Commentaries | Jun 04,2022

Feb 6 , 2021

By Yehualashet Tamiru Tegegn

For startups and small and mid-size enterprises (SMEs) and in a country dependent on agriculture, finance plays a crucial role in enabling these businesses to grow and achieve their potential. This is why a proclamation that allows movable property to be used as collateral to access finance could not have come too early, writes Yehualashet Tamiru Tegegn (yehuala5779@gmail.com), adjunct lecturer at Addis Abeba University and an associate at MTA.

Ethiopia is one of the fastest-growing countries in Africa and attracts a large amount of foreign direct investment (FDI). One of the areas investors will look into when deciding whether to invest is the very existence of a comprehensive and modern security law regime.

Under the Civil Code, the two primary security devices are mortgages, which are created for immovable property and businesses as a going concern, and pledges created for movable property. The main form of perfecting a pledge is through the transfer of the possession of the collateral to the creditor.

For startups and small and mid-size enterprises (SMEs), access to finance plays a crucial role in enabling these businesses to grow and achieve their potential. SMEs are built on ideas. Thus, their most valuable asset is the movable property, and they mostly do not own immovable property like buildings. These businesses cannot access finance by using their movable property due to the requirement to transfer the possession of the asset to the creditor, which impedes them from using the asset and generating income.

Further, in a country like Ethiopia where more than half of the population is estimated to be engaged in agricultural production, it is important to create a system that will enable agricultural products to be used as securities to access finance.

To enable businesses and individuals to use their movable property as securities to access finance and create an effective system to govern this, parliament has enacted the Movable Property Security Right proclamation.

It explicitly excludes security rights created for land, houses or buildings from the applicability of the proclamation as these will be governed by the provisions of the Civil Code to a mortgage. Further, the proclamation will not be applicable for securities traded on an exchange, the mortgage of a ship or the interest in an aircraft.

The proclamation applies to security rights created for movable property. The definition of movable property under the proclamation is an illustrative one that includes inventory, agricultural products, incorporeal assets, corporeal assets and the right to use land if it is not prohibited by the law.

The proclamation has introduced several changes to the creation and enforcement of security rights in Ethiopia. One of the changes introduced by the re-characterisation of rights is that if it is created to secure a payment or the performance of an obligation, it will be considered a security right despite the different name given to it by the parties or the type of movable property.

For instance, under Ethiopia’s Civil Code, retention of title has been recognised as a sales transaction. However, it is a security right created over the tangible asset, according to the proclamation. Thus, parties involved in this kind of transaction have to create and perfect their security right according to the requirements of the law to benefit from the priority position and enforcement rights.

The other significant change introduced by the proclamation is allowing security rights over future acquired assets. Thus, the grantor is not required to own the asset when creating the security right. This is a new development from the previous regime, which required the movable good at the time of the creation of the security right.

The other significant change introduced by the proclamation is the perfection of the security right. This refers to the action of creating priority over the collateral and binding third parties. Previously, the main form of perfecting a security interest over movable property was by taking possession of the creditor's collateral. However, the proclamation provides three forms of perfecting a security right over movable properties: registration, possession and control.

Previously, the debtor was required to pay one percent of the collateral value as a stamp duty to register the security right created for it. One of the main changes introduced by the proclamation is abolishing the stamp duty during the registration of the security right. This will make obtaining finance affordable for individuals and SMEs.

Despite these promising introductions, the proclamation has its drawbacks. One of the core principles of contemporary security law is the recognition of party autonomy. This means that contracting parties are free to determine the terms and conditions of the contract. However, the proclamation is too detailed and tries to govern areas that neither violate the country's fundamental policy nor the rights of third parties like that of search criteria and result.

On the contrary, the proclamation seems to keep silent and vague on some areas that have a spillover effect on third parties' rights. For instance, it is indicated that the higher ranking secured creditor may relinquish its right to any competing secured creditor even without the beneficiary being a party to the subordinate. This overlooks that the higher ranking creditor with the malicious purpose of hurting creditors may relinquish his priority right in favour of other secured creditors. Above all, the proclamation fails to provide possible grounds for the elimination of security rights and does not address whether or not a lapsed right of security can be re-established or not.

PUBLISHED ON

Feb 06,2021 [ VOL

21 , NO

1084]

Commentaries | Jun 04,2022

Commentaries | Oct 15,2022

Fortune News | Jun 11,2022

Commentaries | Jul 03,2021

My Opinion | Apr 22,2023

Fortune News | Feb 06,2024

Radar | Feb 29,2020

Fortune News | Nov 13,2021

Advertorials | Dec 19,2023

Viewpoints | Feb 12,2022

Photo Gallery | 96182 Views | May 06,2019

Photo Gallery | 88445 Views | Apr 26,2019

My Opinion | 67011 Views | Aug 14,2021

Commentaries | 65719 Views | Oct 02,2021

My Opinion | Apr 13,2024

Feb 24 , 2024 . By MUNIR SHEMSU

Abel Yeshitila, a real estate developer with a 12-year track record, finds himself unable to sell homes in his latest venture. Despite slash...

Feb 10 , 2024 . By MUNIR SHEMSU

In his last week's address to Parliament, Prime Minister Abiy Ahmed (PhD) painted a picture of an economy...

Jan 7 , 2024

In the realm of international finance and diplomacy, few cities hold the distinction that Addis Abeba doe...

Sep 30 , 2023 . By AKSAH ITALO

On a chilly morning outside Ke'Geberew Market, Yeshi Chane, a 35-year-old mother cradling her seven-month-old baby, stands amidst the throng...

Apr 13 , 2024

In the hushed corridors of the legislative house on Lorenzo Te'azaz Road (Arat Kilo)...

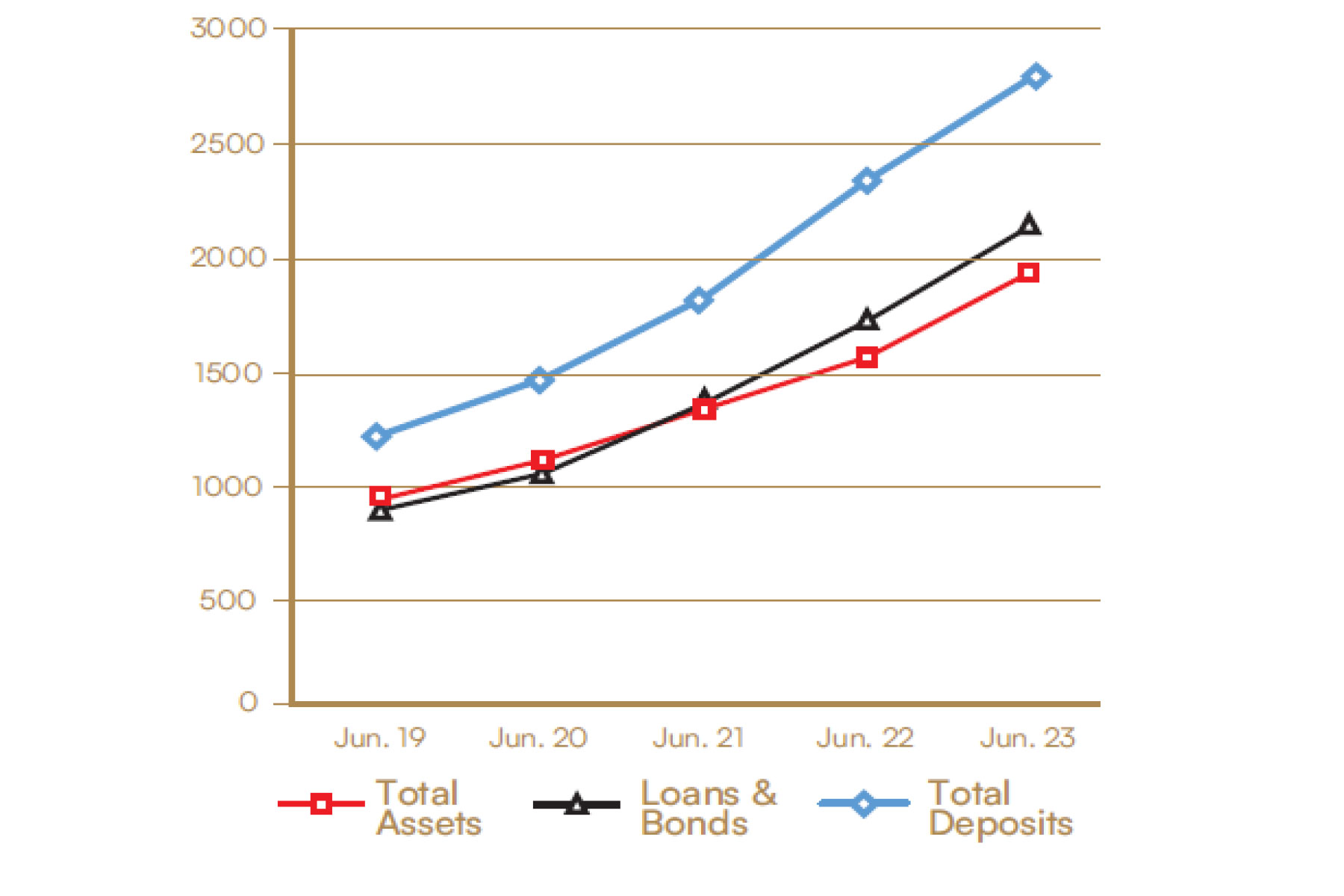

Apr 6 , 2024

In a rather unsettling turn of events, the state-owned Commercial Bank of Ethiopia (C...

Mar 30 , 2024

Ethiopian authorities find themselves at a crossroads in the shadow of a global econo...

Mar 23 , 2024

Addis Abeba has been experiencing rapid expansion over the past two decades. While se...

Apr 13 , 2024

A severe financial stranglehold has been imposed on the banking industry, underminin...

Apr 13 , 2024 . By MUNIR SHEMSU

In an unprecedented move, the central bank has published its inaugural stress test report, uncovering potential fault lines within the finan...

Apr 13 , 2024 . By MUNIR SHEMSU

In a bold departure from its historical position on foreign investment, the federal government has opened...

Apr 13 , 2024 . By AKSAH ITALO

A proposed excise tax stamp system draws controversy amongst industry leaders in the alcohol, tobacco, be...