.

At the hub of Ethiopia's fiscal planning on King George VI Street, the country’s budget formulation wheels for the upcoming fiscal year are now in full swing. Finance Minister Ahmed Shide and his cadre of planning experts are tasked with the formidable job of poring over budget submissions from hundreds of federal agencies, an annual ritual in the arduous process of federal budget making.

Yet, a sense of disquiet seems to permeate their discussions.

The Ministry’s attempt to introduce a ceiling on budget submissions has been met with resistance, with multiple ministries, authorities, commissions and agencies showing little restraint in their demands. A notable pair of recalcitrants are Brehanu Nega’s Ministry of Education and Tassew Woldehanna’s Addis Abeba University, known to habitually overshoot their budget caps.

Indeed, this insatiable appetite for resources extends to almost all the regional states, with Addis Abeba as the sole exception for covering its expenditure from taxes it mobilises. Most regional states are highly dependent on federal subsidies to finance their activities. In the face of this, Minister Ahmed’s resoluteness in advocating for fiscal restraint will be put to the test. Failing to tighten the purse strings, especially amidst prevalent macroeconomic imbalances, could have severe repercussions.

The economic situation does not paint an optimistic picture either.

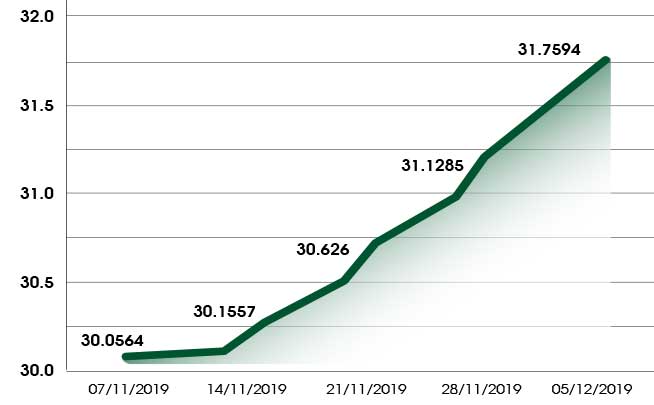

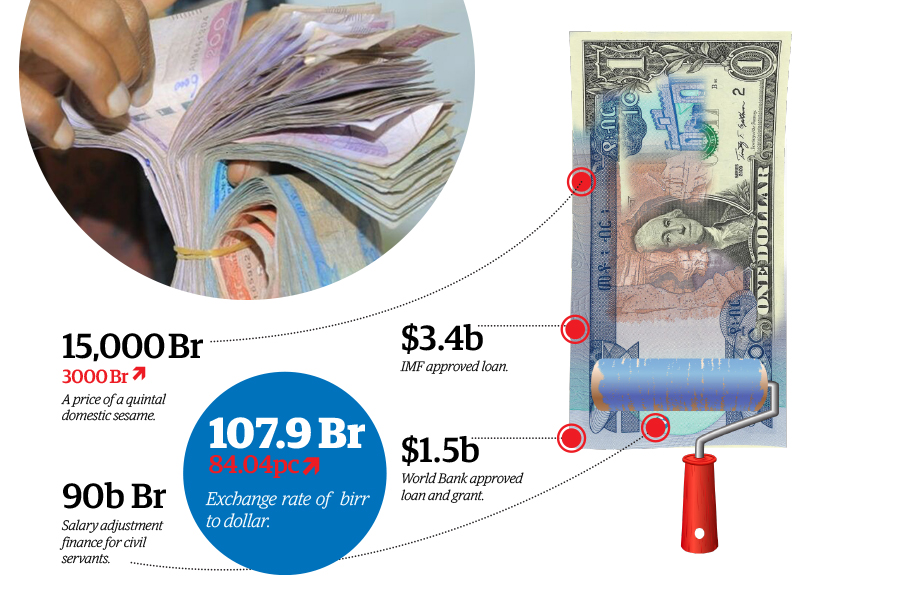

With inflation spiralling out of control and the Birr depreciating against a spectrum of currencies, it is conceivable that the federal budget for the upcoming fiscal year could well cross the trillion Birr threshold. If past patterns are anything to go by, the budget has seen an average growth rate of 55.3pc in the past five years since 2018/19. Should this trajectory continue, Ethiopia’s Parliament may face a budget bill featuring an all-time high expenditure amounting to a staggering 1.2 trillion Br.

Alternatively, Minister Ahmed could hold his ground and cap the budget just shy of the trillion Birr mark, a move that would halt the budget growth, unprecedented for over two decades. The impending budget hearing, where the Finance Minister will have to face Parliamentary scrutiny, promises to be an ordeal. A pertinent question that may arise during this hearing would be the macroeconomic framework underlying the budget bill.

Indeed, budget planning is not merely an economic exercise, but also a political tool. It facilitates the allocation of limited resources to different sectors in line with the ruling party’s political agenda. However, the political and economic vision of the Prosperity Party (PP), of which Minister Ahmed is an executive committee member, remains enigmatic. The guiding principles behind the budget appear elusive, marking a significant departure from the era of the Revolutionary Democrats.

Under the EPRDFites, Ethiopia experienced a series of economic transformations, primarily guided by a statist development model that relied heavily on public expenditure in critical sectors such as health, education, and infrastructure. Often hailed as “pro-poor,” this development model saw substantial budget allocations to human development, food security, and infrastructure development initiatives, all crucial for long-term economic growth and poverty reduction.

However, recent years have witnessed a significant shift in budget allocations.

Once beneficiaries of generous funding, sectors like education, health, agriculture, and infrastructure are now grappling with declining ratios in the budget. The share of poverty-reducing spending has plunged dramatically from 84pc in 2018-19 to 59pc this year, hinting at a potential shift in the Prosperitians’ philosophy towards poverty alleviation.

This shift appears to have been triggered by an urgent need to restore macroeconomic balance after decades of heavy reliance on external loans and grants to fund public investments. The expansive fiscal policy of the EPRDF era led to fluctuating inflation rates and macroeconomic instability.

The country's trade profile is worth noting. The slow yet steady increase in export revenues suggests a certain resilience in the face of adversity, yet a sharper rise in imports illustrates an escalating dependence on foreign goods. The resulting trade deficit has strained the country's foreign exchange reserves, triggering a ripple effect on the exchange rate and, by extension, the overall fiscal stability.

The increasing reliance on foreign financing to meet domestic development needs was a hallmark of the EPRDF's macroeconomic management. This legacy has left the country grappling with mounting public debt, sparking concerns about long-term debt sustainability and the crowding out of private investments due to public borrowing. Over the years, the allocations for debt servicing have surged, obliging the new administration to declare course correction.

Prioritising prudent debt management and sustainable borrowing practices remain daunting challenges to the macroeconomic team the Prime Minister chairs.

Although federal government revenues have risen over the years, jumping from 11.7 billion Br in 2001-02 to a projected 477.7 billion Br this year, it still falls far short of expenditure. There is a yawning chasm between revenues, including domestic revenue, tax revenue, and grants, and government spending. The administration’s fiscal position has been hampered by a growing trend towards indirect taxes, which now account for a larger slice of revenues.

Persistent fiscal deficits remain a thorny issue for successive administrations. The overall balance has remained in the red for decades, a common problem in many countries. Where they differ is in their response. Governments usually resort to borrowing or attracting investment to finance public expenditure, but Ethiopia’s budget deficit, having doubled to 4.1pc this year, sounds like a clarion call for fiscal rectitude.

Ethiopia’s fiscal strategy stands on a tightrope, with the country teetering on the edge of a fiscal precipice. Many believe Ethiopia, blessed with diverse economic potential, particularly in agriculture, manufacturing, and services, has ample room for increased revenues. The real challenge is harnessing this potential while reducing reliance on foreign financing and fostering a conducive investment environment.

Key to Ethiopia’s fiscal reform could be a major overhaul of the taxation system. With a low tax-to-GDP ratio of just eight percent last year, a far cry from the sub-Saharan Africa average of 24pc, there is considerable scope for augmenting public revenues. This could be achieved through measures such as improving tax efficiency, broadening the tax base, and cracking down on tax evasion.

Despite the country’s potential, Ethiopia's fiscal journey is strewn with hurdles.

Agriculture, a cornerstone of Ethiopia’s economy, is not immune to the whims of climate change. Geopolitical shifts, including ongoing conflicts across the country, threaten economic stability. Peaceful resolutions to these conflicts are indispensable for maintaining fiscal health. Political instability invariably has implications for public finances and budget allocations, necessitating a comprehensive approach towards achieving sustainable economic growth.

The federal budget has evolved considerably over the past two decades, prioritising infrastructure, human development, and poverty reduction. However, the growing fiscal deficit and rising debt service allocations indicate obstacles that must be overcome to ensure robust growth.

It is imperative to monitor these trends closely, particularly in light of current economic uncertainties and the fallout from global events. Ethiopia is currently at an inflection point, poised between the promise of economic advancement and the peril of fiscal vulnerability. The budgetary decisions its leaders and policymakers make will dictate the trajectory of its future economic stability.

The forthcoming budget bill, crafted under the watchful eye of Minister Ahmed and his team, could serve as a beacon for the government's policy agenda – provided that such an agenda exists. The uncertainty surrounding Ethiopia's path in this fiscal challenge epitomises the million-dollar question against a backdrop of a trillion Birr budget.

PUBLISHED ON

[ VOL

, NO

]

Viewpoints | Feb 19,2022

Radar | May 29,2021

Agenda | Oct 12,2019

Fortune News | Dec 07,2019

Life Matters | Aug 05,2023

Fortune News | May 11,2019

Radar | May 31,2020

Fortune News | Aug 04,2024

Radar | Jun 21,2025

Radar | Nov 24,2024

My Opinion | 132154 Views | Aug 14,2021

My Opinion | 128564 Views | Aug 21,2021

My Opinion | 126485 Views | Sep 10,2021

My Opinion | 124094 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 13 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Revenue Bureau has introduced a new directive set to reshape how...

Jul 13 , 2025 . By BEZAWIT HULUAGER

Addis Abeba has approved a record 350 billion Br budget for the 2025/26 fiscal year,...

Jul 13 , 2025 . By RUTH BERHANU

The Addis Abeba Revenue Bureau has scrapped a value-added tax (VAT) on unprocessed ve...

Jul 13 , 2025 . By NAHOM AYELE

Federal lawmakers have finally brought closure to a protracted and contentious tax de...