Radar | Sep 18,2023

Oct 1 , 2022.

The foreign exchange market is seeing a war of attrition, with the Dollar gradually taking out its opponents as its strength grows unmatched.

Neither is the green buck taking any hostages. A blitzkrieg against the Euro has left it trading for less than a Dollar for the first time in two decades. The Yen is under fire, threatening a delicate monetary policy that keeps the unsustainable Japanese debt afloat. There is a siege against the UK’s Pound Sterling. Combined with an unpopular economic policy package introduced by a new Prime Minister, the Pound is at a four-decade low. If it tanks below the Dollar, it will be the first in its history.

How is the Birr doing? Worse.

The official market rates make it seem like the Birr is doing just fine, and is bucking the trend. The currency has depreciated at a much slower rate than the previous year when it fell about 10 Br against the Dollar, all within a year. Since January, it has only lost around eight percent; banks buy it for around 52.5 Br. Against the Euro, official rates have gained.

But the official rate of the exchange is growing less relevant by the day. The economy, particularly businesses, is sustaining itself with foreign currency sourced from the parallel market. There lies the actual value of the Birr, an unsanctioned over-the-counter market for trade in currencies. The parallel market offers a more precise measure of Birr’s performance against other currencies. It is not a pretty sight, though.

The exchange rate in the parallel market against the Dollar broke the psychological barrier of 100 Br last week. It underlies an unprecedented worsening in the structural failings of the economy. The foreign currency crunch may be nothing new for Ethiopia. But above 100pc premium over the official rate is unheard of. It is an outcome of macroeconomic policy failure, unlike the conspiracy narrative some in the discipline appear to push.

The Pound, Yen, Euro, and most other currencies worldwide can blame their underperformance on the rate hikes by the US Federal Reserve. The Dollar’s status as a reserve currency is generally considered the safest investment in a more volatile world. Ethiopia’s policymakers on the macroeconomic front have resisted capital account liberalisation precisely for this reason – the rush of hot money out of the country.

But protectionist monetary policy is not “shielding” the slide of the Birr against the Dollar, as experienced by the parallel market rates, which come closer to the currency's actual value. The economy is not reaping any of the supposed benefits of a managed float, but suffering all the adverse effects. Only the bureaucrats at the central bank, and their political skippers shoving their orders down, enjoy the power derived from the allocation of forex. They determine who wins and who losses in this spectacular show.

It was not like this once upon a time. The forex market was like any other commodity determined by market forces before the 1974 revolution. A military junta bent on a conviction that everything should be “about the state, for the state and within the state” had closed the capital account and introduced a quota system for forex allocation. For nearly half a century, Ethiopia’s economy has yet to free itself from scarcity and the vagaries of regulations. In the words of foreign Finance Minister Sufian Ahmed, the forex crunch is a puzzle that will not be fixed in his lifetime.

There is, however, and always, a scramble to blame all types of players but the government. Taking a shot at underground dealers and parallel market players is easy. Policymakers of successive regimes are tempted not to look at the central bank and its ill-fated policies as the very source of the parallel market, popularly known as the “black market”.

Imagine that the government decreed from this day on that all shoes across Ethiopia cannot be sold above a ceiling of 100 Br. Overnight, there could be a severe shortage of shoes at shops. A parallel market trade emerges where shoes would be sold for much higher prices that consider not just the cost of making and transporting the shoe, and the traders’ profit, but also a premium for taking the risk and paying off authorities regulating the value chain to look the other way. Foreign currency should be no different commodity than the shoe market.

The foreign currency shortage is part of the economy responding to incentives created by fixing prices on the exchange rate market. Blaming traders and dealers in the parallel market is like accusing the fire of burning down the house. It is the policymakers that have lit the fire and left it burning unchecked.

The conspiracy hypothesis - conveniently peddled by the slothful academic herd - and the blame game are excuses for a failure to find (or implement) alternative policy options. They insist on repeating efforts that have been tried and failed before. The forex crunch is an economic problem whose origin is delinquent macroeconomic policies; no amount of underpaid border agents can extinguish the raging fire.

It could be argued - and some indeed do - that a foreign currency shortage does not exist in Ethiopia.

Undoubtedly, a fall in new borrowing, grants and a rise in imports has led to central bank reserves falling to an estimated 1.5 billion dollars, periodically even under a billion dollars. But there is an unaccounted volume of foreign currency available in the country outside banks, and the hands of traders in the parallel market. Look at the many car importers brimming the capital’s roads with the latest model and brand new vehicles.

The answer is clear: policymakers can remove the incentive for the bureaucrats and their few peddlers in the private sector. A flexible exchange rate is necessary to pull the rug under their feet. When the official rate responds to market forces, and foreign currencies start trading for the Birr at market prices, there could be no need that justifies the parallel rate. As international currencies begin to flow back into the formal market, the foreign currency shortage will improve, and the economy can rebalance.

One of the criticisms against the policy of floating the Birr has been that it could lead to inflation. Granted, the official rate is overvalued. With a flexible exchange rate, it is likely to fall further. In so doing, it may make imports expensive. Fair enough. But, except for goods imported by the federal government, most businesses are sourcing dollars from the parallel market anyways. Most imported goods already price at a much higher exchange rate for the Birr against the Dollar - inflation may not even rise simply because the authorities floated the Birr.

It is also helpful to note that the Birr may not even depreciate 100pc, as it is traded in the parallel market, once floated. Banks will not have to price in the cost of sneaking in and out of the country wads of dollars and euros, bribing officials, wastage due to poor storage and risk of getting caught.

This, though, does not mean that all headaches will be solved. Floating the Birr is a step along the ladder of capital account liberalisation. There are legitimate fears that the economy can be exposed to hot money and the impacts of rate changes by central banks that print the major currencies. Such exposure can be exacerbated by war, political instability and reckless monetary expansion. It further tanks the value of the Birr. These are all understandable of the consequences of policy moves as bold as opening up the capital account as the case was pre-1974.

PUBLISHED ON

Oct 01,2022 [ VOL

23 , NO

1170]

Radar | Sep 18,2023

Radar | May 09,2020

Radar | May 13,2023

Agenda | Feb 25,2023

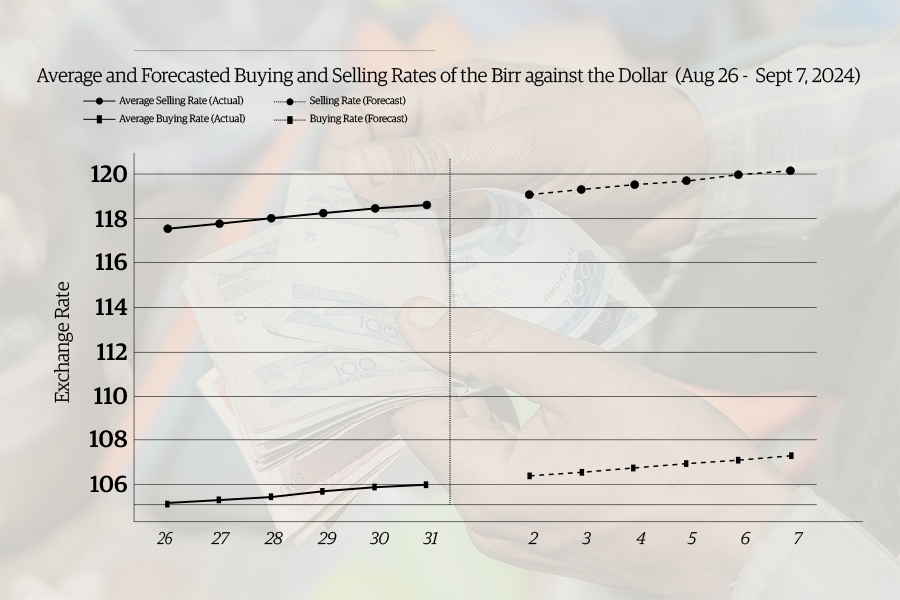

Money Market Watch | Sep 01,2024

Editorial | Nov 25,2023

Radar | Jun 24,2023

Radar | Oct 22,2022

Sunday with Eden | Mar 07,2020

Radar | Dec 10,2022

My Opinion | 131590 Views | Aug 14,2021

My Opinion | 127946 Views | Aug 21,2021

My Opinion | 125921 Views | Sep 10,2021

My Opinion | 123545 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...