Jan 25 , 2020

By MESAY BERHANU ( FORTUNE STAFF WRITER

)

Earnings per share of the company declined slightly.

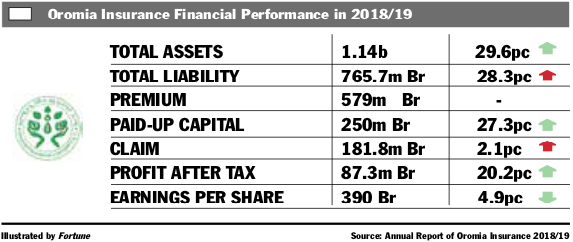

Oromia Insurance Financial Performance for the Fiscal Year 2018/19.

Oromia Insurance Financial Performance for the Fiscal Year 2018/19. Despite a notable improvement in profitability, the earnings per share (EPS) of Oromia Insurance saw a marked decline in the last fiscal year.

The company’s profit after tax went up by 20pc to 87.3 million Br, while the EPS slid by 20 Br to 390 Br, undermined by a marked increase in paid-up capital.

The capital was raised to ensure the company's competitive advantage in the industry and for increased reinsurance coverage, according to Asfaw Benti, the CEO of Oromia, whose branch network reached 47 including six contact offices in the last fiscal year.

Oromia raised its paid-up capital to 250 million Br, an increase of 27pc.

The paid-up capital of the company was raised based on the decisions of the shareholders, according to Aberra Bekele, the chairperson of the board of directors of Oromia.

"The shareholders even agreed to double the capital to half a billion Br in the coming year," he told Fortune.

The reasonable increases made in all income activities helped the company to raise its profit. Oromia registered a 13pc increase in the total gross written premium both for life and general that reached 452.4 million Br. The company also ceded 75.7 million Br of the gross premium to reinsurers, helping the retention rate rise by a percentage point to 83.3pc, above the industry average of 79.4pc.

Against the increased retention rate and the growth in gross written premium, claims paid and provided both for life and general insurance increased reasonably by 11pc to 202.9 million Br.

This shows that claims were well-controlled, according to Abdulmenan Mohammed, a financial statement analyst with close to two decades of experience.

"The management should keep this practice,” remarked Abdulmenan.

Oromia’s income has also expanded considerably. Its commission from reinsurers increased by 13pc to more than 23 million Br, whereas it paid 8.3 million Br in commission to agents, which was five percent less than the previous year.

Sound investment activities Oromia made in the last fiscal year resulted in a 15pc increase in earned interest on deposits and a 208pc spike in dividend payouts that reached 57.2 million Br, and 7.7 million Br, respectively.

“The management should be applauded for consistently increasing the income from investment activities,” Abdulmenan noted.

Total expenses of the company have grown by eight percent to reach 124.5 million Br.

Oromia increased its total assets by a marked 29.6pc that reached 1.1 billion Br. More than 472 million Br of the total assets were invested in fixed time deposits, while 110.6 million Br in shares and associates.

A huge amount of money was held in the current account, and the amount receivable from reinsurers showed a considerable increase. As a result, the company’s total investment in savings and shares declined to 51pc from 60pc in the previous year.

“Oromia needs to collect its huge receivables and put them in income-generating activities,” suggested the expert.

Asfaw says the money the company held in the current account could be used for the construction of the 35-storey future headquarters of the company that will be built over a 3,000Sqm plot of land at Sengatera area. The construction of the building began last year, and it is expected to be completed in the coming four years.

“We'll also use the money to expand the ICT base of our operations,” Asfaw told Fortune.

Oromia showed an increased level of liquidity as cash and bank balances went up by 108pc to 135.1 million Br. Its ratio of cash and bank balances to total assets increased to 12pc, an increase of six percentage points. The ratio of cash and bank balances to total liabilities also rose to 16pc from 11pc.

Capital and non-distributable reserves of the firm accounted for 27.5pc of its total assets.

“With its strong capital base," said Abdulmenan, "Oromia Insurance must strive to use this resource efficiently rather than constantly increasing it."

Yosef Habtemariam, a founding shareholder, appreciated the performance of the company despite the challenging external environment in the overall economy.

"Though the EPS declined slightly," said Yosef, "it is still very high compared to the trends over the years since its establishment."

PUBLISHED ON

Jan 25,2020 [ VOL

20 , NO

1030]

Fortune News | Oct 16,2021

Fortune News | Mar 18,2023

Commentaries | Dec 10,2022

Radar | Oct 19,2024

Fortune News | Mar 23,2024

Fortune News | Mar 02,2019

Fortune News | Jan 05,2020

Fortune News | Nov 07,2020

Radar | Nov 27,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...