Fortune News | May 03,2025

Jul 9 , 2022.

Fuel shortages are a staple in Ethiopia. Severe policy miscalculation in the form of subsidies has led to underinvestment in the retail fuel business. It fed a thriving contraband trade in areas bordering Somalia, Somaliland and Kenya. The latter is happening more widely, forcefully and frequently lately. The main contributor is the start of phasing out of fuel subsidies. While implementation leaves much to be desired, it is one of the most daring policies taken by the administration of Prime Minister Abiy Ahmed (PhD).

The news hardly comes as a bombshell. The administration has been signalling its intentions for more than a year, determined to save more than 25 billion Br public spending in annual subsidies. When a litre of benzene at gas stations hit 47 Br (historical high) last week, there was no clamour. The anxiety is, however, there. It comes at a time of runaway inflation when the May prices index reached 37pc. High prices will inevitably fuel prices for essential goods.

The decision to lift state subsidies on fuel products is an appropriate policy long overdue in the making. It could not have come at the wrong time. Subsidising fuel at a huge burden on the budget is one of the misguided policies contributing to the egregious structural imbalances in the economy. Another is how the foreign exchange regime has governed for half a century. It has been as good as the interests of a few bureaucrats and businesses aligned with them.

Ethiopia follows a managed floated regime, where the Birr is pegged to the dollar. Lately, it followed a crawling peg, depreciating the Birr by about 10 Br a year, though the depreciation rate slowed in 2022.

The central bank's Governor has never managed to explain why. Yinager Dessie (PhD), governor of the National Bank of Ethiopia (NBE), is not in the habit of meeting the media. Ironically, his public exposure is limited to attending bank openings and a few workshops. There is no such thing as central bank minutes to gauge targets or priorities. Worse, quarterly reports are not released until a couple of quarters have already passed. Under Yinager, the central bank is not interested in communicating with market actors and the wider public but in ruling from the shadows in his tower on Sudan Street.

If the crawling peg is meant to catch up to black market rates, it should be understandable why the central bank is so tight-lipped. It is a plan that has not worked. The central bank is trying to gradually reduce its propping up of the Birr, much like phasing out a subsidy. This will not work in an environment where the import bill grows, net service sector exports are poor (or negative), and productivity across the economy is down.

Phasing out, in this case, would not work but a radical exchange rate policy reform. Global economic and financial events are making this more necessary than ever.

The latest bad news for developing countries like Ethiopia is a rise in global interest rates, especially in the United States. This monetary tightening by the Federal Reserve causes three crucial changes. It will increase the cost of capital for firms and governments, attracts capital to the United States from emerging markets, and strengthens the dollar. None of these is good news for debt-stressed, foreign currency-deprived countries. Ethiopia is in this category.

Take debt. A rise in borrowing costs and capital inflow to the US make all non-fixed interest loans more expensive. This matters especially with the billion dollar 10-year Eurobonds set to mature in two years, and for which bond yields are going up. The budget bill for the incoming fiscal year anticipates debt servicing will consume more than any other item, at 16pc of the expenditure. Add to this a strong dollar; it will continue to expose companies in the private and public sectors to foreign currency volatility.

The effect on foreign direct investment (FDI) is no less concerning. Higher global interest rates raise the cost of financing. This does not matter for the government, which does not have the appetite to take on new commercial debt. But it is not good news for emerging markets looking to attract business.

If getting a good deal on Ethio telecom privatisation and selling a license to a third operator was hard before, it is worse now and will be for a while. Significant capital needs to be raised if a prospective investor wants to engage. The equity and credit markets are apprehensive at the moment. They are uninterested in risky, below investment-grade projects and are parking their funds in US dollars, a safe bet. The risk appetite for investing in a country still at war and with political instability has gone even lower. It will likely be just Ethio telecom and Safaricom Ethiopia for a while.

When the accounting is done, the consequence of a rise in interest rates will be on foreign currency reserves. Foreign direct investment may be lured away, debt service takes an ever greater chunk of the reserve, and a strong dollar will further disincentivise formal channels. The most effective policy to deal with the historical end of cheap money will be to take a page out of the bold efforts to phase out fuel subsidies. Float the Birr, and open up the capital account.

What good will they do?

An exchange rate led by market forces can harmonise the official and parallel market rates and help foreign exchanges flow through formal channels. It is essential to recognise that Ethiopia does not necessarily have a foreign currency shortage but an underground market crisis if the capital account is opened to let anyone exchange forex, like commodities. There are euros and dollars in the economy, sterling pounds and Swedish Kroner. Ask car importers, whose lots are always full of the latest models. Yet, a federal agency struggles to access foreign currency to buy inputs for printing license plates. This is a farce.

Floating the Birr can bring the foreign currency lost to the parallel to the formal market. This is necessary to address Ethiopia’s debt stress. The country’s sovereign debt is not that bad (although the growth of domestic debt over the past few years is alarming) by global standards. It is only around half of the GDP, which is well below the international average of about 80pc. More than half of that debt is owed to external creditors in foreign currency.

A country with an annual GDP of a little over 100 billion dollars should be able to raise the hard currency needed to cover the current external debt service costs. It is struggling to do so and may very well default when Eurobonds mature in 2024, partly because of the foreign exchange policy it has decided to follow.

Floating the Birr can also amount to removing part of capital controls, making economic policy reforms to attract foreign direct investments possible. The convertibility from Birr incentivises investors to bring capital to the country without fear of having their profits locked up in a currency only tradable in Ethiopia. They know the Birr loses ground against other currencies and is eaten up by runaway inflation.

The benefits are clear. It does not mean that there are no consequences, though. The Birr could be much less valuable than it is now but will stabilise in the long term. A rise in the cost of living will also further hammer consumers. But no economy ever developed without tough choices. The determination to end fuel subsidies is a gutsy effort to bring to a close a populist policy that has plagued the economy for too long. The same energy should be put into foreign exchange policy.

PUBLISHED ON

Jul 09,2022 [ VOL

23 , NO

1158]

Fortune News | May 03,2025

Fortune News | Oct 07,2023

Fortune News | Jun 29,2024

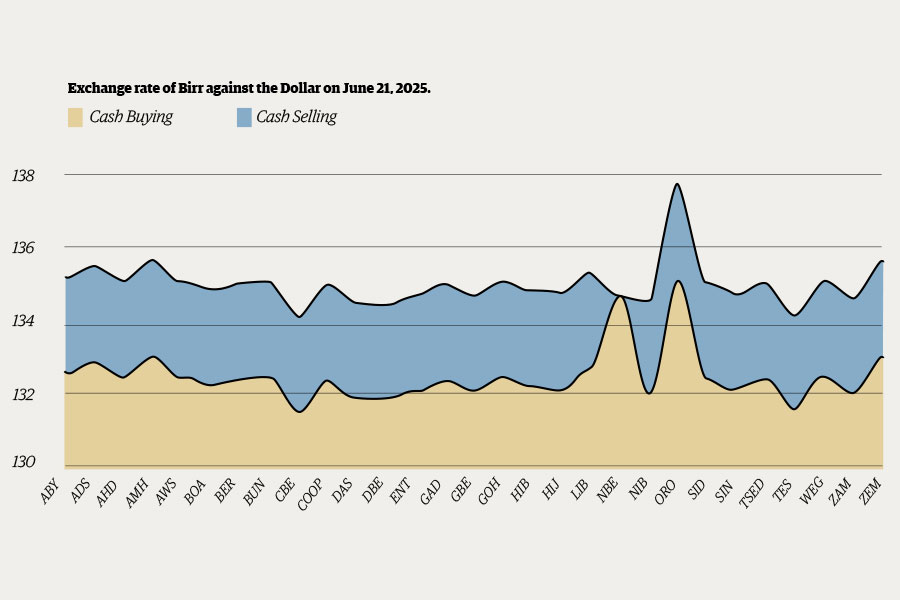

Money Market Watch | Jun 21,2025

Agenda | Feb 20,2021

News Analysis | Jan 05,2020

Radar | Jun 07,2025

Radar | Nov 24, 2024

Fortune News | Jun 04,2022

Viewpoints | Jun 25,2022

My Opinion | 131766 Views | Aug 14,2021

My Opinion | 128149 Views | Aug 21,2021

My Opinion | 126095 Views | Sep 10,2021

My Opinion | 123717 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 6 , 2025 . By BEZAWIT HULUAGER

The federal legislature gave Prime Minister Abiy Ahmed (PhD) what he wanted: a 1.9 tr...

Jul 6 , 2025 . By YITBAREK GETACHEW

In a city rising skyward at breakneck speed, a reckoning has arrived. Authorities in...

Jul 6 , 2025 . By NAHOM AYELE

A landmark directive from the Ministry of Finance signals a paradigm shift in the cou...

Jul 6 , 2025 . By NAHOM AYELE

Awash Bank has announced plans to establish a dedicated investment banking subsidiary...