Radar | Aug 26,2023

Mar 14 , 2020

By ELIAS TEGEGNE ( FORTUNE STAFF WRITER )

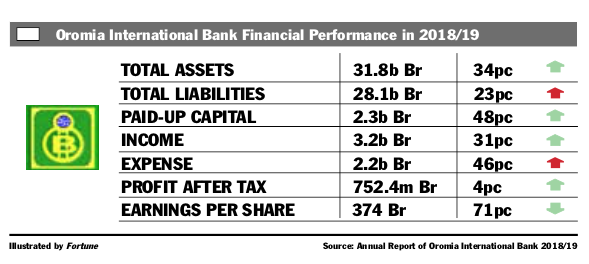

The earnings per share (EPS) of the Bank also fell sharply by 151 Br to 374 Br. Huge capital injection is attributed to the fall in EPS.

The earnings per share (EPS) of the Bank also fell sharply by 151 Br to 374 Br. Huge capital injection is attributed to the fall in EPS. Oromia International Bank (OIB), a decade-old firm, registered marginal profit growth in the past fiscal year, walking backward from the considerable growth it reported the preceding year.

The earnings per share (EPS) of the Bank also fell sharply by 151 Br to 374 Br. Huge capital injection is attributed to the fall in EPS.

In the last fiscal year, the Bank netted 752.4 million Br in profit, a four percent increase from the preceding year. This is despite the 145pc growth that was registered the prior year.

The Bank, which recently marked its decaversary, intended to register one billion Br in gross profit during the year, according to Teferi Mekonnen, acting president of the Bank after replacing Abie Sano, who left to lead Commercial Bank of Ethiopia (CBE).

It grossed a little over one billion Birr in profits before taxes, which is seven percent higher than the same period two years ago.

"I'm very proud to be part of this history-making moment," Abie remarked in his message to shareholders.

The smaller increase in profit after tax was mainly due to the growing total revenue, which was outpaced by the growth of total expenses.

Last year Oromia’s interest on loans, advances and investments in NBE bonds and income from interest-free financing soared by 46pc to 2.4 billion Br. Service charges and commissions increased by 29pc to 654.2 million Br, while gains on foreign exchange dealings sank by 22pc to 146.4 million Br.

The performance in foreign exchange dealings is disappointing, according to Abdulmenan Mohammed, a financial statement analyst with close to two decades of experience.

"The management should take measures to rectify it," Abdulmenan said.

The chronic foreign currency shortage is among the significant challenges the Bank faced in the past fiscal year, according to Gadissa Bultosa, board chairperson of the Bank.

"Forex crunch, stiff competition, limited basic infrastructure, as well as the sporadic public unrest were the major challenges the banking industry in general and our bank, in particular, had faced," wrote Gadissa in his message to the shareholders.

The export sector was not fond of the country’s major agricultural products, such as coffee, due to instability and a fall in commodity prices in the global market that worsened foreign currency earnings, according to Abie.

"This challenged our international trade and may cause significant credit default risk to the industry," said Abie.

Oromia also registered a massive expansion in expenses. Interest expense increased by 54pc to 836.8 million Br. Salaries and benefits went up by 28pc to 798.7 million Br, while general administration expenses increased by 31pc to 438.6 million Br.

Provision for impairment of loans, advances and other assets soared by 424pc to 155.8 million Br.

In the reporting year, OIB maintained the highest provision for the impairment of loans, advances and other assets in the private banking industry.

"The size of the provision is shocking," commented Abdulmenan. "The management should thoroughly review the matter and take appropriate action."

In providing loans, impairment is expected, but it doesn't mean the loans are not returned eventually, according to Teferi.

"Considering this, the Bank established a department to follow up on this case, and such issues are managed by such conduct and inclination,” Teferi said.

Oromia expanded its total assets by 34pc to 31.8 billion Br. It also increased loans, advances and interest-free financing by 49pc to 17.2 billion Br.

The deposits of the Bank went up by 33pc to 26.6 billion Br. The loan-to-deposit ratio increased to 65pc from 58.2pc, a level which is considered reasonable.

The increase in the loan-to-deposit ratio must have been mainly caused by massive liquid resources brought forward from the preceding year and the injection of fresh capital, according to the expert.

Oromia’s investment in NBE bonds increased by 46pc to 7.1 billion Br due to a swell in lending activity. These investments represent 22pc of total assets and 27pc of total deposits of the Bank.

Liquidity analysis revealed that liquidity decreased in absolute and relative terms. Cash and bank balances decreased by 12pc to 5.1 billion Br. The ratio of liquid assets to total assets dropped by eight percentage points to 16pc and liquid assets to total liabilities also decreased by 10 percentage points to 17.9pc.

"The liquidity level of Oromia was still reasonable," said Abdulmenan.

Oromia increased its paid-up capital by 48pc to 2.4 billion Br. Its capital adequacy ratio (CAR) slightly decreased to 18pc from 19.1pc. The CAR of the Bank shows that it is a well-capitalised.

Bulbula Tule, a shareholder of the Bank, says that he was impressed by the performance of the Bank, which was able to attain the target of bagging a billion Birr in gross profit.

"Considering Oromia’s performance with other competitors," said Bulbula, "it was good."

However, he expects the Bank to improve its performance in terms of gains from foreign exchange.

"By providing a modern and horizontal service to the exporters," Bulbula said, "the Bank should have better foreign currency dealings than its competitors."

PUBLISHED ON

Mar 14,2020 [ VOL

20 , NO

1037]

Radar | Aug 26,2023

Radar | Feb 05,2022

Fortune News | May 11,2019

Radar | Jul 24,2021

Fortune News | Aug 03,2019

Radar | Jun 24,2023

Fortune News | Oct 14,2023

Radar | Oct 31,2020

Fortune News | Dec 28,2019

Fortune News | Jun 07,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...