Commentaries | Feb 18,2023

Sep 16 , 2023.

The Ethiopian economic narrative oscillates between pockets of resilience and significant challenges. While sectors like services comprising 38pc of the economy and agriculture, nearly 40pc, demonstrated adaptability and moderate growth, underlying vulnerabilities, particularly in the industry sector (23pc), external trade and investment landscape, pose significant hurdles in the path of long-term economic growth.

A discerning glimpse into the economic performance of the past half-decade to 2022 paints a vivid picture of fluctuating fortunes and burgeoning sectors. They signal a juncture to redefine the country’s fiscal narrative, echoing the desperate demand for policy reorientation for a recovery that cannot be ignored.

Ethiopia’s mining and quarrying sector, an erstwhile underperformer, emerged as one of the pockets of resilience, showing an impressive rebound to an average growth rate of 34pc over the past five years. This sector turned the tide by exhibiting negative growth rates in the initial two years, hinting at untapped potentials and new avenues in the sub-soil wealth.

Contrasting this, the health and social work sectors have become a beacon of steady development, an upward trajectory with a commendable 12pc average growth rate. It is another example of resilience in times of adversity amid a global health crisis.

But the tale of Ethiopia's economy is not merely a series of upsurges.

The educational sector and private households with employed persons have languished with a three per cent growth rate, exhibiting a pressing need for reforms that could unlock their potential. These sectors seem caught in an economic tempo, awaiting a catalyst to spur their momentum.

The crop sector commands a notable 21.2pc. Its substantial share in the GDP underscores the agrarian backbone of Ethiopia's economy, but a slight contraction in productivity recorded over the past five years should give policymakers reasons to stay up at night. However, it is a sector ripe for innovation and sustainable reforms provided the incumbent party's leaders generate a progressive political-economic blueprint for the country.

The construction sector has built a solid foundation, contributing 20.8pc to the GDP. The rise of the wholesale and retail trade sectors was no less impressive, paired with financial intermediation. These sectors contribute positively to the GDP, signalling a promise for a diversified and resilient economy.

Nonetheless, persisting inflationary pressures, coupled with a precarious foreign exchange position, demanded the authorities a calibrated approach in policy formulation and execution. Fostering a supportive environment for investment, alongside pragmatic fiscal and monetary policy adjustments, appears to be vital to unlocking a sustainable economic growth pathway.

In the intricate maze of Ethiopia's financial landscape, potent complexities are converging with precarious elements, weaving a needlepoint that reflects both potential and vulnerability.

A careful dissection of the latest data reveals a narrative steeped in pragmatic borrowing and state intervention, striving to maintain a macroeconomic equilibrium.

Ethiopia's public sector debt exhibited a noticeable uptick, at a staggering 60.6 billion dollars as of March 31, 2023. This marks a six per cent jump from the previous year's 57.3 billion dollar mark, underlining a significant effort to foster growth despite a prevailing fiscal tightening.

This course of action, however, has introduced elements of fragility, especially with the fluctuating dynamics of the US Dollar affecting the external debt scenario and runaway inflation rattling the domestic economic landscape.

Domestic debt is steering the helm, accounting for 53.5pc of the total burden. The federal government shoulders most of this load, with a liability amounting to 38.9 billion dollars, leaving state-owned enterprises (SOEs) grappling with a 35.8pc share of the debt pie. As Ethiopia sails through political storms and militarized conflicts, the burgeoning debt numbers mirror a broader economic narrative that encapsulates the country's audacious balancing act between fostering growth and exercising fiscal prudence.

The external debts have climbed to 28.1 billion dollars, experiencing a modest increase of over 200 million dollars since June 2022. This could be partly due to fluctuations in the US Dollar’s value and a somewhat restrained principal payment during the recent months compared to the disbursements.

With an overwhelming 69.1pc stake in the external debt portfolio, the federal government emerges as the dominant player. The remaining portions are dispersed between government-guaranteed and non-guaranteed SOEs, holding 20.8pc and 10.1pc stakes, respectively.

In what seems to be a determined stride towards economic bounce, the federal government adopted the role of the primary borrower this fiscal quarter, orchestrating nearly 79pc of new loans, a move valued at approximately 641.82 million dollars.

In Ethiopia’s trajectory of the debt landscape, this could be a cause for cautious optimism. Macroeconomic policymakers appear to exhibit an approach towards debt management, highlighted by a 47.83pc average grant element in the new loans.

Ethiopia's engagement with the G20 Debt Service Suspension Initiative (DSSI) signifies a season of fiscal breathing space. It was allowed to freeze debt service payments to bilateral creditors, a strategic respite translating to a substantial relief of 216 million dollars. The country also secured grant aid from the International Monetary Fund’s Catastrophe Containment and Relief Trust (CCRT), offering a reprieve from IMF debt services to the tune of about 12 million dollars.

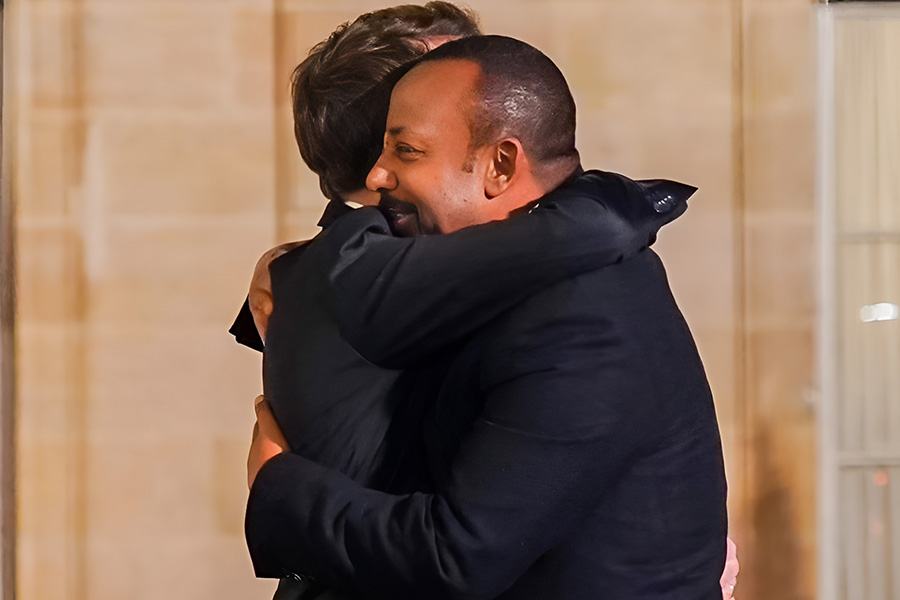

As Ethiopia stands at a crossroads, key figures such as Central Bank Governor Mamo Mihretu and Finance Minister Ahmed Shide, alongside State Minister Eyob Tekalign (PhD), are spearheading negotiations under the Common Framework (CF) initiative of the G20. Despite the slow-paced progress, with creditor committee activities co-chaired by France and China yet to gain momentum, there rests a glimmer of hope.

A fruitful negotiation could propel Ethiopia from a high to a moderate debt distress rating, promising a financial rebound. The success of these talks could also be a forerunner of renewed fiscal optimism, opening new vistas for Ethiopia and potentially ushering in an era of increased macroeconomic stability.

The domestic debt saga, meanwhile, is gathering substantial momentum. Despite the fiscal prudence exhibited in external borrowing, the domestic debt market is undergoing a transformation.

The record shows a significant 14pc surge from the previous year’s 1.53 trillion Br, signalling the government's intensified focus on domestic borrowing avenues. In a pivotal policy shift, the federal government introduced a domestic debt instrument, compelling commercial banks to procure a five-year treasury bond amounting to 20pc of their new loan disbursements reaching a little over 25 billion Br, a manoeuvre presumably aimed at curtailing inflationary trends.

Treasury bills (T-bills), which serve as a critical instrument in budget deficit financing, witnessed a one percent dip, settling at 314.6 billion Br by the end of March. This shows higher payouts to T-bill holders during this period, coupled with soaring yields across various maturities, hinting at an evolving dynamic in the domestic debt arena.

PUBLISHED ON

Sep 16,2023 [ VOL

24 , NO

1220]

Commentaries | Feb 18,2023

Fortune News | Jun 14,2020

Commentaries | Sep 07,2019

Radar | Feb 09,2019

Agenda | Oct 14,2023

Radar | Feb 09,2019

Fortune News | Feb 11,2023

Viewpoints | Nov 02,2024

Life Matters | Dec 21,2019

Fortune News | Oct 18,2025

Photo Gallery | 178663 Views | May 06,2019

Photo Gallery | 168857 Views | Apr 26,2019

Photo Gallery | 159692 Views | Oct 06,2021

My Opinion | 137093 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025 . By YITBAREK GETACHEW

Officials of the Addis Abeba's Education Bureau have embarked on an ambitious experim...

Oct 26 , 2025 . By YITBAREK GETACHEW

The federal government is making a landmark shift in its investment incentive regime...

Oct 29 , 2025 . By NAHOM AYELE

The National Bank of Ethiopia (NBE) is preparing to issue a directive that will funda...

Oct 26 , 2025 . By SURAFEL MULUGETA

A community of booksellers shadowing the Ethiopian National Theatre has been jolted b...