Radar | Oct 14,2023

Jan 5 , 2019

By Lea Mehari

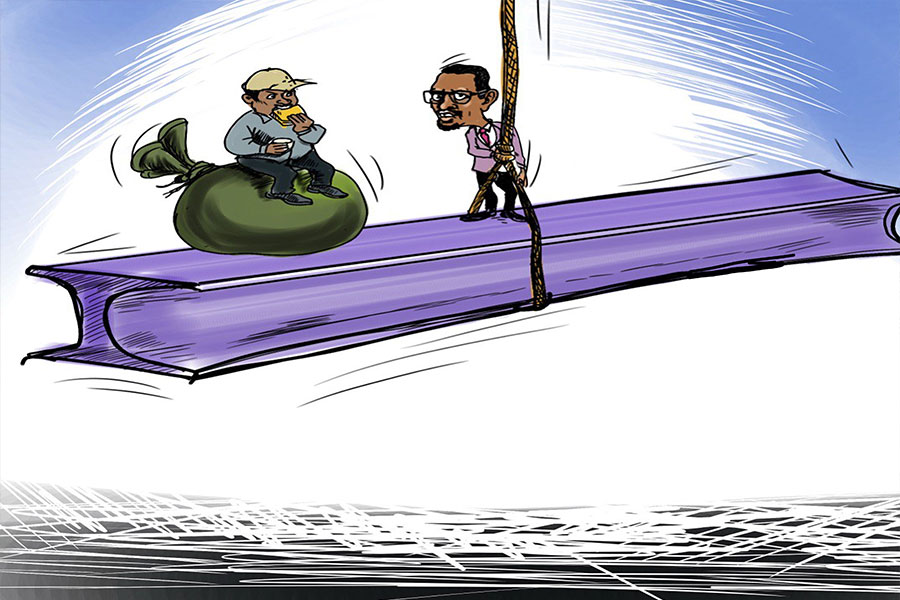

It is fortunate that not all goods and services are subject to the payment of a value-added tax (VAT). It is calculated on the value added to the product at each stage of its production, unlike a turnover tax, which is imposed on the gross value of the taxable product. VATs ultimately fall on the shoulders of the consumer, which could be detrimental when it comes to products of necessity, such as medical goods and services.

The VAT regime was introduced in Ethiopia in 2002 as part of the tax reform undertaken by the government in that year. It is a payment of an additional 15pc of the total price of a service or good.

International experience shows that for the supply of goods and services to be taxable under the VAT regime it has to either be a VAT taxable activity as registered in the law or if the person taxed earns an amount above the stated threshold from the business. There are also activities that have been exempted from the payment of VAT.

The suppliers of some goods or services are not made to collect the VAT from their consumers. For a certain business activity to be exempted from the payment of VAT, a clear indication in the law showing that it is indeed exempted needs to be written.

One of such exemptions that can be read in the Ethiopian VAT proclamation is the import and supply of medical services and prescription drugs or medicines. In reading the VAT proclamation only, one can see that medical services and prescription drugs are the only elements in medical services that have been exempted from the payment of VAT. However, the law is a network of articles from different laws. Therefore, to clearly conclude as to which services are exempted, one needs to read different laws.

As such, members of parliament, in enacting the VAT proclamation mandated the Council of Ministers and the then Ministry of Finance & Economic Development - now the Ministry of Finance & Economic Cooperation - to issue regulations and directives that would help in interpreting and properly carrying out the obligations stated in the VAT proclamation. Through the powers delegated to it, the Council of Ministers enacted the Value Added Tax regulation in the same year.

That regulation specifies the type of medical services and prescription drugs that have been exempted. On that basis, if a medical service is provided in a medical facility such as a clinic, hospital, maternity home or even the office of a doctor and the service is provided by a medical professional that has been registered by the Health Ministry, the service provided will be exempted from the payment of VAT.

The law also provides that diagnostic services, therapy facilities such as radiotherapy and physiotherapy, psychoanalytic services as well as medicines and drugs issued in the hospitals are exempted from the payment of VAT.

With regard to drugs, the law provides that it is only prescription drugs that have been exempted from the payment of VAT. This begs the question as to the fate of non-prescription or over-the-counter drugs. Many people buy various painkillers, anti-inflammatory medications and other drugs and medicines without a prescription issued from a certified doctor.

Neither the proclamation enacted by parliament nor the Council’s regulation discuss whether or not the exemption will extend to cover non-prescription drugs as well. There was also much confusion as to whether VAT will be paid on drugs or medicines that are in nature non-prescription but were in fact prescribed by a medical professional.

This legal vacuum lasted for about a year until MoFED issued a directive stating that much difficulty has been witnessed in regard to this issue. As a solution, it has been provided in the directive that both prescription and non-prescription drugs will be exempted from the payment of VAT.

Although not stated in the proclamation, the regulation enacted by the Council of Ministers also provided that medical devices supplied for the use of the medical facility or to patients are also exempted from the payment of VAT. This includes devices such as health monitors and surgical and orthopedic aid.

The implications of this exemption become clear when one thinks of the fees charged by hospitals and pharmacies for the supply of medical services or goods. The price of hospital bills and medicine and drugs has skyrocketed in the past few years, owing to inflation and recurrent shortages in supply. A 15pc addition on that amount would thus put an extra unnecessary burden on patients and consumers.

PUBLISHED ON

Jan 05,2019 [ VOL

19 , NO

975]

Radar | Oct 14,2023

Commentaries | Jan 16,2021

Fortune News | Aug 03,2019

Sponsored Contents | Mar 03,2022

Commentaries | Sep 04,2021

Commentaries | Jan 07,2024

Commentaries | Jun 08,2019

Editorial | Apr 04,2020

Fortune News | Mar 09,2019

Commentaries | Jun 17,2023

Photo Gallery | 96764 Views | May 06,2019

Photo Gallery | 88947 Views | Apr 26,2019

My Opinion | 67177 Views | Aug 14,2021

Commentaries | 65764 Views | Oct 02,2021

Feb 24 , 2024 . By MUNIR SHEMSU

Abel Yeshitila, a real estate developer with a 12-year track record, finds himself unable to sell homes in his latest venture. Despite slash...

Feb 10 , 2024 . By MUNIR SHEMSU

In his last week's address to Parliament, Prime Minister Abiy Ahmed (PhD) painted a picture of an economy...

Jan 7 , 2024

In the realm of international finance and diplomacy, few cities hold the distinction that Addis Abeba doe...

Sep 30 , 2023 . By AKSAH ITALO

On a chilly morning outside Ke'Geberew Market, Yeshi Chane, a 35-year-old mother cradling her seven-month-old baby, stands amidst the throng...

Apr 20 , 2024

In a departure from its traditionally opaque practices, the National Bank of Ethiopia...

Apr 13 , 2024

In the hushed corridors of the legislative house on Lorenzo Te'azaz Road (Arat Kilo)...

Apr 6 , 2024

In a rather unsettling turn of events, the state-owned Commercial Bank of Ethiopia (C...

Mar 30 , 2024

Ethiopian authorities find themselves at a crossroads in the shadow of a global econo...

Apr 20 , 2024

Ethiopia's economic reform negotiations with the International Monetary Fund (IMF) are in their fourth round, taking place in Washington, D...

Apr 20 , 2024 . By BERSABEH GEBRE

An undercurrent of controversy surrounds the appointment of founding members of Amhara Bank after regulat...

An ambitious cooperative housing initiative designed to provide thousands with affordable homes is mired...

Apr 20 , 2024 . By AKSAH ITALO

Ethiopia's juice manufacturers confront formidable economic challenges following the reclassification of...