Viewpoints | Apr 26,2025

A severe financial stranglehold has been imposed on the banking industry, undermining businesses due to a loan cap policy imposed by the central bank to control inflation. While reducing inflation to 28pc by the end of 2023, the monetary tightening has cast a long shadow over the fledgling third-generation (3G) banks that have sprung up in recent years. These finance institutions are now being stifled under the weight of a one-size-fits-all regulatory cap, severely limiting their lending abilities.

The credit scene shows a banking sector that has expanded its loan portfolios — up 24.3pc to 1.8 trillion Br — with significant lending to manufacturing, domestic trade, services, and consumer banking. However, the distribution of credit across sectors has been overshadowed by the overarching constraints imposed on total loan growth, which remains capped at an annual 14pc irrespective of a bank's size or market reach. The uniform cap penalised newer banks that have faced severe restrictions on their operational scale and investment in growth, as evidenced by a shortfall in branch expansion and constrained staff recruitment. Executives blame the policy’s lack of flexibility to account for financial institutions' diversity and varying capacities to contribute to the economy.

The repercussions extend beyond the banks themselves to the broader economy, affecting investor confidence and the capital market, where share prices have been observed to falter. The directive requiring banks to increase their paid-up capital, while well-intentioned, further strains these financial entities, compelling some to consider mergers or face potential failure. There is a growing call among financial experts and bank executives for a more nuanced approach to loan growth regulation that considers the unique circumstances of newer banks and their strategic importance to economic diversification and growth. As the central bank continues its study on the impacts of the loan cap, the hope is for adjustments that will allow these financial institutions to thrive.

You can read the full story here

PUBLISHED ON

Apr 13,2024 [ VOL

25 , NO

1250]

Viewpoints | Apr 26,2025

Fortune News | Feb 24,2024

Agenda | Oct 09,2021

Radar | Jul 17,2022

Commentaries | Jul 13,2020

News Analysis | Mar 02,2024

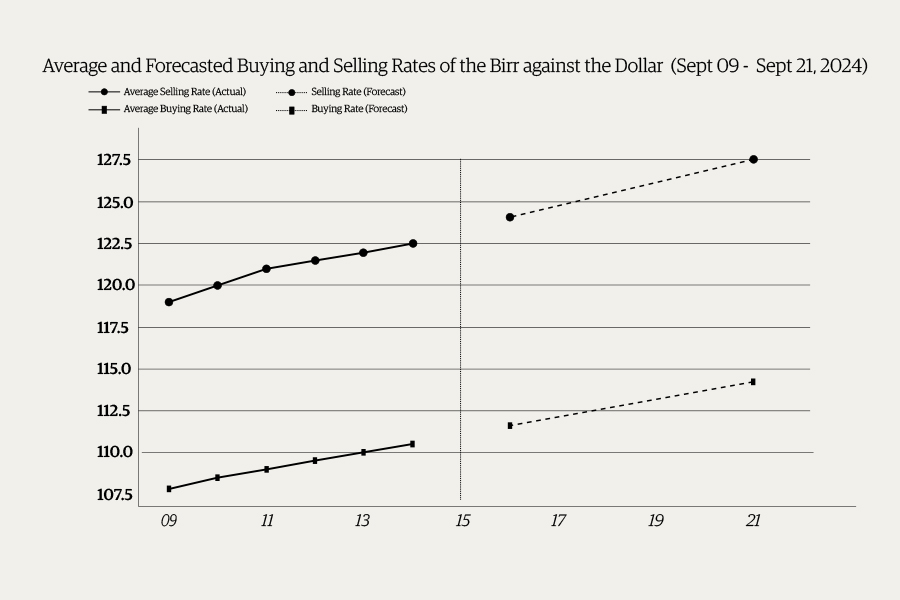

Money Market Watch | Sep 14,2024

Agenda | Apr 13,2024

Editorial | Aug 28,2021

Fortune News | Dec 19,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...