Fortune News | May 23,2025

Feb 23 , 2019.

Last week saw yet another institutional initiative taken by Prime Minister Abiy Ahmed’s (PhD) administration designed to review legal constraints in the business of governance. This time around it is the formation of a project office at the federal level dubbed Tax Equity & Cooperation Office. The administration hopes the new office will identify loopholes and address impediments to efficiency and broadness of the tax regime.

Like every administration that has come before it, Prime Minister Abiy faces an uphill battle in domestic revenue mobilization. Ironically, the cause of the problem should have been straight forward to understand.

Total revenues of the nation in the past fiscal year stood at 270 billion Br, 87pc of which was from taxes. It grew by 12pc compared to the previous fiscal year. But its ratio to the gross domestic product (GDP), at 11pc, remained a far cry from the OECD countries’ average of 34pc, or even Kenya’s 18pc. It has been clear for a while that without addressing the matter of tax collection, domestic revenue mobilisation will remain a recurrent nightmare to the government, pushing it to chase foreign loans and grants.

Past administrations have been well aware of the matter but have mostly looked to strengthen tax administration and enforcement as a panacea. Prime Minister Abiy is not just following suit but doubling down as a bill at the Finance Ministry to introduce property taxes shows.

Without any significant tax reform plan on the table, the administration is looking to old tactics meant to change the uncomfortable fact that the private sector is hiding wealth and citizens have no appetite for paying taxes. It is unfortunately a misguided perception to say the least.

There is no arguing that some businesses hide portions of their wealth from the government. It is a problem to varying degrees even in countries with the most sophisticated tax enforcement mechanisms such as the United States.

“That makes me smart,” President Donald Trump said during his campaign trail about using a tax code loophole to dodge federal income taxes.

Citizens’ habits of tax avoidance is not a matter that should be condoned by the government. Neither can it be divorced from human nature. Productive citizens want to retain as much of the capital they have gained to themselves, a matter that should never be blamed on lack of patriotism or greed.

Indeed, this issue does not exacerbate only when the tax regime is unfair or punitive, but the laxer enforcement is as well. But as long as there is no follow up by meaningful reforms to address flaws, gains made as a result of stricter controls are likely to be temporary.

Similarly, publicity events such as the five-kilometre awareness creation race last Sunday, tax ambassadors or even stricter enforcement will not allow the authorities to tackle the problem more than temporarily. Poor domestic revenuesmobilization requires a change of mentality, one that includes a compromise, on how it should be approached.

Under an excessively taxed and poorly administered tax regime, the nation is harmed in two ways. Citizens, as well as business, are more likely to be pushed to the informal sector, or plain hoarding, a nuisance even the most severe police states would be hard-pressed to do away with entirely. Worse, this would be money that will likely not be put in circulation, at least in terms of large transactions, which harms the economy.

The compromise would be to follow the equity principle and allow citizens and businesses to keep more of their capital, which would thus either be used to transact or invest, both of which are beneficial to the economy. This can be done by introducing tax deductions on personal income taxes for expenses such as medical bills. It would be a smart means of leaving citizens, who are the ultimate bearers of consumption taxes, with additional income at their disposal.

At the very least, it would keep them from looking for employment opportunities in the informal sector, and get them spending in the formal one. At most, it would help citizens save more and invest.

A similar outcome can be achieved when it comes to businesses by making corporate taxes progressive, with a view to making business entry smoother. A long overdue matter, it will help incentivise new start-ups and small as well as medium enterprises - the bedrock of wide employment - while fairly taxing the rich.

However smooth the bureaucratic process or reliable the provision of services becomes, businesses can barely survive the first few years if there is not enough capital to begin with. Allowing them to pay lower tax rates than the 30pc flat rate that is currently deducted from the profit of every business organization will make life for owners of start-ups easier.

A further improvement that could be made in how businesses are taxed would be allowing districts to collect property taxes that are under consideration by the Finance Ministry. It can encourage them to go the extra mile to attract property and reinvest the taxes in facilities and services within their own communities. The consequence would be competition between districts to make doing businesses smoother, which would be highly consequential to the economy.

The authorities also may want to look beyond the current tax base, especially in employment tax, which includes 1.6 million civil servants and 2.6 million people employed in private companies and non-profit organisations. It should address the fact that income from agricultural activities, collected and administered by regional governments, is not taxed appropriately.

It is baffiling to see agriculture, the mainstay for 83pc of the population contributing 35pc to the GDP and generating 73pc in foreign exchange, is the least contributing to taxes.

The discrepancy arises from the uneven methodology in tax valuation, which in some cases is carried out based on the sizes of lands. It is a combination of the poor tax administration regime to correctly account income derived from the sale of produces as well as the incumbents’ view, whose political base mostly constitutes the rural community, that farmers should not be taxed.

It may be a politically unwise decision to make, but the authorities can barely broaden the tax base if they are unable to compel farmers to pay what is due to them for reinvestments in their own regions. The public good that is provided is used by farmers in no less manner than the urban poor whose wage, however small, is taxed by the state.

PUBLISHED ON

Feb 23,2019 [ VOL

19 , NO

982]

Fortune News | May 23,2025

Commentaries | Jan 03,2021

Radar | Jul 08,2023

Agenda | Nov 24,2024

Fortune News | May 01,2022

Fortune News | Dec 19,2018

Viewpoints | Dec 28,2019

Radar | Jan 25,2020

Fortune News | Aug 03,2019

Radar | Feb 08,2020

Photo Gallery | 156988 Views | May 06,2019

Photo Gallery | 147280 Views | Apr 26,2019

Photo Gallery | 135853 Views | Oct 06,2021

My Opinion | 135290 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 15 , 2025 . By AMANUEL BEKELE

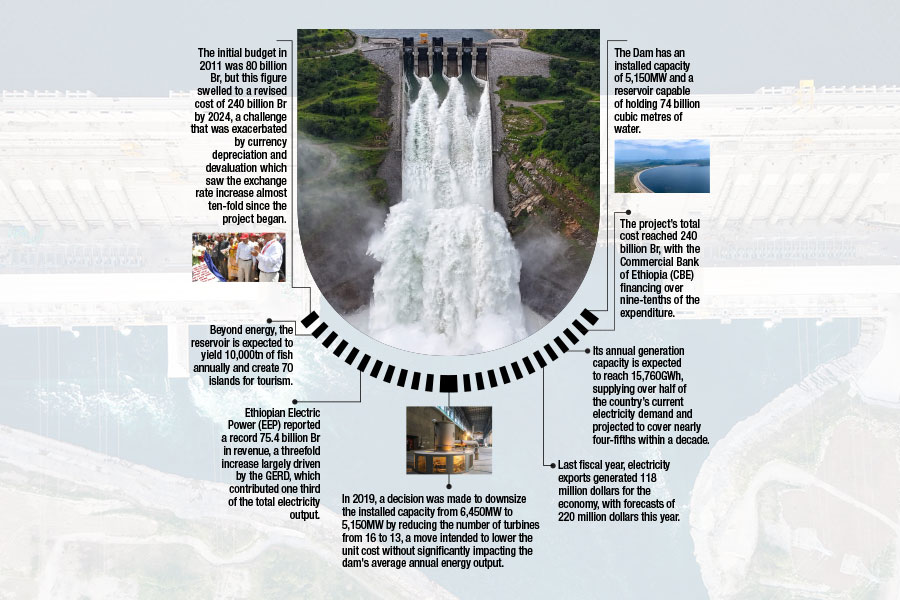

The Grand Ethiopian Renaissance Dam (GERD), Africa's largest hydroelectric power proj...

Sep 13 , 2025

The initial budget in 2011 was 80 billion Br, but this figure swelled to a revised cost of 240 billion Br by 2024, a challenge that was exac...

Banks are facing growing pressure to make sustainability central to their operations as regulators and in...

Sep 15 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Cabinet has enacted a landmark reform to its long-contentious setback regulations, a...