoods, and mobilise investments in new vaccine manufacturing capacity. In many cases, these measures helped avert deeper social crises and unrest.

But while the 2021 allocation helped countries steady the bridge, it was not large enough to help them cross it.

Of the 650 billion dollars, the largest allocation in the IMF's history, Africa received about 33 billion dollars, and Argentina 3.1 billion dollars. In neither case was the sum large enough. Argentina was able to meet its debt obligations to the IMF, using 100pc of its SDR allocations to pay the IMF, but it still faced massive debt-service payments. Now, the US Treasury is proposing a swap nearly six times larger than the 2021 allocation.

Support on such a scale would provide meaningful relief, and if combined with a robust package of policy reforms, it could help Argentina break its long-running cycle of unsuccessful IMF bailout programs.

A similarly proportionate allocation to Africa, over 200 billion dollars, could allow many countries to start tackling inflation, improve infrastructure, and keep up in the AI race. Some would be able to invest in ascending the value chain in the critical minerals sector, which would redound to America's benefit. And all African countries could come together to support regional institutions, strengthening their balance sheets and allowing for greater leverage in investments (consistent with the Hybrid Capital proposal from the African Development Bank (AfDB) and the Inter-American Development Bank).

Africa, Argentina, and many developing economies around the world need additional resources to manage the liquidity crunch stemming from increased fiscal stress, mounting global imbalances, the high costs of capital, and the massive subsidies offered by the developed world to attract and keep capital.

A new SDR issuance under a US-led G20 would showcase American leadership on an issue that has frustrated others who have tried to address it. With G7 members increasingly struggling to manage their own fiscal stress, it would alleviate the need for them to make transfers to developing countries. In the US, Japan, France, Italy, and the United Kingdom, interest payments alone now represent three percent of GDP.

According to the IMF, Japan's debt-service cost at current rates is expected to exceed 180 billion dollars in 2025, more than 10 times its development aid budget.

One of the many advantages of SDRs is that they are non-debt-creating reserve assets until monetised, and even then, the cost of conversion is still lower than borrowing at concessional rates. This makes SDRs a commonsense way to provide low-cost capital to all lower-middle-income and middle-income countries.

Rather than provide a swap line, where US taxpayers are essentially sending money to Argentina, the US could provide broad-based support to many countries under one framework. It could still withhold allocations from the handful of countries that it may not want to support, and it would avoid the risk of lending to a party that may default (as in Argentina's case). In fact, by shoring up other economies, the US would still be supporting Argentina, given Argentina's reliance on exports.

The US still holds a unique leadership role in the world. It could use its power not only to roll out a global safety net at a time when one is urgently needed, but also to ensure that the next allocation is large enough to give countries the liquidity they need to invest in growth and jobs, reduce migration, and escape from debt distress.

The Trump Administration's proposed Argentina swap line could be a step in the right direction. But there is a better way. The US could spare taxpayers the cost of lending money to other countries while still providing those countries with support. Doing so would deliver a major strategic and economic victory, giving the US a big win at the very start of its G20 presidency.

PUBLISHED ON

Nov 01,2025 [ VOL

26 , NO

1331]

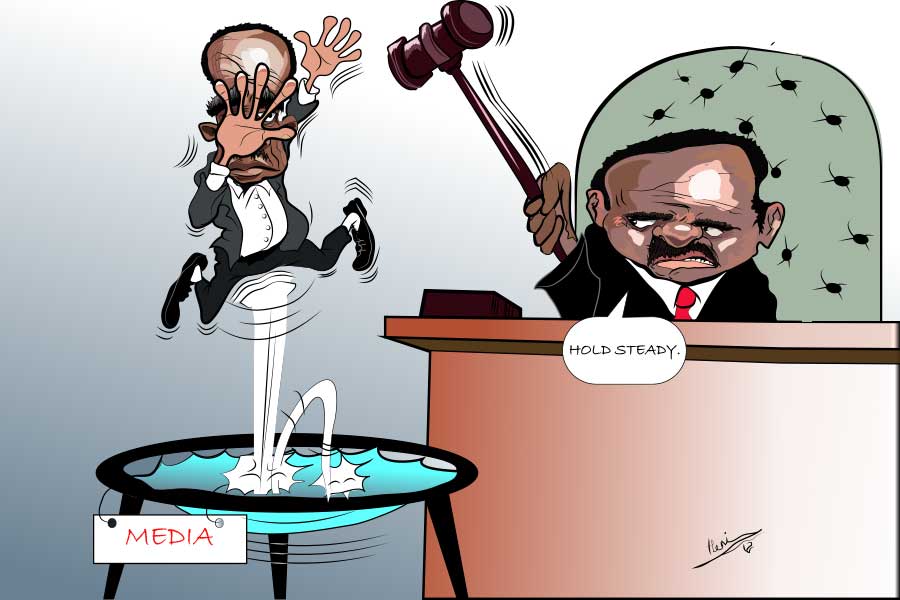

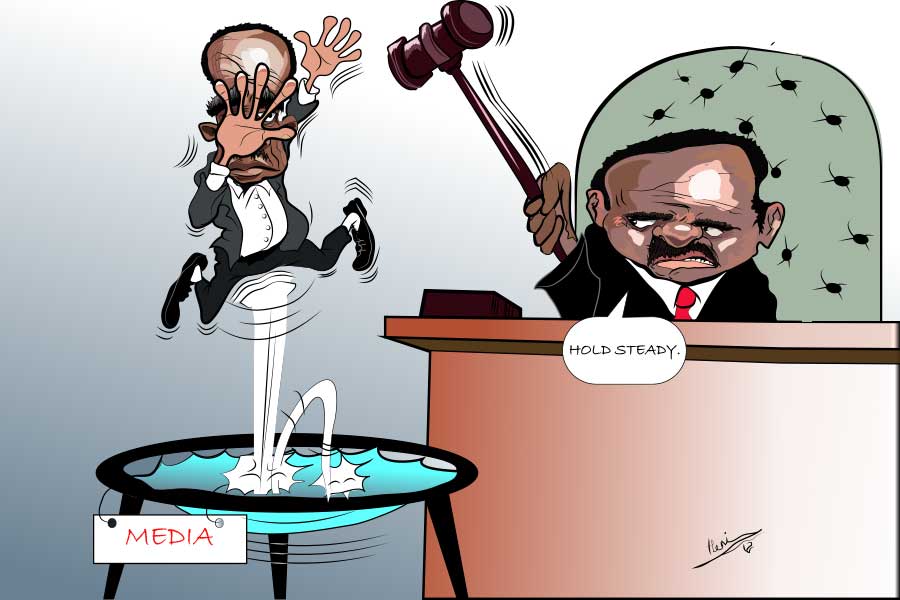

Editorial | Jul 18,2020

Fortune News | May 07,2022

Radar | Jul 02,2022

Viewpoints | Oct 10,2020

Agenda | Nov 23,2019

Commentaries | Jun 08,2019

Commentaries | Aug 16,2025

Commentaries | Jun 21,2025

Fortune News | Jun 22,2024

Viewpoints | Jun 12,2021

Photo Gallery | 179839 Views | May 06,2019

Photo Gallery | 170035 Views | Apr 26,2019

Photo Gallery | 161009 Views | Oct 06,2021

My Opinion | 137220 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Nov 2 , 2025

The National Bank of Ethiopia (NBE) has scrapped the credit-growth ceiling that had s...

Nov 2 , 2025 . By SURAFEL MULUGETA

The burgeoning data mining industry is struggling with mounting concerns following th...

Nov 2 , 2025 . By YITBAREK GETACHEW

Berhan Bank has chosen a different route in its pursuit of a new headquarters, opting for a transitional building instea...

Nov 2 , 2025 . By BEZAWIT HULUAGER

Nib International Bank S.C. has found itself at the epicentre of a severe governance...