Radar | Feb 02,2019

Nov 27 , 2018

By BEHAILU AYELE ( FORTUNE STAFF WRITER )

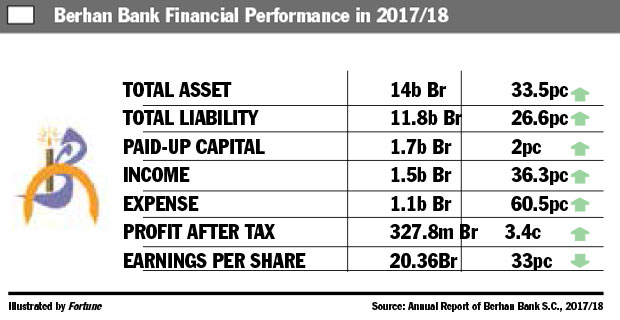

Berhan Bank, one of the late entrants to the private banking industry, posted a slight profit increase during the last fiscal year, recording 327.85 million Br.

Berhan Bank, one of the late entrants to the private banking industry, posted a slight profit increase during the last fiscal year, recording 327.85 million Br. Berhan Bank, one of the late entrants to the private banking industry, posted a slight profit increase during the last fiscal year, recording 327.85 million Br.

The firm's shareholder return declined by 33pc to 20.36 Br from two years prior.

The profit growth of the firm has slowed down due to a newly introduced reporting system, International Financial Reporting Standards (IFRS), according to Abraham Alaro, president of the Bank.

In preparations to report with IFRS, the bank re-audited its financial statements of the past two years. In the process, the asset, income and expenses of the bank were adjusted.

The increase in the number of shares is also the source of the decline in dividends, according to Abraham.

Last fiscal year, Berhan sold new shares to its 15,000 shareholders to raise 680 million Br in an attempt to meet capital requirements set by the National Bank of Ethiopia (NBE). The central bank has established a minimum paid-up capital threshhold for private banks of two billion Birr.

Berhan Bank's paid-up capital reached 1.7 billion Br. The Bank also increased its capital by two percent in the reporting period.

"We are investing in the Bank's future, and this is just a necessary step to take," Abraham told Fortune.

Shareholders' acceptance of the slight growth and the decline of the EPS is part of the effort to put the Bank in a strong financial position.

"We would have loved it if we could get more returns," says Daniel Wondimu, Chairperson of Berhan Insurance, one of the major shareholders of the Bank. "But as we know, the Bank is on the right growth track, and the results are good."

In terms of income, 2017/2018 was a good year for Berhan, managing to increase its income by 60.5pc. Income from loans, advances and NBE bills reached 1.11 billion Br. Income from service charges & commissions and foreign exchange dealing decreased by 5.6pc and 6.26pc, respectively.

The bank earned 343.31 million Br from service charges and commissions and 62.15 million Br from foreign exchange transactions.

The declines must have been due to stiff competition in the industry coupled with volatile international business, according to Abdulemenan Mohammed, a financial expert with over a decade and a half of experience.

Board chairperson of the Bank, Gumachew Kassie, echoed the expert's opinion on the annual report.

"Formidable challenges characterise the year," said Gumachew, "A sluggish export sector, acute shortage of foreign currency and political unrest have undermined the smooth functioning of the bank's operations."

Despite the challenges, deposits grew by 41.6pc, reaching 10.8 billion Br. The attainment of the resource mobilisation effort came up with the expansion of the bank's outlets and an increase in the number of depositors. The number of depositors at the bank reached over half a million. The Bank opened 21 additional branches, reaching a total of 182 branches across the country.

The firm disbursed 7.2 billion Br in loans and advances, a 33pc increase from the preceding year. This makes the loan-to-deposit ratio of the Bank 65.1pc. For the past two years loan disbursement showed a slight decline. During the preceding year, the loan-to-deposit ratio of the bank was 68.8pc.

Berhan's loan-to-deposit ratio stood one percentage point lower than the industry average.

Abdulmenan attributes the Central Bank's credit cap as the major reason for the ratio decline.

Last year, the Central Bank set a 16.5pc lending disbursement ceiling for outstanding loans on sectors other than export and manufacturing. This has affected the disbursement effort of banks that have reported so far this year.

Still, the expert believes that Berhan can improve the ratio.

“The Bank has some room to increase its loan-to-deposit ratio,” said Abdulmenan.

Provision of doubtful loans of the bank has also shown a slight growth from last fiscal year, reaching 22pc and amounting to 25.1 million Br.

The problem has got the attention of the Bank too.

"We have done a series of follow-ups on bad loans in the second half of the reporting year," Abraham told Fortune. "Thus far we have successfully curtailed bad loans within 2.5pc."

The maximum non-performing loan ratio as set by the Central Bank for commercial banks is five percent.

Berhan also increased its investment in NBE bills. With five percent interest rates, these bills are helpful for reducing high liquidity. Berhan's five-year bonds increased by 37.4pc to three billion Birr. The bonds amount to one-fifth of the total assets of the Bank.

The total assets of the Bank reached 14 billion Br, a 25pc increase from the preceding reporting period.

"This is a significant achievement of the Bank," said the president.

The expenses of the Bank soared, which affected the efforts made to increase interest income. The bank's interest expenses increased by 83.5pc to 417.35 million Br.

The salaries and benefit for the 3,237 employees of the bank increased by 48.4pc to 438.75 million Br, and general administration expenses went up by 57pc to 249.44 million Br.

The main reason for the increase in expenses is the introduction of two new structures in the company, according to Abraham.

The Bank installed two new divitions led by vice presidents and opened five district offices and an additional 21 branches in the past fiscal year.

The expert suggests the enactment of a cost monitoring system to control expenses.

“The bank should put appropriate cost control mechanisms in place,” Abdulmenan told Fortune.

Despite its cost, the bank's cash balance went up by 32pc, reaching 2.6 billion Br. The liquid assets sit at 19pc of total assets.

"With the aggressive resource mobilisation, we have low liquid assets," the president said. "Yet this is manageable."

PUBLISHED ON

Nov 27,2018 [ VOL

19 , NO

970]

Radar | Feb 02,2019

Radar | Nov 20,2023

Fortune News | Dec 27,2018

News Analysis | May 04,2024

Fortune News | Jan 25,2020

News Analysis | Dec 02,2023

Exclusive Interviews | Jan 05,2020

Radar | Oct 19,2024

Fortune News | Mar 21,2020

Radar | Dec 01,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...