Fortune News | Mar 02,2024

Oct 14 , 2023

By Jayati Ghosh

The avoidable tragedy of growing hunger receives only fleeting mention among the multiple crises that have erupted worldwide. And any attention it attracts is apparently not enough to prompt global policymakers to act, writes Jayati Ghosh, professor of economics at the University of Massachusetts Amherst, in this commentary provided by Project Syndicate (PS).

A new report from the Food & Agriculture Organisation (FAO) of the United Nations makes for grim reading. According to the State of Food Security & Nutrition in the World 2023, an estimated 42pc of the world's population – more than 3.1 billion people – could not afford a healthy diet in 2021. Moreover, global hunger is still far above pre-pandemic levels, with around 122 million more people facing food insecurity in 2022 than in 2019, and is on the rise throughout Africa, Western Asia, and the Caribbean, owing partly to higher prices.

A worrying pattern can be seen at the national level: the countries with the largest increases in food insecurity are also those engulfed in debt crises and experiencing the severest effects of climate change.

Hunger reflects the interplay between food supply, purchasing power, and prices. Supply depends on domestic production, which can be affected by extreme weather and conflict, and on a country's ability to import foodstuffs, which high transport costs and foreign exchange constraints can undermine. The availability of income-earning opportunities determines the purchasing power of households and individuals; money wages and earnings from self-employment relative to food prices; and the extent of social protection, for example, through public provision of essential items. Food prices, meanwhile, are mainly driven by national and international trade patterns.

But, as I argued earlier this year, there is now a growing awareness of the concentration of power in agribusiness and the ability of the sector's behemoths to influence global food prices. In addition, speculative activity in commodity futures markets can affect food prices in spot markets.

Both factors were addressed in detail in the Trade & Development Report 2023, published by the United Nations Conference on Trade & Development (UNCTAD), which confirms that "corporate profits from financial operations appear to be strongly linked to periods of excessive speculation in commodities markets and to the growth of shadow banking." The report goes on to recognise that "during periods of heightened price volatility, certain major food trading companies gain amplified profits in the financial markets."

Speculative activity is short-lived by nature. Thus, the sharp spike in global food prices (particularly for wheat) that began in late 2021, during the run-up to the Ukraine war, peaked in May 2022 and then dropped off just as quickly. Wheat prices in August 2023, for example, were well below their August 2021 levels.

This should have made life easier for food-importing countries. And, it could be argued that short-lived surges in food prices can be ignored because they are short-term fluctuations. But in many countries, domestic food prices have remained high or continued to rise even as global prices fell. This is not new. Something similar happened in the wake of the global food crisis 2007/08, when prices in many low- and middle-income countries increased even after global food prices had declined significantly.

Much of the problem can be traced to the ability to import food. The period from early 2022 onward was marked by multiple cascading shocks that hit several food-importing countries particularly hard: the end of the moratorium on sovereign debt repayment; the shift to tighter monetary policies and higher interest rates in advanced economies, which led to capital flight from developing economies; and upward pressure on import bills from higher energy prices.

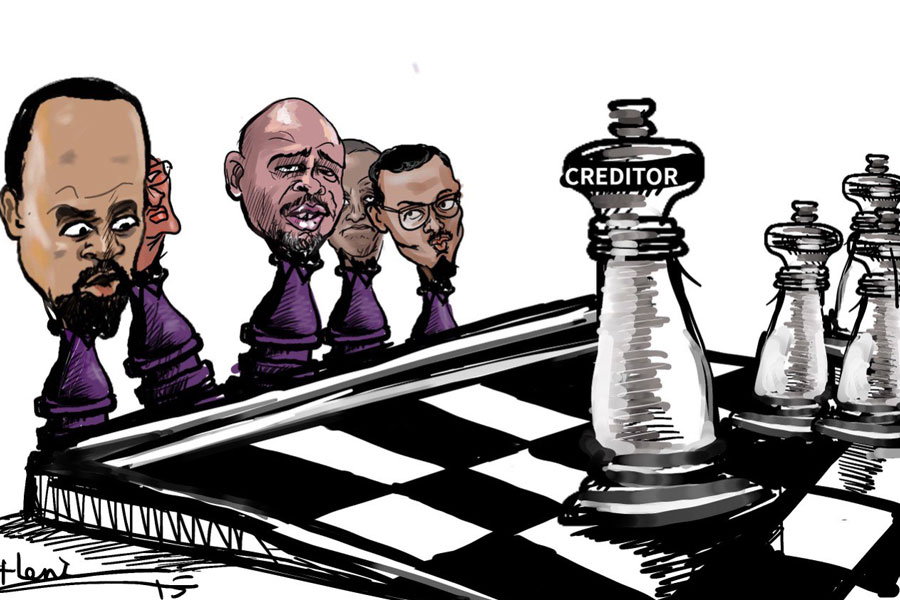

Most of all, unsustainable external debt burdens and the insistence on repayment have made it difficult to sustain essential imports. Taken together, these factors have led to steep currency devaluations, making the local price of imported food that much higher.

The FAO has identified 10 countries where food prices rose well above global trends from mid-September 2023: Argentina, Ecuador, Ghana, Malawi, Myanmar, Pakistan, South Sudan, Sudan, Zambia, and Zimbabwe. All have severe sovereign debt problems and acute foreign exchange shortages.

Apart from Ecuador (owing to its dollarised economy), these countries have also experienced large currency depreciations since the start of 2022, ranging from 24pc for Zambia to a whopping 344pc for Argentina, according to my calculations using the CEIC database. Economic mismanagement is only partly to blame. Instead, large swings in cross-border capital flows, as a result of macroeconomic policies in the world's major economies, are likely having a more considerable impact.

This implies that trying to control financial activity in global commodities markets, while necessary, is not enough to combat hunger. Policymakers will need to revisit other means of food-price stabilisation, such as national agrarian policies and international trade regimes that – soil and climate permitting – ensure domestic or regional self-sufficiency in staple food items.

Building up buffer stocks of grain to sustain domestic and regional supply is once again a salient issue and should be seriously considered. (The United States uses strategic oil reserves to manage fuel prices, but food is no less crucial for most countries.) In addition to emergency reserves, social protection to prevent food insecurity will also be essential. That means policymakers must focus more on public investment, while also incentivising the private sector to invest in sustainable smallholder agriculture.

Establishing a publicly administered virtual reserve mechanism, with the possibility of direct government intervention in physical and financial markets, could also help countries cope with global price fluctuations. This would involve small amounts of decentralised physical reserves, coupled with a financial fund to intervene in futures markets against price spikes or dips. Public intervention could even help market participants recognise the real fundamentals in financialised commodity markets, as in currency markets.

Low- and middle-income countries must also consider how to manage short-term capital flows, mainly to prevent them from destabilising domestic food prices.

The fight against global hunger requires policymakers to understand and address its root causes. Regulating financial activity in volatile commodities markets is only one of the necessary institutional changes. Withstanding price fluctuations will also require helping countries and regions build up reserves of essential food items.

PUBLISHED ON

Oct 14,2023 [ VOL

24 , NO

1224]

Fortune News | Mar 02,2024

Viewpoints | May 18,2024

Fortune News | Oct 23,2021

Editorial | Apr 15,2023

Viewpoints | Oct 14,2023

Fortune News | Sept 18,2021

Commentaries | May 25,2019

Viewpoints | Mar 11,2023

Commentaries | Apr 30,2022

Viewpoints | Jun 07,2025

My Opinion | 131983 Views | Aug 14,2021

My Opinion | 128371 Views | Aug 21,2021

My Opinion | 126309 Views | Sep 10,2021

My Opinion | 123927 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jul 6 , 2025 . By BEZAWIT HULUAGER

The federal legislature gave Prime Minister Abiy Ahmed (PhD) what he wanted: a 1.9 tr...

Jul 6 , 2025 . By YITBAREK GETACHEW

In a city rising skyward at breakneck speed, a reckoning has arrived. Authorities in...

Jul 6 , 2025 . By NAHOM AYELE

A landmark directive from the Ministry of Finance signals a paradigm shift in the cou...

Jul 6 , 2025 . By NAHOM AYELE

Awash Bank has announced plans to establish a dedicated investment banking subsidiary...