Fortune News | Jul 15,2023

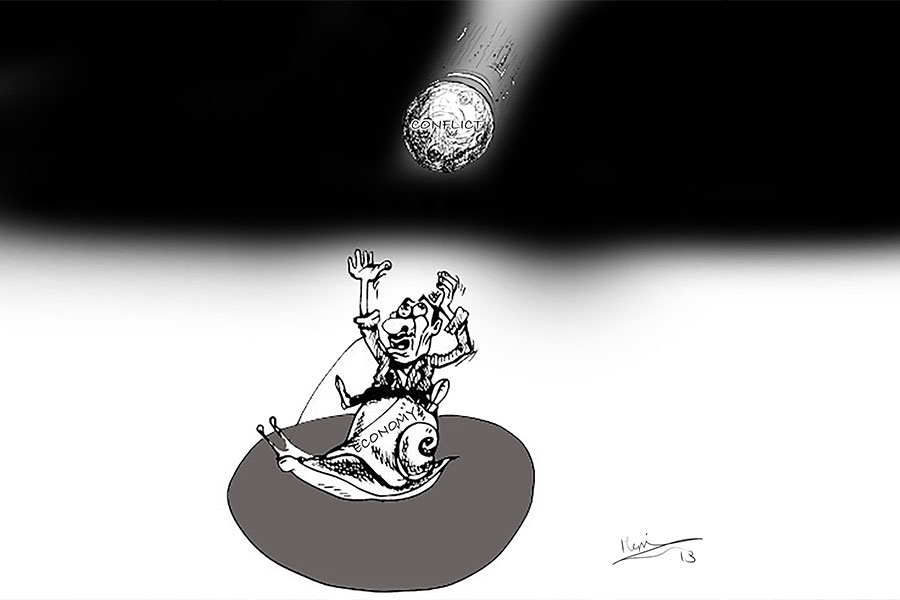

In an attempt to manage an expanding budget deficit, Finance Minister Ahmed Shide proposed last week a series of fiscal policy prescriptions focused on domestic borrowing, targeted subsidies, and project postponements. These were laid out during his sobering nine-month report to Parliament as the country grapples with the aftermath of a wartime economy, which led to a 20.4pc contraction in its productivity.

The Minister disclosed that the deficit, amounting to a hefty 192.6 billion Br, has been funded primarily through direct borrowing from the central bank and through treasury bills and bonds. The strategy underlines the federal government’s continued reliance on domestic financial sources, a move which has contributed to the spiralling inflation.

“As part of our reform efforts, we’ve turned to these instruments,” Minister Ahmed stated, referencing a directive by the central bank from October when the budget deficit hit 125 billion Br, reaching four percent of the GDP.

The directive mandated commercial banks to purchase five-year maturity treasury bonds—a practice previously halted after Abiy Ahmed (PhD) became the Prime Minister.

However, Ataw Alemu (PhD), an economist from Addis Abeba University, expressed concerns about the substantial budget deficit’s sustainability. He argued that government interference in the economy is unproductive when it does not produce consumer or investment goods.

Atlaw urged projects like park construction, for instance, should be left to the private sector, particularly given the stringent budget constraints the government faced.

“These projects should be left to the private sector,” Atlaw told Fortune. “Assuming they’re a priority on a tight budget.”

This year, the federal government’s total expenditures amounted to 458 billion Br, a significant decrease compared to last year’s figures. This reduced spending raises the possibility of an increased tax burden for Ethiopians as the government seeks to broaden its tax base aiming for an 18.2pc tax to GDP ratio within the next five years. It will be monumental feet to climb, having a 10 percentage point increase in insight. Ethiopia’s historically high tax-to-GDP ratio of 15pc was registered in the early 2010s.

The Finance Minister alluded to an imposition of property tax, which he believes could significantly enhance treasury inflows. The Addis Abebe City Administration has taken the lead this last week, imposing a new property tax regime, hoping to raise nine billion Birr.

Ahmed presented an excise tax amendment already approved by Parliament, which he anticipates will increase revenue by about seven billion Birr. Introducing an excise tax stamp is predicted to boost income from the tax by up to 300pc.

The focus on tax policies comes as no surprise, given that 95pc of the treasury’s inflows, amounting to 282 billion Br, were generated from taxes. The previous fiscal year recorded tax revenue at 477.7 billion Br.

Economists caution that implementing a robust fiscal policy necessitates a carefully balanced combination of taxes, debt, and investments.

Tiringo Dinku (PhD), teaching at Debrebrihan University College of Business & Economics, stated that when tax revenues are used for capital investments that stimulate employment and consumption, they generate taxable income deflationary in the long term. However, she also pointed out that using tax revenues to finance debt or budget deficits can be inflationary, potentially resulting in a liquidity crisis.

“It’s an indispensable tool in fiscal policy,” said Tiringo.

In contrast, Ataw advocates for a broader tax base with efficient collections. But he also cautions against hasty and ill-conceived imposition of taxes, which he believes could impact citizens already dealing with high inflation. The year-on-year headline inflation reached 33.7pc in April.

Minister Ahmed outlined measures the federal government has taken to counteract rampant inflation—subsidies on fertiliser imports and fuel, amounting to 17 billion Br and 180 billion Br, respectively. Duty waivers on essential commodities such as edible oil, sugar, rice, and pasta were also granted, despite the potential to collect 11 billion Br in revenues.

“The government has foregone its revenues,” he said.

Addressing the repayment of Ethiopia’s external debts, Ahmed reported that 70.3pc of the repayment plan had been achieved, while a significant portion of domestic debt repayments had been deferred.

“Our external debt is being serviced as scheduled,” he assured Parliamentarians.

Ethiopia’s 2014-issued Eurobond, set to mature in December next year, holds a precarious CCC- rating, signalling a high default risk. FitchRatings has warned that absent the Common Framework debt initiative, which could alleviate Ethiopia’s external debt burden, its external liquidity is set to worsen.

Minister Ahmed, however, hinted at an upcoming debt restructuring deal with the IMF and major creditors such as China to enhance Ethiopia’s credit rating. In a noteworthy mention, he also emphasised that Ethiopia has not taken a commercial loan in the last five years.

Highlighting the impact of declining foreign financial inflows, the Minister cited a modest 1.8 billion dollars from developmental partners, four times lower than the average a few years ago. He attributed this drop to the suspension of projects in areas impacted by the civil war last year and ongoing conflict, coupled with creditors exerting political pressure during the wartime. The Minister candidly shared his discontent with development partners for not fulfilling their responsibilities while also acknowledging the domestic reliance on borrowing due to increased wartime expenditure.

“They’ve overlooked their responsibilities,” Ahmed said of the decline in new commitments and forgone commitments.

The aftermath of the civil war has resulted in 22 billion dollars in damages and six billion dollars in economic losses, pulling an astonishing three million people into extreme poverty and directly impacting a third of the population living in the war-torn areas.

The Minister projected that a comprehensive damage assessment, expected to be released in the forthcoming weeks, will require 20 billion dollars and five years to effectively address and rebuild the war-ravaged areas of Tigray, Amhara and Afar regional states. He announced that the World Bank has already pledged 300 million dollars to initiate this critical reconstruction process.

Minister Ahmed was optimistic about the ongoing reforms in Ethiopia, expressing confidence that they will adequately finance the budget deficits without triggering excessive inflationary pressures. He also shared plans to impose a budget ceiling for federal agencies and to encourage a focus on prioritised areas.

Underlining his government’s drive towards a tightly controlled fiscal policy, Ahmed revealed a five-year macroeconomic policy framework that has been submitted to the Council of Ministers. This blueprint emphasises the need for tightening the budget and increasing savings. Tightening on public expenditure was communicated, with a directive issued to delay procurements in federal agencies. Ahmed attributed the deferral of projects estimated to shot up to 18 billion Br to a further cost-cutting measure his Ministry took.

PUBLISHED ON

May 20,2023 [ VOL

24 , NO

1203]

Fortune News | Jul 15,2023

Editorial | Nov 21,2020

Agenda | Feb 17,2024

Fortune News | Jun 07,2020

Agenda | Jun 25,2022

Commentaries | Aug 03,2024

Commentaries | Sep 07,2019

Fortune News | May 09,2020

Life Matters | Apr 03,2021

Commentaries | Jun 01,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...