Sunday with Eden | May 06,2023

Mar 10 , 2022

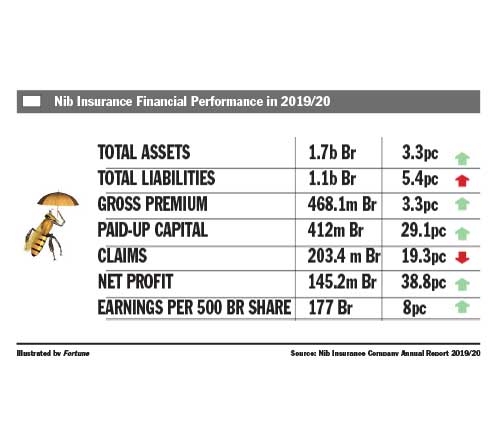

The executives of Nib Insurance look to capitalise on traditional bereavement associations as a source of growth for the life insurance line of business.

Known as "Edir", these associations act as a form of social insurance. Members provide financial support to cover the cost of burials in the case of death.

Nib has signed a contract with Jamii One, a Denmark-based firm, for the supply of a digital savings platform that helps Edir members to pay daily premiums of up to two Birr each for a group life insurance policy. Though the life insurance business has seen notable growth over the past three years, it lags far behind non-life policies. Premiums paid for long-term insurance policies registered at nearly one billion Birr last year, accounting for seven percent of the industry gross written premiums.

Eleven of the 18 insurance firms offer life insurance policies.

The life insurance business made up slightly more than 10pc of the 568 million Br Nib generated from premiums last year.

Sunday with Eden | May 06,2023

Commentaries | Sep 10,2021

Fortune News | Apr 24,2021

Fortune News | Feb 20,2021

Commentaries | Feb 06,2021

Fortune News | Oct 30,2022

Exclusive Interviews | Jan 05,2020

Verbatim | Jun 29,2019

Fortune News | Jul 26,2025

Viewpoints | Nov 30,2024

My Opinion | 133416 Views | Aug 14,2021

My Opinion | 129931 Views | Aug 21,2021

My Opinion | 127736 Views | Sep 10,2021

My Opinion | 125288 Views | Aug 07,2021

Aug 9 , 2025

In the 14th Century, the Egyptian scholar Ibn Khaldun drew a neat curve in the sand....

Aug 2 , 2025

At daybreak on Thursday last week, July 31, 2025, hundreds of thousands of Ethiop...

Jul 26 , 2025

Teaching hospitals everywhere juggle three jobs at once: teaching, curing, and discov...

Jul 19 , 2025

Parliament is no stranger to frantic bursts of productivity. Even so, the vote last w...