Nov 25 , 2023.

Ethiopia’s quest to develop a functioning capital market is a demanding yet not unachievable journey. It requires persistent effort, strategic planning, and an all-rounded approach. A synergy of regulatory frameworks, macroeconomic stability, embracing technology, and educational initiatives may be a necessity. The success of this enterprise will not only redefine Ethiopia’s financial landscape. It will significantly contribute to the economic growth and development.

What has been lacking up until recently, political will from the place of the highest order, appears to be in abundance since Abiy Ahmed took office as Prime Minister. His administration has demonstrated its commitment to transforming the financial sector, which is predominantly dominated by a handful of commercial banks. They mirror a common African scene of limited liquidity and lacklustre participation from private and institutional investors.

The urgency of a paradigm shift towards capital markets is apparent in countries like Kenya, where businesses obtain approximately 95pc of their funding from banks.

The Administration has initiated significant reforms under the Capital Market Authority, under its founding and able Director General, Brook Taye (PhD).

The helmsman of the nascent capital market, Brook wields considerable influence over the financial destiny of this country. Educated in the venerable halls of London’s School of Oriental & African Studies and Paris’ l’École des Mines, his academic path, which began in Addis Abeba, provided him with a blend of local insight and international perspective. The latter could have served him well in his previous tenure as a senior advisor to the Minister of Finance.

Known to have a significant role in the telecom licensing saga - Abiy’s signature liberalisation crusade that brought Safaricom to the Ethiopian market - under Brook’s stewardship the nascent Ethiopian Securities Exchange (ESX) has emerged, heralding a new era for the investment landscape and how domestic and international capital can be mobilised.

Since the enactment of Proclamation 1248, which outlines the Authority’s powers and duties, Brook has been laying the groundwork for a regulatory framework for the capital market. However, he seems to be keen on defining the role of the government to go beyond mere regulation. It is clear that he wants it to encompass a commitment to enhancing financial transparency, facilitating public access to information, and fostering a tax environment supported by legal frameworks and an unwavering adherence to the rule of law.

Undoubtedly, recognising the correlations between thriving capital markets and a robust business environment is crucial. Joseph Schumpeter, the celebrated Austrian political economist, advocated for capital markets as efficient platforms for resource allocation. However, African capital markets, often characterised by their shallow and imperfect operations, have shown limited contributions to broader economic growth, signalling the need for a tailored approach to developing such markets for emerging economies like Ethiopia’s.

Historically, Ethiopia had a brief stint with a capital market of some sort during the Imperial Regime, which was formally institutionalised in 1965 following the enactment of the Commercial Code. However, this early venture was short-lived, abolished in 1974 with the rise of the Dergue regime. The soldiers who claimed power from the monarchy had no regard for a capitalist machine. Their successors were no different in their disdain to the creation of a money market.

The current push to establish a capital market has its roots in the early 2000s, spearheaded by Addis Abeba Chamber of Commerce leaders. The effort by businesspeople such as Ermias Amelga and Zemedeneh Negatu was frustrated to no end by the Revolutionary Democrats. Unfortunately, their shortsightedness missed the fact that the capital market could be integrated into broader macroeconomic and structural reforms, addressing the critical shortfall in capital and complementing the abundant labour and natural resources.

A significant milestone was achieved in 2021, when Parliament passed a bill for the establishment of the country’s first securities exchange. This market, intended to enable trading of securities like company stocks and bonds, is to be established as a share company through a merger of public and private sector efforts.

The Ethiopian Securities Exchange (ESX) aims to connect capital individuals and institutions raise to financial products and projects. Subsequently, the National Bank of Ethiopia (NBE), supported by the UNDP, established a capital markets project implementation team, whose members designed for the ESX to offer main markets and small and an additional for medium enterprises. These segments are crucial for raising the 20 trillion Br needed for infrastructure development over the next decade.

Nonetheless, the capital market’s journey is not without snags. As public debt mounts and inflation and liquidity crunch loom large, the call for price stability and the creation of strong supporting institutions became louder. The Prime Minister’s upbeat outlook on the transformative potential of capital markets could be laudable, yet it has yet to be grounded in realism. The success of vibrant capital markets hinges on more than official aspiration; it requires policy actions to create conducive market conditions.

A stable and equitable tax policy is fundamental to the emergence of such markets. As demonstrated by the ‘wall and roof’ tax in Addis Abeba, the government’s approach to taxation needs to evolve towards predictability and fairness, indispensable for inspiring investor confidence. The judiciary’s independence, confidence and competence also play a crucial role in building investors’ trust. Ethiopia’s 129th ranking out of 142 countries in the World Justice Project’s Rule of Law Index signals a need for reform in the legal system to attract and retain investment.

Developing a vibrant capital market is not just a political enterprise but also a technical one. It requires building the infrastructure, including trading platforms, clearinghouses, and investor protection mechanisms. Embracing technology for trading and leveraging fintech for wider market access, will become vital.

Capacity building through education and training for market participants is equally important to enhance market efficiency and integrity.

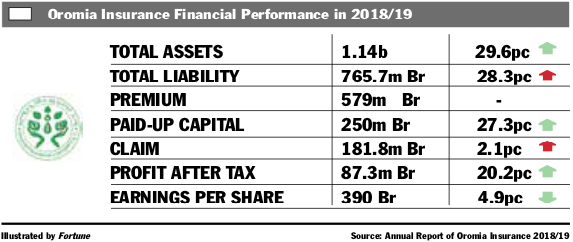

An inclusive capital market that caters to various sectors and investor classes is essential as developing diverse financial instruments to suit different risk appetites and investment horizons is crucial. Attracting domestic and international institutional investors is key to achieving market depth and liquidity. Policies that encourage the participation of pension funds, insurance companies, and mutual funds will significantly contribute to the market’s development.

Ethiopia can benefit from international partnerships and learning from global best practices. Collaborations with established markets can provide valuable insights into regulatory frameworks, technological advancements, and operational efficiencies. Cultivating a savings and investment culture among the populace through financial literacy programs and incentives is necessary to stimulate interest and participation in the market.

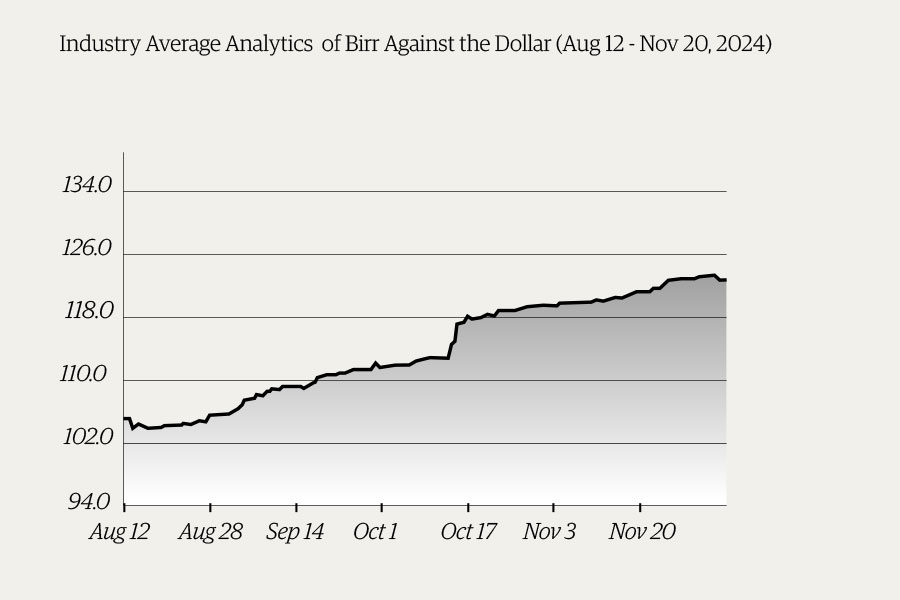

Most importantly, though, policymakers should focus on macroeconomic stability, which is also a prerequisite for a flourishing capital market. Issues such as inflation, currency volatility, and fiscal deficits need to be addressed to create an investment-friendly environment, ensuring a sound macroeconomic setting.

PUBLISHED ON

Nov 25,2023 [ VOL

24 , NO

1230]

Money Market Watch | Dec 08,2024

Fortune News | Jun 06,2021

Fortune News | Apr 03,2021

View From Arada | Mar 09,2019

Agenda | Sep 10,2021

Fortune News | Feb 22,2020

Radar | Dec 10,2022

Radar | Oct 06,2024

Fortune News | Oct 23,2021

Fortune News | Jan 25,2020

My Opinion | 131674 Views | Aug 14,2021

My Opinion | 128041 Views | Aug 21,2021

My Opinion | 126002 Views | Sep 10,2021

My Opinion | 123625 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...