Covid-19 | Mar 21,2020

Apr 6 , 2024

By Kidist Yidnekachew

Offering help without expecting something in return is a genuine act. However, while well-meaning, these kind souls can unintentionally lead the recipient down a path of financial trouble. My friend experienced this firsthand.

She relied on a trusted Bajaj driver for everything, from errands to picking up her niece from school. He went above and beyond, lending her money in a pinch, like the time he gave her 1,000 Br. Because of his generosity, my friend used his services regularly, planning to repay him at month's end. The driver never pressured her, despite his financial limitations.

However, as days turned into weeks, my friend grew increasingly anxious. Finally, the bill arrived. The total amount was a staggering blow. It was mind-boggling that the combined cost of rides and groceries could balloon to several thousands of Birr – equivalent to her entire salary! Disbelief forced her to double-check, meticulously reviewing each expense with the driver. Yet, the sum remained a near-unbelievable 20,000 Br. Settling the debt took a significant amount of time, but more importantly, it taught her a valuable lesson.

She realised the importance of tracking all expenses, no matter how small. They can silently accumulate and become overwhelming. This revelation struck a chord with me too. I can be careless with spending, neglecting minor expenses that snowball into significant amounts. As the saying goes, a small pebble can tip a barrel.

In the fast-paced world, it is easy to lose track of spending. We tap our phones, and see receipts dwindle, but lack a clear picture of where the money goes. This lack of awareness blocks financial goals. That is where the humble expense journal comes in – a superhero for finances.

Diligently recording daily expenses reveals valuable insights into spending habits. This paves the way for a stable and secure financial future. It is astonishing how easily individuals overlook seemingly insignificant expenses that quietly drain their bank accounts. Whether it is daily coffees or impulsive purchases, they all add up. Holding oneself accountable and uncovering hidden money leaks is essential. Imagine the shock of realising that a seemingly harmless coffee indulgence amounts to a substantial sum over time. Keeping an expense journal cultivates mindfulness when it comes to budgeting.

Categorising expenses into groceries, rent, and clothes provides a crystal-clear understanding of where income goes. This breakdown allows us to compare spending against the budget, highlighting areas for adjustment.

Expense journals also develop financial responsibility. Recording every expense forces taking ownership of finances and compels us to confront spending head-on. It shifts the person from a passive spender to an active decision-maker. This newfound awareness empowers making conscious choices about allocating hard-earned money, leading to better financial outcomes.

These journals are not only about tracking money; they are allies in achieving financial goals. Monitoring monthly savings can be incredibly motivating. Seeing the numbers climb fuels a sense of accomplishment. Even in the face of setbacks, flipping through the journal serves as a powerful reminder of past successes which reignites commitment and propels forward.

PUBLISHED ON

Apr 06,2024 [ VOL

25 , NO

1249]

Covid-19 | Mar 21,2020

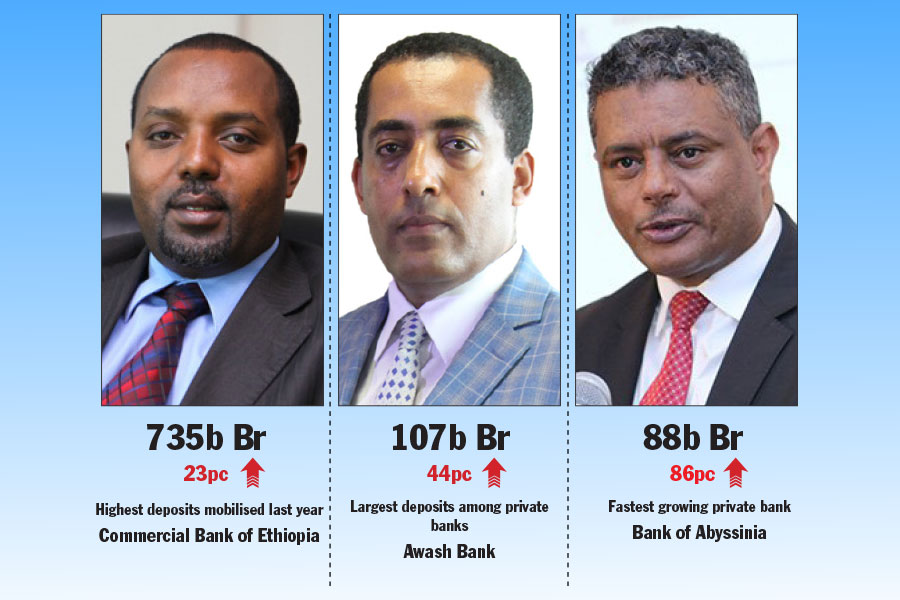

In-Picture | Oct 12,2025

Radar | Jul 18,2021

Radar | Aug 12,2023

Fortune News | Jul 18,2021

Fortune News | Jul 23,2022

Editorial | Sep 02,2023

Agenda | Jun 17,2023

Agenda | Oct 12,2019

Fortune News | Oct 11,2020

Photo Gallery | 180681 Views | May 06,2019

Photo Gallery | 170875 Views | Apr 26,2019

Photo Gallery | 161962 Views | Oct 06,2021

My Opinion | 137303 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Nov 2 , 2025

The National Bank of Ethiopia (NBE) has scrapped the credit-growth ceiling that had s...

Nov 2 , 2025 . By SURAFEL MULUGETA

The burgeoning data mining industry is struggling with mounting concerns following th...

Nov 2 , 2025 . By YITBAREK GETACHEW

Berhan Bank has chosen a different route in its pursuit of a new headquarters, opting for a transitional building instea...

Nov 2 , 2025 . By BEZAWIT HULUAGER

Nib International Bank S.C. has found itself at the epicentre of a severe governance...