Money Market Watch | Oct 27,2024

Aug 3 , 2024.

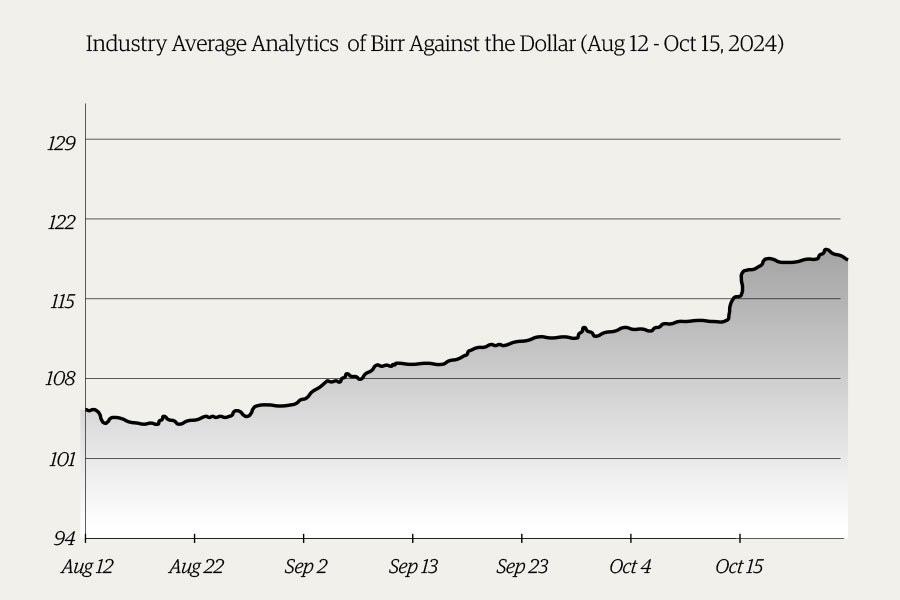

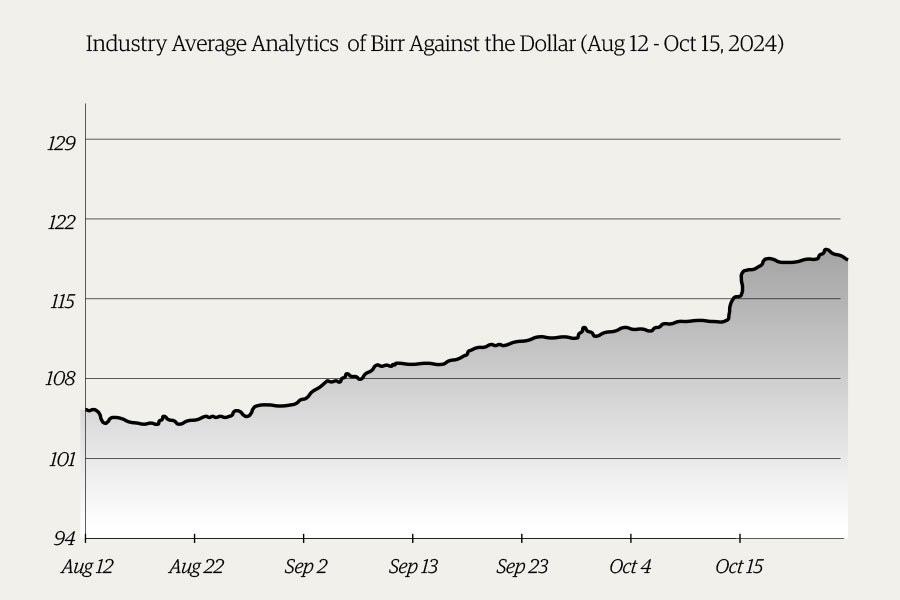

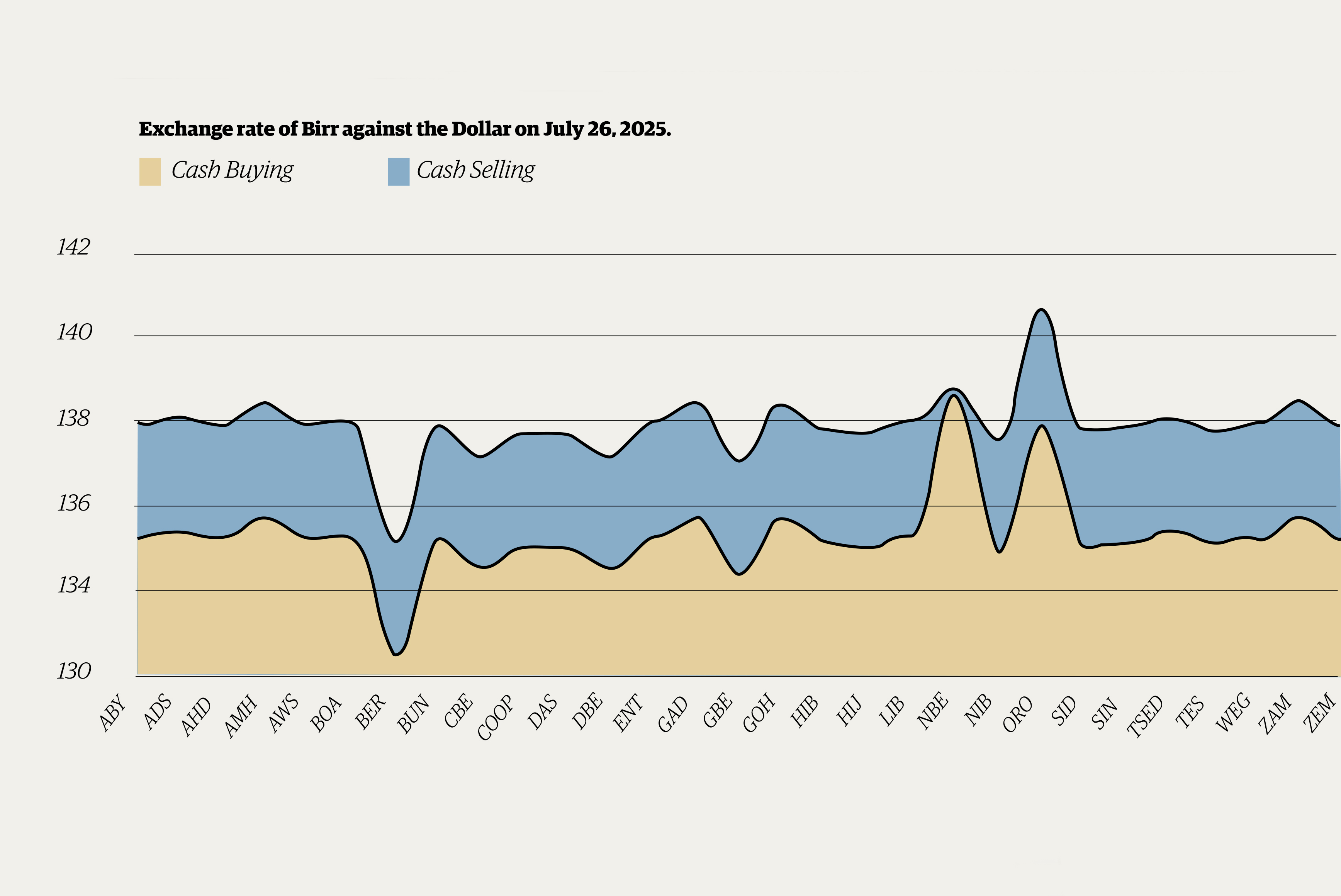

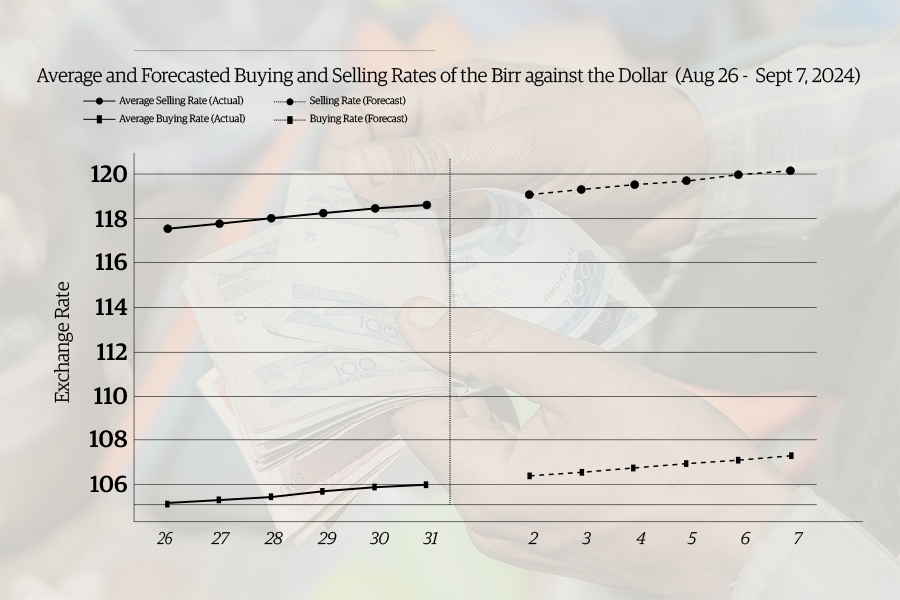

Much like the unpredictable brew of a strong coffee from the Ethiopian highlands, the Brewed Buck has experienced unprecedented fluctuations in over half a century. On Wednesday of last week, the rate changed three times before settling, with the state-owned Commercial Bank of Ethiopia (CBE), the Bank of Abyssinia, and Siinqee Bank each posting different rates throughout the day. The era when market agents could determine the true value of the Birr against major currencies appears distant.

In the meantime, the Birr will continue its tumultuous journey in a market liberated for the first time since the mid-1970s. The recent decision by the federal government to float the Birr has sent ripples through the country's economic ecosystem. Debates among academics, pundits and the elite have raged, while the private sector was muted due to sheer confusion. Its members are not familiar with a spectacle, seeing late last week CBE traded the Birr against the dollar, buying at 83.94 and selling at 85.6.

By the day's closing on Friday, Dashen Bank offred to buy a dollar for 90.78 Br and sell it for 98.05 Br.

The steep fall saw the Birr plummet by a jaw-dropping 67.24pc. Yet, after adding commission and service fees, the effective exchange rate of Dashen Bank would surge to 121.58 Br a dollar, marking an astonishing 106.58pc increase from the same days last week. This swift movement signalled that the “Brewed Buck,” a colloquial term for the Birr, is rapidly approaching the parallel market rate, which exceeds 124 Br a dollar.

Prime Minister Abiy Ahmed (PhD) administration's bold policy decision to float the Birr is courageous by any measure. However, interpreting this important economic shift merely as “devaluation” is misleading. Unlike the devaluations of the 1990s, 2000s, and 2010s, where authorities set the Birr's value with a stroke of a pen, last week's move is as monumental as the Derg's historic land nationalisation, responding to the students’ cry of “land to the tiller.”

Ironically, though long overdue, the timing of this decision is far from ideal.

The country is embroiled in militarised conflicts, with insurgencies in several regional states, including the large states of Oromia and Amhara. Armed rebellions challenge the federal government's legitimacy, while social polarisation is at an all-time high. Trust between various social groups has eroded, and the absence of peace has severely impacted the logistics, transport, agriculture, and tourism sectors. The budget deficit is substantial, and the policy instruments to cover it have fueled inflation, eroding the incomes of fixed-income households. External debt reached 28.9 billion dollars, with annual payments at a record high.

Ironically, the historic policy shift seen last week illustrates a missed opportunity for the Meles-era policymakers (Melesaites), who could have taken similar steps in the early 2010s, had it not been for their ideological rigidity. Their exchange rate policy created a disconcerting spiral for the Brewed Buck, maintaining an unrealistic value that strangled the economy for decades, undermining productivity and keeping the balance of payments all but balanced.

They could have opted for market-driven currency exchanges to improve the availability of consumer goods and curb rent-seeking behaviours. Instead, they maintained a dual exchange rate system, where the parallel market rate eventually doubled the official rate, yielding an unsustainable exchange regime.

The unsustainability of the status quo was evident. It lessened exports, discouraged investments, and restrained official remittances. The forex reserves dwindled to the extent that the country could not cover a month's worth of imports. Federal authorities had to prioritise imports, banning letters of credit for 38 categories of items, revealing the system's inefficiency and arbitrariness. The frustrating wait for the availability of letters of credit led to periods when the effective price of foreign currency was prohibitively high.

Businesses suffered immensely due to forex shortages. Manufacturers could not obtain the necessary forex for raw materials, leading to production halts. Hundreds of industries, including iconic brands like Pepsi, ceased operations at times. With limited access to foreign currency, manufacturers operated at only 20pc capacity. The opportunity to profit from privileged forex access fuelled corruption, rewarding and demoralising productive work, thus undermining economic growth.

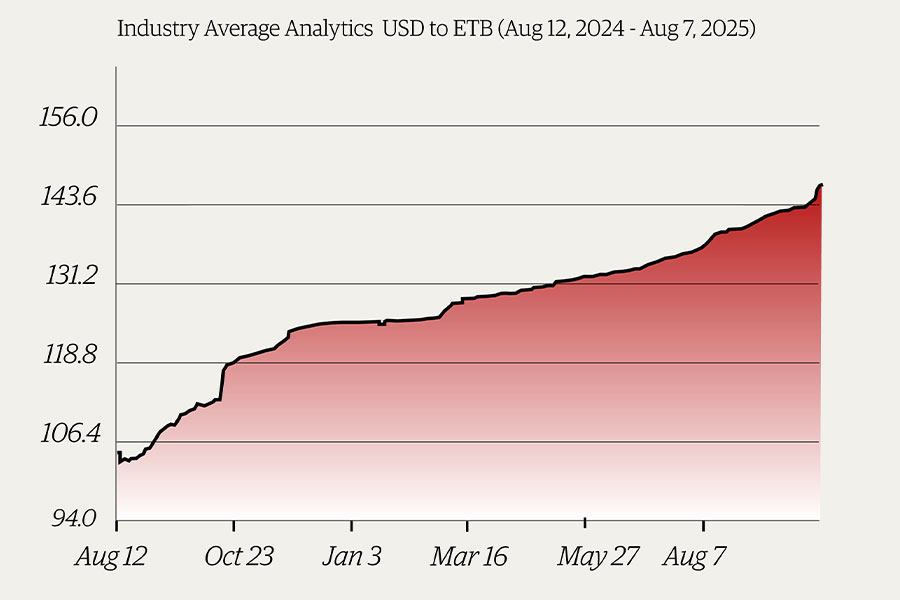

The policy objective behind floating the Birr was thus to suffocate the parallel market and allow the Brewed Buck to attain its real value against other currencies, determined by market forces. Under pressure from the IMF to correct economic distortions, the authorities opted for the nuclear option. This approach can be criticised for transitioning too abruptly from a Volkswagen (VW) to a Ferrari while the infrastructure remains riddled with potholes.

However, the authorities believe that a free-floating exchange rate is crucial for price discovery in the economy. Undoubtedly, they could have chosen a phased approach, abandoning the crawling peg in favour of an auction system, as was the case in the 1990s. Besides IMF pressure, there seems to be a contemporary influence among policymakers who embrace the liberal conviction that central planners, no matter how well-intentioned, cannot possess all the information needed for optimal resource allocation in a large economy. Indeed, information is distributed among innumerable individual actors who make decisions based on their specific circumstances.

There is little debate that exchange rates reflect the flow of dollars in and out of an economy. In the lexicon of the economics discipline, it shows the status of the balance of payments. Ethiopia is a country that has never enjoyed a positive balance since 1977. The Brewed Buck weakens when the economy fails to generate sufficient forex inflows to match outflows. According to data from the World Bank, 2016 was the worst year, with a negative balance of 7.91 billion dollars, almost double the amount recorded last year.

For decades, the fixed-rate regime unduly taxed exporters, investors, and remittance recipients through the official channel, reducing forex inflows. The parallel market became mainstream, with importers tracking its rates over the official rate, often with complicit involvement from commercial banks. Even state-owned banks joined in, buying dollars in the parallel market overseas.

Now, with the authorities confronting market realities, it remains to be seen if prices stabilise, consumer goods availability improves, inflation is tamed, and corruption is checked as they hope. Early signs of legalising free exchange have not been reassuring, though. Market apprehension and public anxiety followed Birr's floatation on July 29, 2024. Confusion and panic ensued, while the parallel market went silent, unresponsive to supply and demand as expected.

The state-owned CBE led the way, setting prices based on open exposure, followed by private banks. Unaccustomed to competitive currency markets, but traditional trading in an underdeveloped economy, these banks have executives on a steep learning curve, which will undoubtedly be costly in the coming months. Regulators at the central bank face their learning curve, too, as they should now guide commissions and service fees while providing indicative rates through data on weighted averages and forex stock.

Central Bank Governor Mamo Mehiretu and his aides will need to sharpen their communication skills, signalling the right messages to the industry in a timely and accurate manner. They will be tested on their ability to build reserves to demonstrate their capacity to stabilise the exchange market. They will have to prove that they have enough firepower, with substantial support from the IMF, the World Bank, and bilateral and multilateral financial institutions. Without these signals, hopes for a stable Brewed Buck are slim.

With its newfound freedom, the coming months will be critical for the Brewed Buck in determining whether the bold move will lead to its stabilisation or further turmoil. The authorities have taken a daring step into the unknown, hoping that market forces will ultimately guide the Birr to a real value. Only time will tell if this gamble pays off.

In the long term, though, the indispensable factor to economic stability lies in enhancing domestic productivity and international competitiveness. However, achieving this depends on resolving a myriad of political, economic, and social issues. Most crucially, it requires a country and its people to reconcile and come to terms with each other.

PUBLISHED ON

Aug 03,2024 [ VOL

25 , NO

1266]

Money Market Watch | Oct 27,2024

Editorial | Feb 05,2022

Editorial | Oct 01,2022

Money Market Watch | Jul 27,2025

Fortune News | Oct 14,2023

Editorial | Jul 09,2022

Money Market Watch | Sep 01,2024

Fortune News | Mar 05,2022

My Opinion | Feb 12,2022

Money Market Watch | Oct 18,2025

Photo Gallery | 176016 Views | May 06,2019

Photo Gallery | 166230 Views | Apr 26,2019

Photo Gallery | 156655 Views | Oct 06,2021

My Opinion | 136867 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025 . By NAHOM AYELE

In a sweeping reform that upends nearly a decade of uniform health insurance contribu...

A bill that could transform the nutritional state sits in a limbo, even as the countr...

Oct 18 , 2025 . By SURAFEL MULUGETA

A long-planned directive to curb carbon emissions from fossil-fuel-powered vehicles h...

Oct 18 , 2025 . By BEZAWIT HULUAGER

Transaction advisors working with companies that hold over a quarter of a billion Bir...