Radar | Apr 03,2023

Oct 16 , 2021

By HAWI DADHI

An overseas firm exploring gold in Western Wellega Zone has suspended the erection of a production facility in Tulu Kepi due to security concerns. The second suspension comes weeks before a government-enforced deadline to begin operations takes hold.

The hiccup jeopardises hundreds of millions of dollars in financing Kefi Gold Plc has secured recently. The value of its shares at the London Stock Exchange slumped down 22pc to 1.25 pence days after the suspension was announced by its executives.

The exploration in Tulu Kepi, 350Km from Addis Abeba, began over a decade ago after Kefi acquired an Australian firm, Nyota Minerals Limited, for 5.2 million pounds sterling (7.2 million dollars at current exchange rates). Close to 70 million dollars had already been spent on the venture before Kefi took over. The 2,000hct exploration area is estimated to hold deposits of close to 50,000Kg of gold. Federal officials expect to boost shipments of gold, which is now the second-most exported item next to coffee. The export of gold brought proceeds of over 650 million dollars last year, more than double the amount it earned in 2019.

The suspension is the latest in a series of delays the company has faced since 2016. Its executives attribute the setbacks to security concerns in the area and state of emergency declarations. Two years ago, the company halted operations in the wake of an attack on its exploration site by an unidentified armed group. Uncertainties in the area disrupted transport and office activities in Gimbi town, 315Km west of Addis Abeba, according to Harry Adams, executive chairman at Kefi Gold.

West Wellega has been a hotbed for instability over the past few years, with frequent reports of attacks on civilians and military engagements between the Ethiopian army and a growing insurgency. According to authorities in the area, the security situation is "risky", and the local administration takes measures to respond to the concerns.

"I believe they took the right measure considering the armed conflict in the area," said a senior official of the Oromia Investment Commission, who requested anonymity.

However, officials at the Ministry of Mines find the claims put forth by Kefi Gold executives unconvincing. They suspect the security concern is used as a pretext to push the deadline set by the government to begin production.

"Although security issues are prevalent, the company uses it as an excuse to extend the deadline," Takele Uma, minister of Mines, told Fortune.

An expert with close to 15 years of experience in the mining industry suggests the company follow in the footsteps of firms conducting explorations in Congo.

"The security situation there is not ideal but large exploration projects are taking place," says the expert. He advises Kefi to arrange its own security team in collaboration with the government.

Before the board of directors of Kefi Gold suspended operations, a team of international experts were contracted to conduct assessments. But the team was unable to carry out the evaluation and advised the company to pause its activities. The experts are scheduled to return next month, and the company review its decision based on their report, the Executive Chairman disclosed to Fortune.

"We're working closely with the regional authorities," said Adams. "We expect these issues will be resolved this month."

Suspending operations not only goes against the operational schedule required by the Ministry but has also affected the disbursement of funds Kefi Gold secured almost two months ago. Its executives were in search of financiers for 350 million dollars needed to carry out its plan to erect a production plant. They struck a deal with the Trade & Development Bank (TDB) and the Africa Finance Corporation (AFC), which committed 140 million dollars.

According to Adams, all the legal and documentation work has been completed, but the investors want to see the security issue resolved before signing.

The federal government has a 17pc stake in the company, while domestic and foreign investors have chipped in 160 million dollars.

Darragh Gillen, one of the company's 5,000 shareholders, acquired shares through several rounds of share offerings last year.

"The statement they released on the issue lacked a lot of detail, and we'd like to have clarity on it," he told Fortune. "They said they hope to resolve it within a couple of weeks, but we don’t know what exactly is the issue."

Gillen suspects the company is looking for government assistance to resolve the security issues, under a lot of pressure to clinch the financing before the end of 2021.

The expert has observed that mining explorations carried out by foreign companies are often unfruitful for the government and the public, as the company can sell out its license and make profits without even beginning operations. The experience of Nyota, the previous project owner of Tulu Kappi is a good example, according to him.

"How do the government and society benefit from this?" he asked.

PUBLISHED ON

Oct 16,2021 [ VOL

22 , NO

1120]

Radar | Apr 03,2023

Radar | Jun 07,2020

Fortune News | Jan 09,2021

Radar | Dec 19,2021

Commentaries | Jun 29,2019

Fortune News | Jan 22,2022

Commentaries | Dec 17,2022

Viewpoints | Jun 27,2020

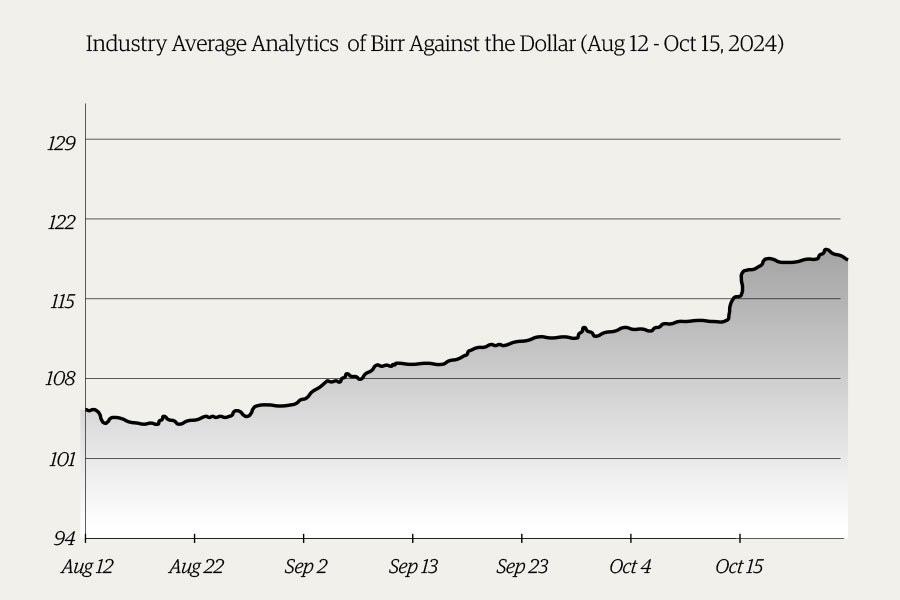

Money Market Watch | Oct 27,2024

My Opinion | Oct 05,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...