Feb 13 , 2021

By FASIKA TADESSE ( FORTUNE STAFF WRITER )

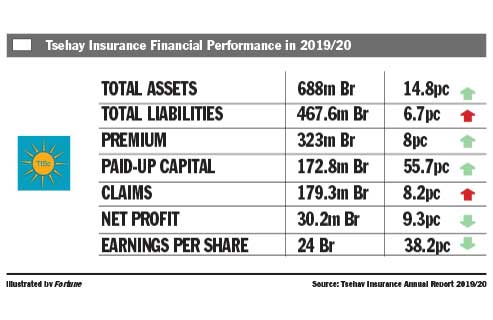

Tsehay Insurance, one of the youngest insurance firms, faced a profit slump over the past fiscal year. The firm netted 30.2 million Br in profit, a 9.3pc decline from the previous year.

Its earnings per share (EPS) also registered a notable decline of 38.2pc to 24 Br. Last year's EPS was 35pc lower than the level that was recorded two years ago.

The higher claims level the firm paid last year and the massive growth of paid-up capital undermined both the profit and the EPS of the eight-year-old insurance firm. Despite the rise in claims, Tsehay achieved a modest performance in investment activities, raised its paid-up capital and recorded a growth in underwriting surplus.

Last year was clearly a period of economic recession and social disruption that engulfed the world due to the effects of the Novel Coronavirus (COVID-19), according to Mandefro Erkou, board chairperson of Tsehay.

Ethiopia faced more problems due to the slowdown of foreign direct investment, including an acute shortage of foreign currency, a decline in construction activities and political unrest, which has continued for more than a decade, affecting the growth momentum, according to him.

"The insurance industry suffered from internal problems like declining premium rates, growing customer bargaining power, increased claims-loss ratio, escalating costs and expenses, and falling demand," he said. "However, despite all these challenges, Tsehay achieved an encouraging financial performance."

The underwriting surplus of the firm increased by 18pc to 28.3 million Br. During the year, Tsehay’s gross premium went up by eight percent to 323 million Br. Out of this total, the firm ceded 16.8pc. The retention rate increased to 83.2 percent from the previous year’s rate of 73pc.

The retention rate of the firm increased considerably, according to Abdulmenan Mohammed, a financial statement analysis working at London-based Portobello Group as an accounts manager.

This might have been the cause of the increased claims, remarked Abdulmenan.

In the past fiscal year, Tsehay's claims paid and provided for went up by 8.2pc to 179.3 million Br.

The increased claims level undermined the other areas of business that performed well, according to Abdulmenan.

"The management needs to pay attention to claims," said Abdulmenan.

The major contributing factor for such an increment [in claims] was the continuous rise in motor accidents coupled with a continuous escalation of spare parts and labour costs, according to Mandefro.

Tsehay earned commissions from reinsurers amounting to 11.2 million Br, an increase of 19.6pc. The commissions paid to agents went up by seven percent to 25 million Br. The commissions paid represent 13pc of gross written premium.

Interest and dividend income showed surges of 17pc and 25pc to 26.3 million Br and 8.5 million Br, respectively. Tsehay invested in Hibret, Abyssinia and Berhan banks, as well as Ethio-Reinsurance.

This indicates that the management of Tsehay did well in investment activities, according to Abdulmenan.

The insurer's expenses in other operations and general administration rose by 13.9pc to 32.8 million Br, while employee benefit expenses rose by 10.8pc to 15.1 million Br.

The increase is reasonable, according to Abdulmenan.

At the end of the last fiscal year, the firm hired 30 new employees, bringing its total workforce to 246. It also opened four branches during the same period, pushing its branch network to 27. During the past fiscal year, the 18 insurance companies opened 37 new branches, and the total branch network of the industry has reached 605.

The total assets of Tsehay expanded by 14.8pc to 688 million Br. The investment in shares, government securities and time deposits accounted for 45.6pc of its total assets.

Tsehay’s cash and bank balances dropped by 19.6pc to 56.3 million Br. The ratio of cash and bank balances to total assets accounts for 8.2pc, which is lower than the preceding year’s 11.7pc.

The paid-up capital of Tsehay increased massively by 55.7pc to 172.8 million Br. During the reporting period, the insurance industry's total capital reached 9.7 billion Br, a 17.9pc increase from the previous year.

Tsehay’s capital and non-distributable reserves accounted for 26.9pc of total assets.

PUBLISHED ON

Feb 13,2021 [ VOL

21 , NO

1085]

Radar | Jun 24,2023

Fineline | Feb 15,2020

Fortune News | Jan 18,2020

Advertorials | Feb 26,2024

Fortune News | Dec 05,2018

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...