Apr 3 , 2021

By Asseged G. Medhin

The general election this year brings with it much hope, but so does it bring a significant amount of risks related to political violence. This can quickly overflow into the financial sector, which serves as a conduit for distributing wealth. But the relevance of the insurance sector for the overall stability of the economy by outlining the sources of risk and vulnerability is not only the issue of players in the financial sector. We need to craft a seasonal strategy to manage both emerging and existing risks. This can start by mapping them out.

Our financial litmus paper should indicate whether there is a growing inter-linkage between insurers and banks; whether the socioeconomic balance can be maintained during unrest, and whether individual and organisational risk behavior can be analysed in a different scenario. These approaches and seasonal strategies will save the nation’s resources from man-made catastrophes. The rationale behind this is to pinpoint and identify some critical challenges for the insurance sector and how it could play a role in economic resilience.

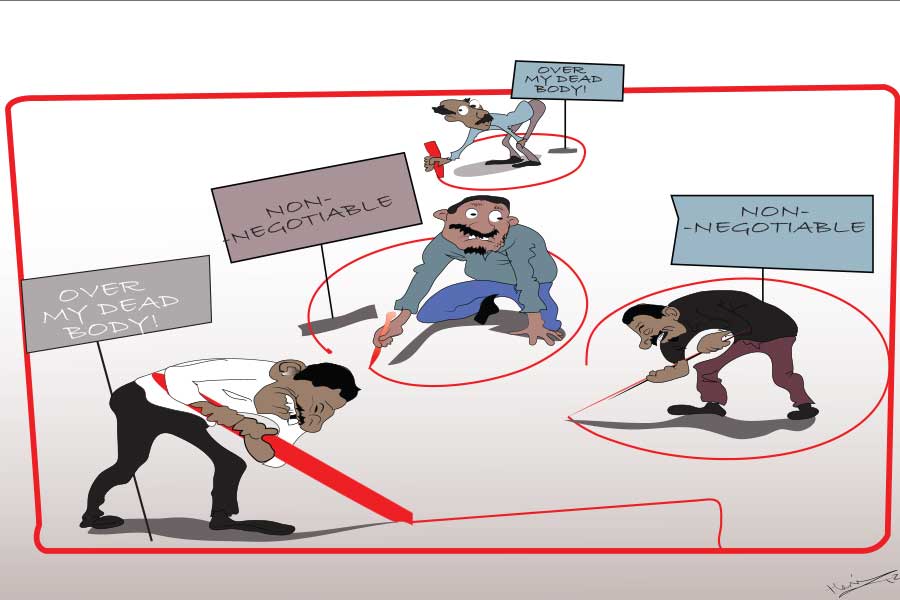

It is challenging to nip political violence in the bud. But a comprehensive approach that involves political engagement can be augmented by a financial sector resilient to such unexpected changes. Economic advisors and consulting firms in the Ethiopian economy should embrace aspects of political risk as a potential factor in planning and implementation.

The sources of risk and vulnerability facing the banking and insurance sectors do not stop here. As new entrants to the sector increase with resources, a dynamic regulation and management approach have to be worked out. The government ought to provide more space for discussion and work with the financial sector to minimise the potential for legal and operational fallout in the event of unrest in the upcoming national election.

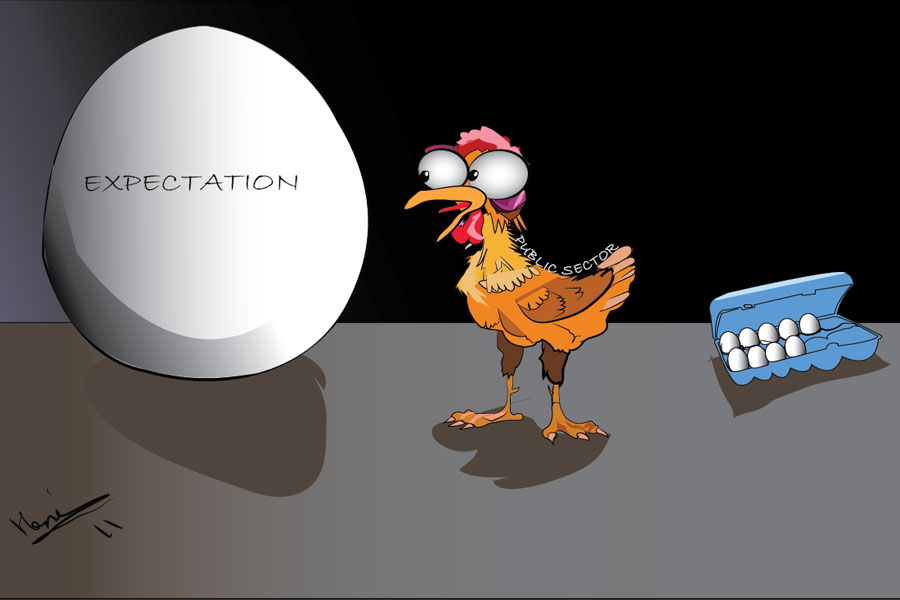

In recent years, the links that have been developing over time between the insurance and banking sectors have become wide. The growth of the insurance industry, in the introduction of new products and services, has deviated from that of banking. This implies that less attention is given to the insurance sector in terms of the broader capability of the sector, which will have consequences in institutionalising risk management.

Financial stability is a somewhat elusive concept, as is demonstrated by the absence of a widely recognised definition. While it is evident when a financial system is unstable or in a crisis situation, it is much more challenging to assess in normal circumstances whether or not the system is moving toward instability. But the underpinning is that stability is a condition where the financial system can withstand shocks without giving way to processes that impair the allocation of savings to investments and the processing of payments in the economy.

This emphasises that in a situation of instability, the financial system would be unable to perform its basic task of providing the financing needed to support real economic processes. It also stresses that to safeguard financial stability, the system should be resilient to potential shocks from unrest and inflation, underproduction or failures along the supply chain.

We do not face a financial crisis thus far. Still, the economic growth for the last two consecutive years has not been resilient and neither has it given rise to a stable financial system that can stand on its two legs in the event of deregulation.

To rise above this unsatisfactory state of affairs, we need to establish a system where the insurance sector is closely integrated into the economy. Stability is not secured in a vacuum brimming with numbers, projections and comparisons to benchmarks. It is achieved by understanding all stakeholders' contexts in the economy, particularly the financial sector, which allows for economic exchanges to take place, savings to happen, and credit to be accessed.

We ought to be more vigilant to manage potential unrest that could have a paramount effect on the economy by putting a question mark around the financial sector's resilience and reliability.

PUBLISHED ON

Apr 03,2021 [ VOL

22 , NO

1092]

Viewpoints | Sep 06,2020

Editorial | Dec 19,2018

Radar |

Viewpoints | Apr 06,2019

Editorial | Jan 04,2020

Radar | Dec 26,2020

Fortune News | Jan 07,2023

Exclusive Interviews | Jan 05,2020

News Analysis | Apr 27,2025

Radar | Aug 05,2023

My Opinion | 131451 Views | Aug 14,2021

My Opinion | 127803 Views | Aug 21,2021

My Opinion | 125783 Views | Sep 10,2021

My Opinion | 123419 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...