Sep 10 , 2021

By Asseged G. Medhin

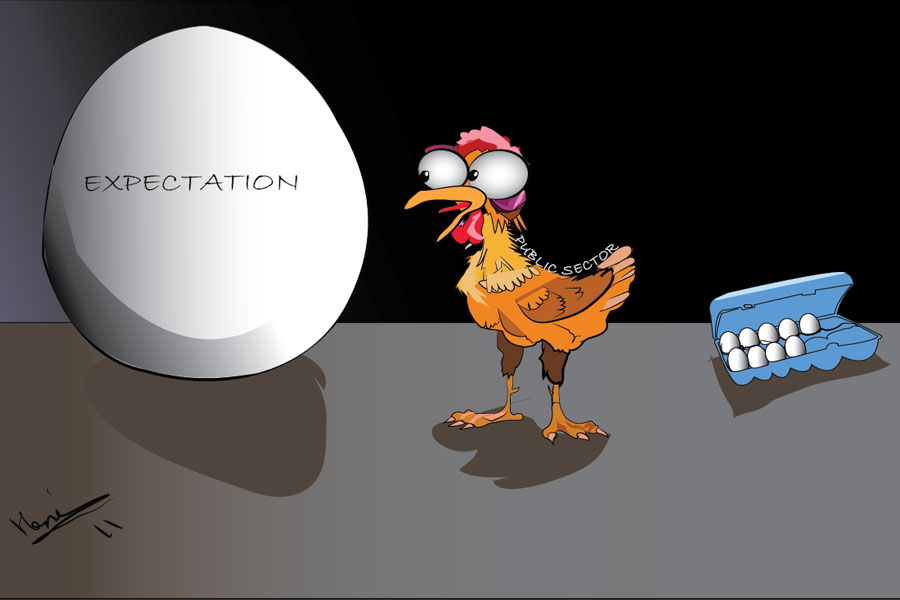

Integrating technology solutions and implementing process improvements that leverage the capabilities of existing personnel and applications should become the norm in the insurance sector, writes Asseged GebreMedhin, insurance professional.

More than most kinds of business, firms in the insurance industry must always find a way to break traditions, legacy systems that perpetuate a limited view of the customer and books of business. They should map out their risks and mitigate them proactively before they materialise.

The solution for every risk they face is their management capability – 19th century risk management systems cannot manage 21st century risks. Both the perception of risk and the attitude of existing and potential customers is changing globally. This challenges insurance companies still following traditional, antiquated business rules, policies, and regulations.

What is the way out from this infant and acrimonious traditional business? Can we name any bank or insurance that is international in its way of doing business? If not, why insert “international” in the brand name of firms? Are we thinking globally but doing locally? There is a strong need to change, but change what?

New models of business and enterprise architecture need to arise. Integrating technology solutions and implementing process improvements that leverage the capabilities of existing personnel and applications should become the norm.

Mere automation is not change, it is the knowhow and the knowledge-based service provision that needs to be updated into the 21st century. There is a need, for instance, for core process improvements, especially in relation to support services. Overlaps must be avoided, work flows simplified and seamless processes integrated to gain a competitive advantage.

Automation is an essential part of this. It has to be properly placed to get the right information from disparate data sources for optimum decision making and ease the inefficient business process. How a 21st-century insurance business should be run is a change in its totality plus automation.

Insurance firms in Ethiopia are introducing automation, but they are doing it using a rigid management philosophy, on an anti-change cemented attitude. Some pay for automation to be built merely to help market the company, while others hate to see the good old days come to an end. But thanks to ongoing global change, companies insisting on tradition have a low fighting chance against the storm of technology and constantly evolving managing techniques.

Companies should be prepared to focus on retaining customers, attracting new ones through various channels, delivering new products, and providing high-quality customer service. Insurance company executives who dare to change their company to streamline the process and deliver improved performance to support profitable growth strategies must work on key strategies.

They can start by changing their core business process to enhance operational efficiency and control expenses across their services value chain. They should also integrate automation across departments where it should be in place, with a central system of operation – this has the advantage of both decentralisation but effective control over running the day-to-day.

No less critical is to change the overall mindset of employees and management until the change reaches customers. Updating the institutions should likewise include introducing business ethics and accountability as well as protect against inefficient employees and inherent gaps of the change itself.

When management systems are updated, the role of the traditionalists is minimised, a typical insurance company’s claim process cycle is shortened, claims leakage will significantly be managed and fundamental market growth through words of mouth can be achieved. It is also possible to optimise customer service, cut costs and staff overload, expand report capabilities to proactively manage works and directives, enhance compliance monitoring and management, lower customer request response time.

If they want to navigate an evolving business environment and fulfill their organisational objectives, insurance companies should take off their traditional casing and put on change as their coat of arms.

PUBLISHED ON

Sep 10,2021 [ VOL

22 , NO

1115]

Fortune News | Jun 10,2023

Viewpoints | Jun 25,2022

Fortune News | Sep 10,2021

Radar | Oct 23,2021

Editorial | Dec 19,2018

Fortune News | Aug 21,2021

Fortune News | Nov 21,2020

Commentaries | Jul 27,2024

Covid-19 | Jan 31,2021

My Opinion | Apr 22,2022

My Opinion | 131674 Views | Aug 14,2021

My Opinion | 128040 Views | Aug 21,2021

My Opinion | 126002 Views | Sep 10,2021

My Opinion | 123625 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...