Radar | Apr 29,2023

Dec 10 , 2022

By Richard Ketley

Although the aggregate capitalization by the banking industry appears to hit 199 billion Br, the breakdown reveals that only two banks take the share of over 40pc. Tens of thousands of shareholders and their directors are faced with dilemmas in meeting the demand from the central bank to reach a capital threshold come 2026, writes Richard Ketley, director of Financial Services Strategy at Genesis Analytics, a South African-based consulting firm.

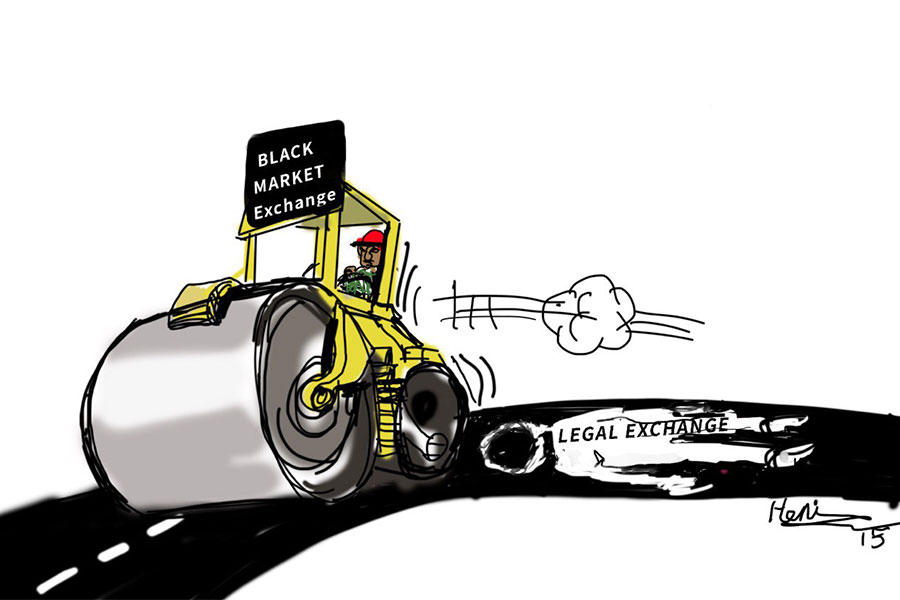

Ethiopia's banking sector is undergoing a rapid transition. When the National Bank of Ethiopia (NBE) issued a directive in April 2021 that required the country's commercial banks to increase their minimum paid-up capital, it was to ensure ongoing financial resilience within the banking sector. The new minimum capital requirement is five billion Birr, about 95 million dollars, a 10-fold increase from the previous floor.

The deadline for the banks to comply is June 2026, with certain concessions for those currently under formation.

Could the banks pull off such a feat?

It is not the first time these financial institutions have seen increases in capital requirements. In 1999, they needed 75 million Br in paid-up capital. A decade later, this was raised to half a billion Birr. And yet, the recent increase remains the most demanding. Failure to comply may result in a bank getting dissolved.

According to the latest available figure from the central bank, the Ethiopian banking industry comprises 30 banks, which collectively boast 199 billion Br. This may suggest that the industry is capitalised in line with the new directive, but the devil is in the details. Two public banks - the Commercial Bank of Ethiopia (CBE), the biggest bank in the country, and the Development Bank of Ethiopia (DBE), a policy bank - dominate the market. Their share of total capital stands at 41.5pc, with CBE accounting for much of this.

Meanwhile, half of the country's banks have yet to meet the requirement.

The good news is that the banks have more routes to raising capital. They can boost their retained earnings and capital by reducing dividend payouts. Another option is to issue new equity. Foreign investors could be a source of capital, attracted to the about-to-be-opened financial sector, given that it is home to 115 million people and Africa's eighth-largest economy with a GDP of 111 billion dollars.

It plays to the advantage of existing banks, at least from raising more equity capital, that the financial sector will be liberalised to foreign capital in short- to medium-term. This will include allowing equity investment by foreign banks into local ones, which could single-handedly address the headache of meeting capital requirements but at the price of selling ownership. Balancing between a well-capitalised financial institution and protecting against the dilution of current shareholders is a dilemma that board directors must decide over in the next few years.

Plans to launch the country's first securities exchange will also provide a route for banks to raise additional equity. It will create a secondary market that makes the buying and selling stocks easier and improve investment by the public in institutions that list, which in Ethiopia's case will mainly be banks, at least at the outset.

A third way is increasing merger and acquisition activities. There is precedent for this in Africa.

Nigeria has had several waves of banking consolidation driven by changes in the minimum capital requirements. Recently, in 2017, the two smallest banks in Malawi merged to meet updated capital requirements. Similarly, two state-owned banks in Ghana merged in 2018 for the same reason.

More dramatically, in Ghana, five banks lost their licences in 2018 for struggling to meet the updated capital requirements, amongst other problems. The Bank of Ghana subsequently merged these five banks into a single entity, with the government injecting additional capital.

While mergers and acquisitions may be a matter of survival for Ethiopia's smaller banks, pulling it off is not a walk in the park. Pitfalls often include inadequate due diligence, failure to optimally integrate the two entities and overestimating the benefits of merging.

PUBLISHED ON

Dec 10,2022 [ VOL

23 , NO

1180]

Radar | Apr 29,2023

Radar | Jan 01,2022

Editorial | Oct 01,2022

Fortune News | Feb 09,2019

Radar | Nov 20,2023

My Opinion | 131548 Views | Aug 14,2021

My Opinion | 127903 Views | Aug 21,2021

My Opinion | 125879 Views | Sep 10,2021

My Opinion | 123510 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...