Radar | Nov 09,2024

Jan 7 , 2024

The outcome of Ethiopia’s efforts to manage debt and revitalise its economy will have far-reaching implications for its citizens and the broader international community watching closely. Its journey through these tumultuous financial waters will undoubtedly be closely scrutinised, offering critical insights into the complexities of sovereign debt management in the 21st Century, writes this author, whose identity is withheld on request.

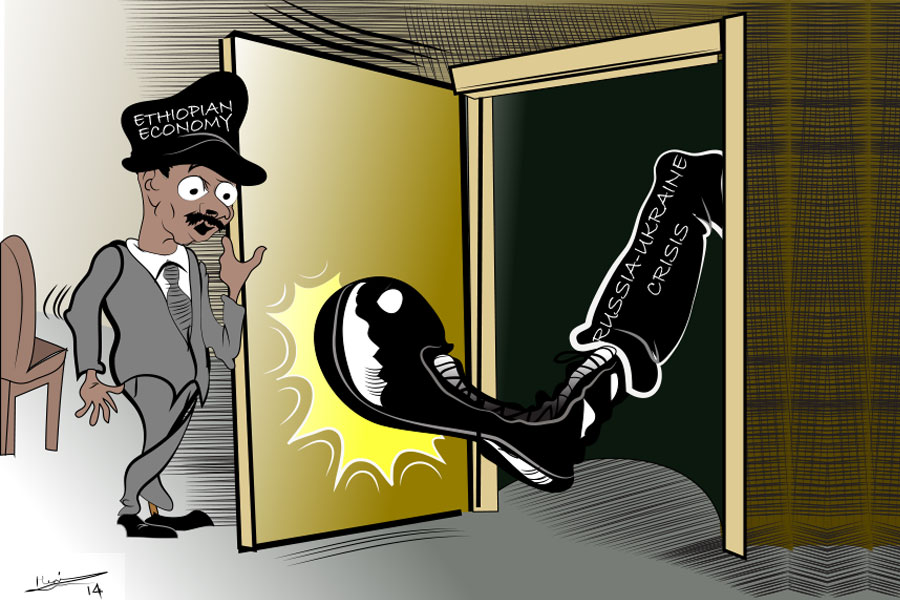

Ethiopia may find itself under the spell of a fiscal plight that echoes across the developing world. But its dilemma has uniquely Ethiopian contours. A spectre that looms large over its economy, despite a marginal dip in the debt-to-GDP ratio, a more disconcerting reality unfolds when we consider the absolute figures of debt. It is swelling at an alarming rate.

The International Monetary Fund (IMF) and various economic prognosticators forecast a troubling uptick in this ratio, potentially cresting at an unsettling 50pc by 2024.

In a twist of fiscal fate, Ethiopia recently stumbled, defaulting on a 33 million dollar coupon payment on a Eurobond. More than a mere monetary mishap, this lapse comes against a backdrop of internal strife and high public debt. It also coincides with the government's ongoing negotiations with the IMF for a financial lifeline and its engagement in debt restructuring talks with the G-20 countries.

In a recent talk with over 100 creditors, the federal government sought to allay fears of a default, attributing the missed payment to a strategic decision targeting equitable treatment of all creditors, rather than financial incapacity.

Arguably a tactical gambit, it could signal Ethiopia's commitment to a transparent and inclusive debt restructuring process. Such a strategy might promote trust as it may encourage cooperation among creditors, which is vital for charting a sustainable fiscal path. Alternatively, it could be perceived as a high-stakes negotiation ploy, leveraging the missed payment for more favourable restructuring terms.

However, the consequences of this missed Eurobond payment have been globally adverse.

This fiscal misstep has stoked fears of a sovereign default, an eventuality fraught with dire implications for Ethiopia and the international financial arena. A default could constrict Ethiopia's access to credit, inflate borrowing costs, and precipitate capital flight. It risks eroding global confidence in Ethiopia's economy and governance, potentially stifling foreign investment and trade, and exacerbating its economic woes.

Ethiopia's plight could herald a reevaluation of how developing countries finance their growth.

The spectre of Argentina's 2001 default, which had a protracted and harmful impact on its economy and international standing, should be a cautionary tale. Ethiopia's current strategy, while ostensibly a constructive step towards equitable creditor treatment, has not escaped global censure, reminding the gravity of the situation.

Ethiopia's fiscal landscape is fraught with peril and diplomatic intricacies. Its leaders must demonstrate an unwavering commitment to responsible debt management and engage in constructive dialogue with creditors and the international community. Restoring strained relations with donors, addressing internal security crises, and charting a course towards sustainable economic health are delicate balancing acts.

Ethiopia stands at a crossroads, with its future hinged on the adeptness of its fiscal management and the benevolence of the global economic order.

The immediate priority for Ethiopia’s leaders should be to articulate a clear and credible strategy for managing public debt. This involves placating current creditors and crafting a long-term plan for economic revitalisation. Transparency will be essential. A clear communication of intentions and methods will go a long way in restoring faith among international stakeholders.

They must address the root causes of the country’s economic vulnerabilities, including tackling internal conflicts that have drained resources and undermined investor confidence. Economic reforms aimed at diversifying revenue sources, improving domestic productivity, and enhancing the business environment are essential to reduce reliance on external borrowing.

The international community's role is equally crucial.

Ethiopia presents a test case for global financial institutions and creditor nations in managing sovereign debt crises. A balanced approach is required, one that ensures debt sustainability without stifling the country's economic growth. The G-20's Common Framework for Debt Treatments beyond the Debt Service Suspension Initiative (DSSI) could play a significant role, offering a structured approach to debt resolution.

Ethiopia's situation also raises broader questions about the sustainability of debt-driven development models in emerging economies. The ongoing global economic headwinds, including rising interest rates and tightening global financial conditions, further complicate the picture. As such, Ethiopia's plight could herald a reevaluation of how developing countries finance their growth, with potential implications for the global economic order.

The path Ethiopia’s leaders choose will not only determine their country’s economic future but also offer valuable lessons for other countries grappling with similar crises. The country's ability to navigate this fiscal storm will be a litmus test for its resilience and a pointer to the evolving dynamics of global finance and development.

PUBLISHED ON

Jan 07,2024 [ VOL

24 , NO

1236]

Radar | Nov 09,2024

Radar | Aug 13,2022

Viewpoints | Sep 08,2024

In-Picture | Feb 03,2024

View From Arada | Apr 03,2021

Advertorials | Mar 29,2024

Commentaries | Oct 19,2019

Radar | Feb 24,2024

Radar | Dec 15,2024

Editorial | Mar 05,2022

My Opinion | 131584 Views | Aug 14,2021

My Opinion | 127940 Views | Aug 21,2021

My Opinion | 125915 Views | Sep 10,2021

My Opinion | 123539 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...