Commentaries | Jan 23,2021

Jul 10 , 2021

By Abu Girma Moges

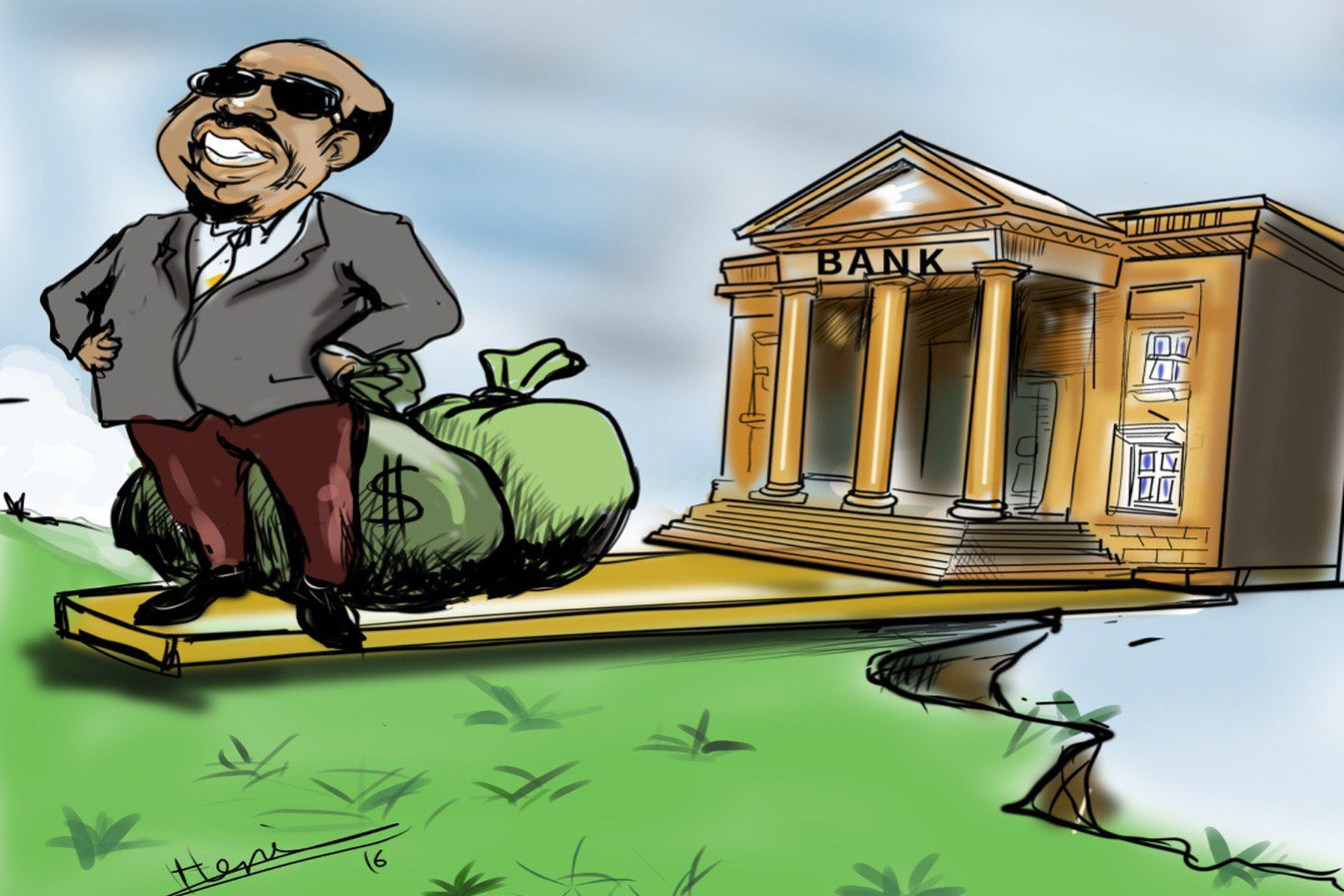

The ever-weakening Birr requires policy reform before it triggers crisis in public trust in the currency and destabilisation in the economy. A pragmatic and yet more prudent reform in monetary and exchange rate policies is required to address the challenge, writes Abu Girma Moges (PhD) (agmoges@gmail.com), a professor of economics at the University of Tsukuba in Japan.

There is often confusion about the exchange rate and what it represents. It is the price of a currency relative to other currencies or a basket of currencies. Unlike the price of goods and services, this price is unique and abstract in the way that it represents the relative state and dynamism of the local economy with respect to trading and financing partners in the rest of the world.

While the currencies, especially fiat money, do not have intrinsic value, they reflect the revealed purchasing power of the respective economies. Exchange of goods and services across countries, when mediated through foreign exchange markets, links tradeable domestic and international commodities, thereby shaping the real exchange rate. From such a perspective, the choice of foreign exchange rate policy plays a prominent role in shaping the relative performance of national economies and their opportunities in the global market setting. Hence, the exchange rate serves as an abstract barometer to measure the relative health of an economy to the rest of the world with which it exchanges and trades economic resources.

While an increasing number of countries have pursued a floating exchange rate regime in which market forces largely determine the exchange rate, most monetary authorities exercise some form of intervention in the foreign exchange market and follow a cocktail of approaches to manage their exchange rate movement. The way such managed exchange rate regimes operate and signal information to the public are essential elements in the economic policymaking eco-system of countries.

The fixed exchange rate regime with pegged rate, which was most common among less developed economies, is less prevalent and has become increasingly unsustainable in the context of large and highly liquid global foreign exchange market systems.

The Ethiopian legal tender currency, the Birr, has shown continuous weakness against all currencies but especially against the US dollar after the government undertook a series of devaluation measures over the past three decades. The exchange rate of the Birr against the US dollar now hovers at over 44 Br. At the same time, there is a vibrant parallel (relatively freer) foreign exchange market at which the Birr is traded about 25pc to 30pc discount.

The ever-weakening Birr could be steadied only if the domestic inflation rate and reserve position are stabilised. Economic agents have a role to play by redirecting their resources into more productive endeavours rather than rushing into assets as inflation-proof and distorting the resource allocation mechanism of the economy. At the same time, recurrent depreciation of the Birr fuels domestic inflation as the import intensity of most consumption and investment spending remains exceptionally high.

When exchange rate elasticity of exports is low because of limited production capacity and exchange rate elasticity of imports is weak for lack of alternative substitutes, the conventional rationale of exchange rate depreciation to address current account deficits does not necessarily hold. Such a situation calls for a more prudent exchange rate policy and pragmatic ways of implementation.

Put in such a context, the exchange rate of the Birr should reflect the relative health of the Ethiopian economy – expressed by what is brought into the global marketplace of ideas, goods, and services. This, in turn, requires efficient use of the human and natural resources and by setting a continuous learning environment for all citizens to build up capabilities in the global network of the value chain.

The revealed and notional relative health of an economy is ultimately the most comprehensive way the rate at which its currency is exchanged compared to other currencies. Therefore, if we are to pinpoint the root determinant of the exchange rate of a pair of currencies, we are bound to get a plausible picture of the relative economic situation than the mere price of a paper currency against another.

From another perspective, the supply of and the demand for foreign exchange reflects the interaction of two or more economies in the exchange process. Ethiopia generates foreign exchange from a set of sources with peculiar features. These include remittance, agricultural export, a bit of industrial and services exports, foreign direct investment (FDI) and external loans. Remittance inflows from the Ethiopian diaspora, which contributes about four billion dollars annually, has increasingly become an important source of hard currency for the country.

Our export sector remains highly dependent on agricultural products, such as coffee, oilseeds, and khat, that smallholder farmers produce with a very low level of productivity and minimal value addition. The subsistence-oriented production system does not have much in the form of marketable surplus except for a few cash crops exported to foreign markets to generate meagre foreign exchange earnings. Despite the potentials, export earnings from the manufacturing sector thus far have been disappointing.

The predominant situation in the economy is that the entire local economy can not produce and export as much to the rest of the world as the poor diaspora community members manage to send to their families. On the demand side, the challenges of the local economy to produce the necessities and conveniences of life for a rapidly growing population has led to increasing reliance on imports, which require foreign exchange currencies. While the services sector is becoming more exposed to a tradeable market, its overall balance shows no significant net inflow to the economy.

As a result, the economy runs recurrent current account deficits financed by borrowing from the rest of the world. This feature of the payment imbalance has given rise to the accumulation of external debt with our trading and development partners.

The structure of the export sector is eerily similar to what happened when Ethiopia started to seriously engage with the rest of the world at the end of the 19th century. With the establishment of the railroad system connecting the country with the seaport, the typical annual shipment consisted of a small amount of coffee, ivory, civet, and live animals, and slaves.

The government of the day was in desperate need to import arms from European suppliers and what it could export was quite limited. It even considered putting its customs base in Harar as collateral for getting access to credit for the import of armaments. Moving fast forward, at the dawn of the 21st century, the economy has failed to diversity and is still exporting coffee, oilseeds and live animals. What has perhaps changed over a century is that instead of the forced slave trade of teenagers, currently, the teenagers are migrating en masse in search of better opportunities for themselves and their families.

All these vicious structural problems regarding the management of the foreign exchange system of the economy suggests that addressing the problem requires structural reforms that fundamentally change the way the economy operates. The central issue is to examine the kind of structural hurdles that prevent economic agents from transforming their subsistence farming into a thriving business enterprise with higher productivity and more significant marketable surplus and specialisation. Some of the challenges are land tenure insecurity, access to basic agricultural infrastructure and financing, lack of bargaining power with the rest of the economy and the politically vocal urban sector, lack of appropriate technology and sectoral policy distortion.

Given such structural economic issues of Ethiopia, intervention in the foreign exchange market is hence inevitable. However, it could be done in such a way that rationalises the policy intervention while improving the realistic price of hard currencies. Excessive intervention to maintain overvalued exchange rate seldom works. The emergence of a parallel (black or free) foreign exchange market is often a symptom of such a misalignment.

Criminalising the black market does not work for all practical reasons as it provides a significant premium margin as much as 25pc to 30pc over the official rate and services a critical gap in the market for foreign exchange. A more prudent and practical approach would be to incorporate the free foreign exchange market information to assess the relative scarcity of foreign exchange and reflect it in the managed official exchange rate.

Here, as is common practice in more successful countries, the power and responsibility to monitor, assess, and intervene in the foreign exchange market is better assigned to the Ministry of Finance. While the exchange rate is a form of price, its unique nature requires separate institutional arrangements to manage and stabilise. The central bank should instead focus on domestic price stability and exercise more operational autonomy in monetary policy decision making away from the fiscal branch of government. This institutional reform streamlines the complex problems of pursuing monetary and exchange rate policies.

Under such an arrangement, intervention in the foreign exchange market, when and if necessary, could identify critical and strategic import items, establish a band of exchange rate movement based on robust research, and transparently communicate to the public indicative information regarding exchange rate policy stances. For the rest of import and export items and remittances, the exchange rate would be allowed to follow the prevailing foreign exchange market tendencies more closely.

The current approach is not sustainable and invites more risk to currency crisis as economic agents may develop general expectations about the ever-weakening Birr and prefer to put their portfolio of liquid assets in hard currencies instead of the local currency. Such erosion of public trust in the Birr could trigger a crisis that no amount of intervention on the side of monetary authorities or the government could manage. It is critically important to address the distortion in the policy landscape and immediately institute policy measures that realistically reflect the health and challenges of the economy. At the same time, the government needs to remove the hurdles for the private economic agents from engaging in productive, efficient, and competitive economic activities.

PUBLISHED ON

Jul 10,2021 [ VOL

22 , NO

1106]

Commentaries | Jan 23,2021

Fortune News | Feb 01,2020

Fineline | Apr 04,2020

Radar | Jan 07,2022

Radar | Jan 23,2021

Commentaries | May 14,2022

Commentaries | May 28,2022

Commentaries | Aug 05,2023

Viewpoints | Feb 12,2022

Commentaries | Apr 15,2023

Photo Gallery | 96799 Views | May 06,2019

Photo Gallery | 88980 Views | Apr 26,2019

My Opinion | 67185 Views | Aug 14,2021

Commentaries | 65767 Views | Oct 02,2021

Feb 24 , 2024 . By MUNIR SHEMSU

Abel Yeshitila, a real estate developer with a 12-year track record, finds himself unable to sell homes in his latest venture. Despite slash...

Feb 10 , 2024 . By MUNIR SHEMSU

In his last week's address to Parliament, Prime Minister Abiy Ahmed (PhD) painted a picture of an economy...

Jan 7 , 2024

In the realm of international finance and diplomacy, few cities hold the distinction that Addis Abeba doe...

Sep 30 , 2023 . By AKSAH ITALO

On a chilly morning outside Ke'Geberew Market, Yeshi Chane, a 35-year-old mother cradling her seven-month-old baby, stands amidst the throng...

Apr 20 , 2024

In a departure from its traditionally opaque practices, the National Bank of Ethiopia...

Apr 13 , 2024

In the hushed corridors of the legislative house on Lorenzo Te'azaz Road (Arat Kilo)...

Apr 6 , 2024

In a rather unsettling turn of events, the state-owned Commercial Bank of Ethiopia (C...

Mar 30 , 2024

Ethiopian authorities find themselves at a crossroads in the shadow of a global econo...

Apr 20 , 2024

Ethiopia's economic reform negotiations with the International Monetary Fund (IMF) are in their fourth round, taking place in Washington, D...

Apr 20 , 2024 . By BERSABEH GEBRE

An undercurrent of controversy surrounds the appointment of founding members of Amhara Bank after regulat...

An ambitious cooperative housing initiative designed to provide thousands with affordable homes is mired...

Apr 20 , 2024 . By AKSAH ITALO

Ethiopia's juice manufacturers confront formidable economic challenges following the reclassification of...