Radar | Jun 01,2019

An undercurrent of controversy surrounds the appointment of founding members of Amhara Bank after regulators at the National Bank of Ethiopia (NBE) withheld approval for two of the Bank's nominated board members, including its founding board chairman. They cited the need for an extended investigation before nodding for the appointments of Melaku Fenta, board chairman until recently, and Tewodros Yeshiwass to serve on the board.

Frezer Ayalew, head of NBE's banking supervision directorate, approved the other 10 nominees three weeks ago; they will undergo training in corporate management, internal control, banking laws, and risk management before officially taking their positions.

Tewodros, a significant shareholder in Gomeju Oil, has come under scrutiny for allegedly using a loan of 125 million Br disbursed to Quara Manufacturing PLC — a company in which he also holds a substantial stake — to cover half of his subscribed capital in Amhara Bank. Despite denying owning shares in Quara Manufacturing Plc when these allegations first surfaced four months ago, the controversy, however, persisted.

"I'll wait for the final decision," Tewodros told Fortune, in response to questions to address the controversy.

Melaku Fenta, another nominee, is also embroiled in controversies.

The allegations against Melaku Fenta centred around a criminal conviction six years ago, which the petitioners argued should prevent him from serving as board chairman. He was charged in a Federal High Court and imprisoned in a high-profile corruption case based on allegations during his tenure as head of the former Ethiopian Customs & Revenue Authority (ERCA). Although many believed the criminal charges were politically motivated during political unravelling within the now-defunct EPRDF, the banking law prohibits individuals with such convictions from holding leadership positions in financial institutions. Attempts to reach Melaku for comment were unsuccessful.

According to Gobena Worena, deputy head of banking supervision at NBE, the regulatory bank's reluctance to approve these nominations has not stalled Amhara Bank's functions. He asserted that "enough members have been approved for the board to continue operations". He argued that the ongoing probe should not delay the board's activities, as nine approved members meet the requirements set forth by the country’s corporate governance laws.

Hizkias Tafesse, the secretariat of Amhara Bank, confirmed that the approved board members are gearing up to begin their mandated short-term training at the central bank.

"We're adhering to the central bank’s rules," he told Fortune.

Remaining optimistic about the Bank's future, Hizkias believes calling a general assembly would likely be unnecessary, as stand-by appointees have been ready should the authorities decline Melaku and Tewodros's nominations.

Amhara Bank's shareholders have not been passive in the unfolding saga. In December, over 20 shareholders petitioned the NBE, objecting to the appointment of nine out of the 29 board nominees, such as Melaku, Mesenbet and Tewodros, placing a series of allegations, including violations of banking laws, inappropriate use of the Bank’s credit line, and nepotistic practices. The petition prompted regulators to engage with the signatories and launch probing over the credibility of these claims.

The newly composed board includes Gashaw Debebe, Berhanu Haile, Berhanu Taemalew, Ewentu Alene, Biyadeglegn Sheferaw, and Abebaw Geta. Three nominees - Mesenbet Shenkute, president of the Addis Abeba Chamber of Commerce & Sectoral Association (AACCSA); Hailmeariam Temesgen and Eden Ashenafi - have received NBE's approval despite being the subject to complaints by the petitioners. These directors are expected to oversee the Bank's committees on risk, audit, strategy, and human resources.

The contentious atmosphere was discernible during Amhara Bank’s general assembly held at the Golf Club near Mauritania Street. Shareholders learned of a 460 million Br loss days after the departure of the Bank's founding president, Henok Kebede. The meeting, marked by the indignation of shareholders angry over the negative three percent Earnings Per Share, gave way to new board members under the watchful eye of the NBE. The revelation came as a blow to an institution that had debuted with a record subscribed capital of 6.5 billion Br, 75pc of which was paup by 150,000 shareholders, setting high expectations for its financial performance. Upon incorporation, Amhara Bank was shy of less than 200 million Br to meet the regulatory threshold of five billion Birr NBE set for all commercial banks before the end of 2026.

Legal experts have weighed in on the situation, emphasising the delicate application of the commercial code in the financial sector.

Yehualashet Tamiru, a corporate lawyer with extensive experience, argued that NBE should prioritise shareholders' interests and maintain the integrity of the financial system. He believes that an established procedure for replacing board nominees who fail to secure approval from authorities could offset the need for a general assembly.

"The minute from the general assembly will colour what happens next," Yehualashet said, forewarning the potential for disputes as the Bank moves away from its tumultuous early days.

Yehualashet also raised concerns about the board's governance dynamics. He advocated for an odd number of directors, which he argued would ensure smoother decision-making during strategic disagreements.

"An odd number board is better suited for decision-making," he said, stating that such a configuration could help prevent deadlocks and facilitate more efficient governance.

PUBLISHED ON

Apr 20,2024 [ VOL

25 , NO

1251]

Editorial | Jun 18,2022

Fortune News | Aug 08,2020

Fortune News | Aug 14,2021

Fortune News | Jul 11,2021

Fortune News | Jul 18,2020

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transportin...

Jul 13 , 2024 . By MUNIR SHEMSU

The cracks in Ethiopia's higher education system were laid bare during a synthesis re...

Jul 13 , 2024 . By AKSAH ITALO

Construction authorities have unveiled a price adjustment implementation manual for s...

Jul 13 , 2024

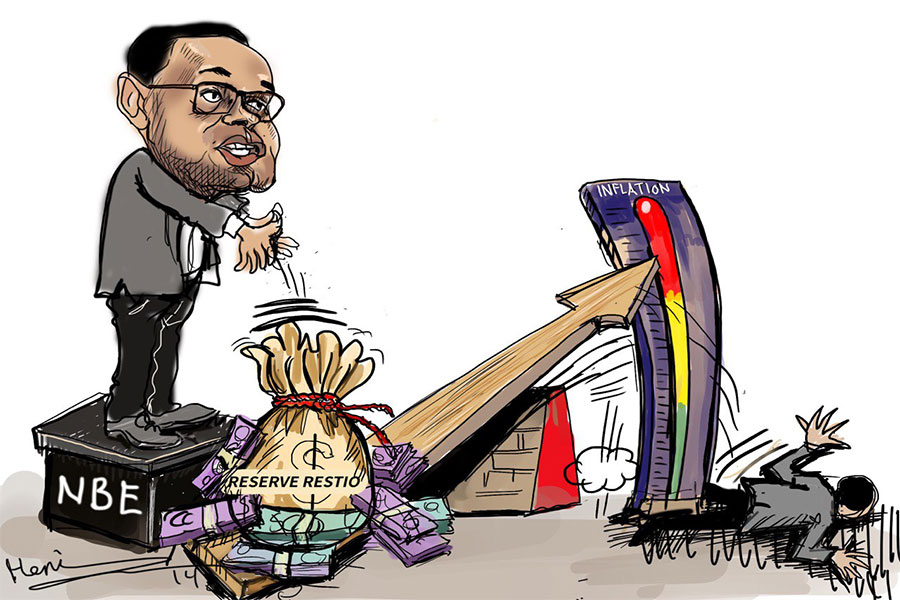

The banking industry is experiencing a transformative period under the oversight of N...

Jul 20 , 2024

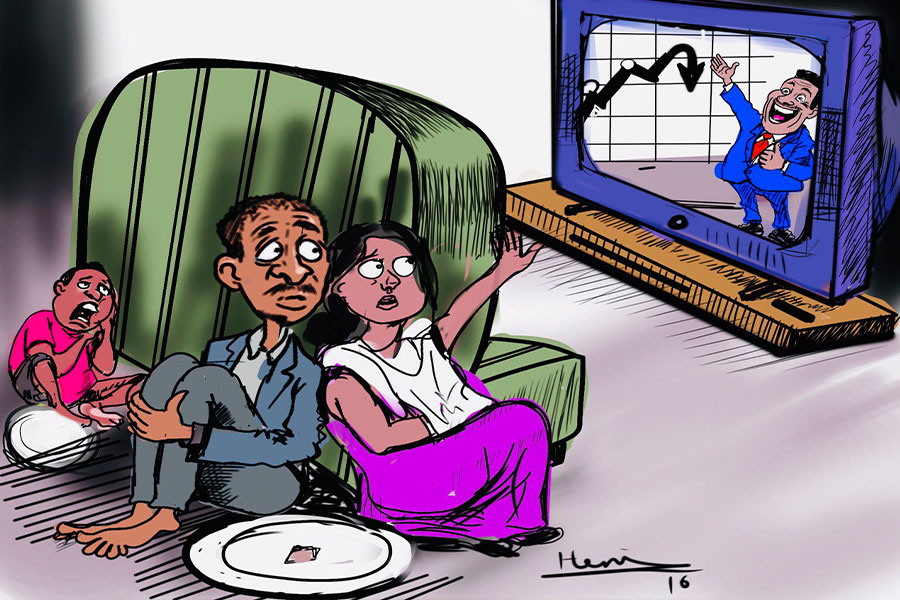

In a volatile economic environment, sudden policy reversals leave businesses reeling...

Jul 13 , 2024

Policymakers are walking a tightrope, struggling to generate growth and create millio...

Jul 7 , 2024

The federal budget has crossed a symbolic threshold, approaching the one trillion Bir...

Jun 29 , 2024

In a spirited bid for autonomy, the National Bank of Ethiopia (NBE), under its younge...