Fortune News | Jul 01,2023

Sep 10 , 2022.

Ethiopia’s policymakers and wonks began planning the economy and directing its course in the 1950s. There have been only two years since Ethiopia registered a positive balance of payment: in 1972 and another 36 years later.

Its economic history is about a perpetual balance of payments crisis. Former Finance Minister Sufian Ahmed was once blunt in publicly admitting that he will not see it resolved in his lifetime. Indeed, it is getting worse. There were two billion dollars more in outflows in the previous fiscal year than inflows. The culprits were falling levels of grants, a drop in new borrowing by the government and alarming growth in merchandise imports, primarily driven by accelerated fuel, grain and shipping costs.

The consequence is a drawdown of the central bank’s reserves by nearly half to an estimated 1.5 billion dollars.

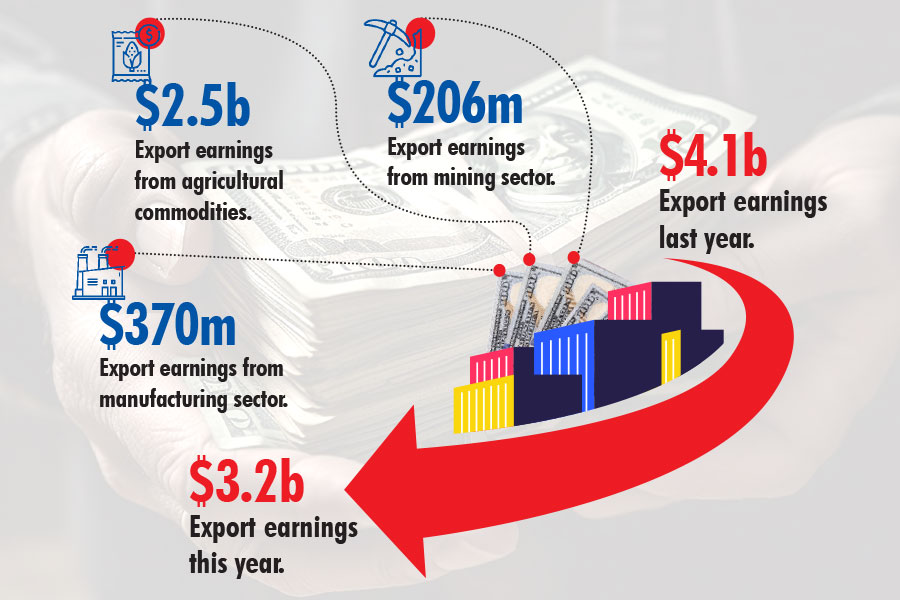

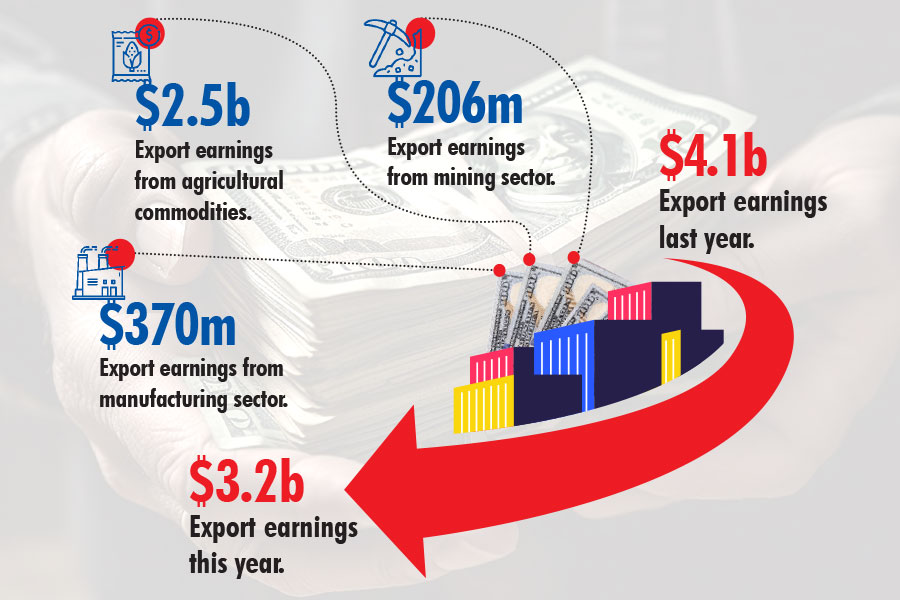

For once, the source of the problem is not the poor performance in trade. Goods export registered 13pc growth over the fiscal year to 4.1 billion dollars. Service exports were even better, jumping by 21pc to 6.2 billion dollars; there is a rare trade surplus of over a billion dollars on the service side. Overall, foreign currency inflows were slightly higher compared to last year, at two percent, and the balance of payments position would have been in the green if it was not for the 26pc outrun in merchandise imports.

The government has exporters to thank for this.

Economic planners appear to be bullish on an even better next year. They expect the value of goods exported to break the five billion dollar mark. It is an ambitious target. The often sanguine Cepheus Research & Analytics, a private equity firm, is less bullish, although it projected 20pc growth. It is still phenomenal, however. Even if the 13pc increase of the past fiscal year were all that the external sector can muster, it would still be impressive.

China, the exporting powerhouse of the world, saw 5.7pc average growth in the 1980s and almost double a decade later. The Chinese did not go from zero to a hundred. It was a high but consistent growth over an extended period that compounds and doubles every few years. Ethiopia’s annualised export growth over the past four years is 11pc. This is twice as good as the 1980s and a percentage point short of 1990s China – not something to be sniffed at for a country that has long struggled with a debilitating foreign currency crunch.

The devil is in the details.

The source of this growth should be concerning. If coffee exports are factored out, merchandise exports declined by one percentage point, as exports of gold, chat, oilseeds and leather all fell. The same goes for service exports. Ethiopian Airlines’ revenues almost entirely account for it.

The lack of export diversification is getting worse. Coffee alone accounts for a third of exports, at 1.4 billion dollars - the highest ever recorded. Among the top five exports, only gold is non-agricultural, while all are commodities, mainly exported without value addition. The leading agricultural commodities (coffee, flowers, chat and oilseed) make up 64pc of export revenues. The same goes for the service sector. In the last fiscal year, Ethiopian Airlines’ revenues were five billion dollars, 80pc of overall service export receipts.

While growth in a sector that has stagnated for very long is something to look forward to, how this growth is being achieved should keep economic planners and policymakers awake at night. The long-term goal had been exports’ diversification – this is going in the opposite direction. When the music stops and those commodities and the business of the national flag carrier in the international economy cools, it will be a disaster.

And there is reason to believe that the music may stop earlier than later.

The jury is out whether the United States is in a recession, despite two consecutive quarters of GDP contraction, but there is no denying that the economy is slowing. Two other major international markets are faring worse. China is crippled by its Zero COVID policy, with major cities periodically under lockdown, and a real estate mortgage crisis. Europe is sure to go into recession shortly.

Economic contraction in the developed world is not good news for airlines, especially as operating costs (especially jet fuel) are rising. Ethiopian Airlines has proven resourceful over the past two years, but growth that lifts the service sector as spectacularly as it did this past fiscal year will not likely come if consumers of developed economies start to cut back on expenses.

The challenge Europe is facing should especially be concerning for Ethiopia. The top two export destinations are European countries, Switzerland and the Netherlands. Germany alone accounts for 17.8pc of coffee exports, while two-thirds of all flowers are shipped to the Netherlands. Sales of both of these products will be affected by a recession.

Neither is it rational to expect that the prices of commodity products will remain elevated. One of the drivers of high coffee prices is bad weather conditions for coffee farmers in Brazil. This will not always be the case. To expect otherwise will be to outsource policymaking to the bad luck of farmers half a world away.

The structural flaw of Ethiopia’s poor export performance since its modern formation lies in productivity and competitiveness. The first is necessary to address the lack of export diversification and deal with dependency on volatile agricultural commodities.

A good place to start is services export, such as business process outsourcing (BPO), which had shown promising results even before tax incentives were implemented. If the globalisation of the last three decades were concentrated on the trade of goods, it would now be service industries, given technological developments (especially digital), unreliable supply chains and complex geopolitics. Supporting these through initiatives such as the Startup Act on the funding side will be necessary.

Textiles are the most apparent source of export growth and foreign currency earner for a country at Ethiopia’s development level. The resiliency of this sector was shown this year despite being booted out of the African Growth & Opportunity Act (AGOA); textile export (19pc) and export to the United States (17pc) both grew.

Textile manufacturing is the best use of richly available competitive labour cost – a path followed by most countries that have graduated to middle-income status over the past half a century. It is crucial to building on this by following flexible exchange rules to make sourcing of inputs easier and address political instability and war. Ethiopia may have luck in having a third episode of a positive balance of payments.

PUBLISHED ON

Sep 10,2022 [ VOL

23 , NO

1167]

Fortune News | Jul 01,2023

Radar | Dec 19,2018

Radar | Nov 23,2019

Fortune News | Sep 09,2023

Viewpoints | Jun 14,2025

Agenda | Feb 18,2023

Commentaries | Jul 24,2021

Fortune News | Oct 06,2024

Radar | Sep 06,2020

Radar | May 25,2019

Photo Gallery | 179443 Views | May 06,2019

Photo Gallery | 169639 Views | Apr 26,2019

Photo Gallery | 160557 Views | Oct 06,2021

My Opinion | 137177 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025 . By YITBAREK GETACHEW

Officials of the Addis Abeba's Education Bureau have embarked on an ambitious experim...

Oct 26 , 2025 . By YITBAREK GETACHEW

The federal government is making a landmark shift in its investment incentive regime...

Oct 29 , 2025 . By NAHOM AYELE

The National Bank of Ethiopia (NBE) is preparing to issue a directive that will funda...

Oct 26 , 2025 . By SURAFEL MULUGETA

A community of booksellers shadowing the Ethiopian National Theatre has been jolted b...