Editorial | Dec 07,2024

Jan 7 , 2022

By Yigermal Meshesha

NPLs are becoming a concerning matter in the financial sector. The central bank should not respond ad hoc but with a narrow focus on conflict-stricken areas and on healthy credit creation going forward, writes Yigermal Meshesha (yigermalet@gmail.com), branch manager at Lion International Bank.

Lending activities require financial institutions to make judgments related to the creditworthiness of a borrower and even the future of the sociopolitical outlook of a market, which is correlated with the economy.

These judgments do not always prove to be accurate, and a borrower's creditworthiness may decline over time due to various factors. Consequently, such issues may bring about a risk that the borrower may fail to honour the obligation. This will result in the loan being nonperforming and this adversely affects financial institutions' growth and profitability.

Regulatory authorities' definition of nonperforming loans (NPLs) varies across jurisdictions. For countries reporting Financial Soundness Indicators (FSI) to the IMF, the guideline recommends that loans (and other assets) should be classified as NPL when payments of principal or interest are past due by 90 days or more. It could also be when debt is capitalised, refinanced, or rolled over, or evidence exists to reclassify them as nonperforming even before the 90-day mark, such as when the debtor files for bankruptcy.

The 90-day criterion is most widely used by countries and in line with the Basel Committee on Banking Supervision criteria for problem assets. The Basel requirement also includes loans that are less than 90 days overdue but are deemed unlikely to be repaid similar to the FSI guideline. The National Bank of Ethiopia (NBE) has also taken an identical definition to NPLs.

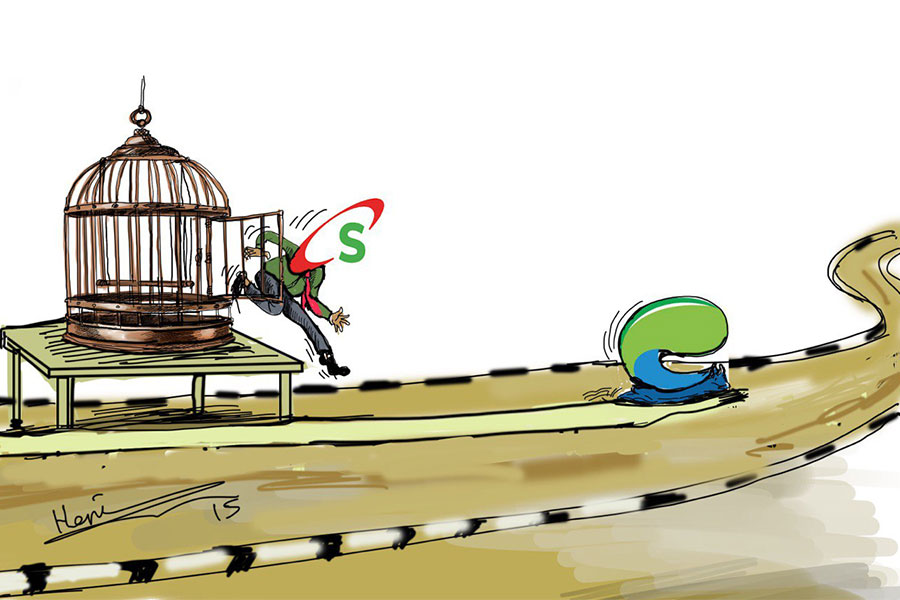

Since the emergence of COVID-19, global trade activity has shown a significant slowdown, and some sectors are seen as even failing if not rescued by interventions from their governments. Even in our country, the pandemic caused a severe effect on the economy that directly and indirectly impacted financial institutions' asset quality, causing NPLs to grow. Adding fuel to the fire has been the war in the northern part of the country as business activities are clogged, and the status of borrowers, their collateral, and even merchandise are uncertain, which brought significant adverse effects on banks' financial statements, without accounting for the actual loss on their various service outlets.

As we have seen in over a year, conflicts and violence have severe negative consequences on the affected economies, which can spill over for quite a time to come. In addition to the loss of lives, human displacement and the material destruction caused, conflicts can result in deep economic recession stemming from high inflation, worsened fiscal and financial positions, and lower institutional quality.

In the pre-pandemic and conflict periods, we knew little about NPL build-up patterns and the factors affecting their resolution as financial institutions reported that they were within the regulatory framework. Compliance was maintained not because all assets were under regular status. Instead, various NPL management techniques were utilised to act according to regulatory requirements through restoring and recovering problem loans and advances by applying corrective actions (cash collection, restructuring and renewal, legal measures or write-off) to minimise loss to the bank.

In the elapsed year, due to the impact NPLs caused, banks were required to hold a provision of as high as 27pc of their total operating income, which could be seen in their published statement of profit or loss and other comprehensive income for the year ended June 30, 2021.

Despite monetary policy measures from the central bank, the industry is considered to be in a liquidity strain even after the regulatory prohibition on loans and advances that lasted for a quarter of a year. Unfortunately, the eventual institution of the credit freeze could not help liquidity buildup. The situation has forced the NBE to tolerate banks utilising reserve money to finance coffee exports beginning last month.

The ad hoc approach should be halted and the regulatory body should maintain intervention particularly on outstanding loans and subsequent NPLs associated with the war-torn areas and related businesses. It should do this through a senior-level consultation between the central bank and the ministries of Finance and Planning & Development together with all commercial banks, as the problem will have a domino effect.

The intervention should keep in mind the worst scenario of what would happen to capital adequacy ratios if all existing and recognised NPLs had zero recovery value. These are tough assumptions - in reality, loans would be written off over time with pre-provisioning income cushioning the hit to capital, and at least some recoveries from NPLs could be expected in the long run. This is especially the case considering the level of collateralisation of outstanding loans, as some are said to be given on a clean, partially clean and merchandise basis.

Successful NPL reduction will help to revitalise credit growth, stimulate activity among previously overextended borrowers, and free up resources trapped in inefficient uses. This will improve overall macroeconomic performance, creating benefits throughout society, including for the banking sector at large through improved asset quality and collateral values. While it is important to address NPL problems expeditiously, it is critical to analyse and deliberate on healthy credit creation going forward by prioritising monetary stability, financial soundness, national priority, and the long-term economic impact. This should be enhanced in congress with the diversification of credit sources, as the concentration of credit by customers, area, or sector will halt the broader goal of monetary stability.

PUBLISHED ON

Jan 07,2022 [ VOL

22 , NO

1132]

Editorial | Dec 07,2024

Fortune News | Apr 09,2022

Commentaries | Sep 10,2021

Fortune News | Feb 27,2021

Radar | Aug 11,2024

Commentaries | Aug 28,2021

Editorial | Oct 15,2022

Fortune News | Nov 09,2019

Agenda | Jan 13,2024

News Analysis | Jul 28,2024

Photo Gallery | 179520 Views | May 06,2019

Photo Gallery | 169716 Views | Apr 26,2019

Photo Gallery | 160644 Views | Oct 06,2021

My Opinion | 137188 Views | Aug 14,2021

Commentaries | Oct 25,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Oct 25 , 2025 . By YITBAREK GETACHEW

Officials of the Addis Abeba's Education Bureau have embarked on an ambitious experim...

Oct 26 , 2025 . By YITBAREK GETACHEW

The federal government is making a landmark shift in its investment incentive regime...

Oct 29 , 2025 . By NAHOM AYELE

The National Bank of Ethiopia (NBE) is preparing to issue a directive that will funda...

Oct 26 , 2025 . By SURAFEL MULUGETA

A community of booksellers shadowing the Ethiopian National Theatre has been jolted b...