Mar 7 , 2020

By ELIAS TEGEGNE ( FORTUNE STAFF WRITER )

Expenses of the Bank have also soared by 32pc to reach 2.4 billion Br. Interest expense went up by 39pc to 1.2 billion Br, while salary expenses and benefits increased by 27pc to 703 million. Other operating expenses increased 23pc to 423.1 million Br.

Expenses of the Bank have also soared by 32pc to reach 2.4 billion Br. Interest expense went up by 39pc to 1.2 billion Br, while salary expenses and benefits increased by 27pc to 703 million. Other operating expenses increased 23pc to 423.1 million Br. Nib International Bank, a two-decade-old firm, was highly successful this past fiscal year, registering considerable net profit growth.

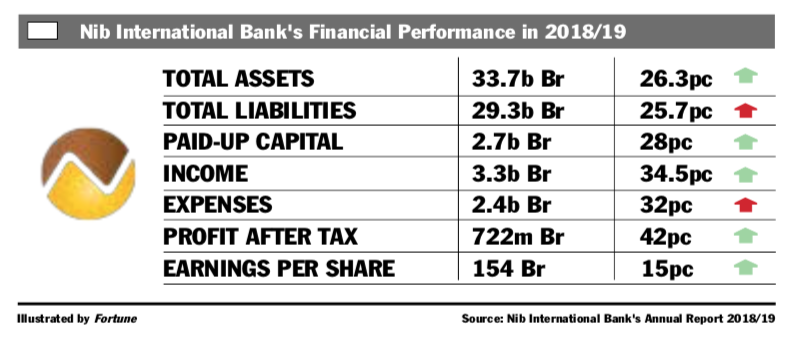

In the reporting period, the Bank netted 722 million Br in profit, a growth of 42pc. During the preceding year, the Bank's profit grew by only four percent. The company's earnings per share (EPS) also climbed by 20 Br to 154 Br.

Organisational structure, customer segmentation, deposit mobilisation and resource monitoring, were the reasons for the improved performance of the Bank, according to Genene Ruga, president of the Bank, which designed a new five-year strategy.

"The work we did on customer segmentation had a great impact on completing this year with a profit," said Genene, "moreover, the strategy helps us to maintain our capacity on technology, human resources and customer service."

Woldetensai Woldegirgis, the board chairperson of the company, attributed the Bank's success largely to its adoption of Balanced Scorecard (BSC), a strategic management tool that contributed substantially to growth.

"The tool concentrates not only on financial aspects but also takes into consideration three other major areas, which are setting customer need priorities, internal process and learning and growth endeavours," he wrote in the financial statement.

Several factors have contributed to such improved performance, including income-generating activities and financial intermediation operations. Interest on loans, advances and NBE bonds increased by 38pc to 2.9 billion Br, while fees and commissions increased by 29pc to 411.2 million Br.

However, income from foreign exchange dealings plummeted to zero from 46.4 million Br. Over the past few years, income from foreign currency dealing has been in decline.

"The decline is very concerning," said Abdulmenan Mohammed, a financial analyst based in London. "This area of business needs serious attention."

The wide gap of the exchange rate at the official and parallel market is one of the reasons why forex earnings declined, according to Genene.

Expenses of the Bank have also soared by 32pc to reach 2.4 billion Br. Interest expense went up by 39pc to 1.2 billion Br, while salary expenses and benefits increased by 27pc to 703 million. Other operating expenses increased 23pc to 423.1 million Br.

Provision for impairment of loans and other assets increased by 38pc to 65.6 million Br.

The growth of expenses at NIB is reasonable, according to the expert.

In the reporting period, Nib's total assets expanded by 26pc to 33.7 billion Br, matching the same growth rate as the preceding year. Nib's assets have largely expanded as a result of an increase in deposits.

Nib mobilised deposits of 27.7 billion Br, an increase of 28pc. It also disbursed loans and advances of 19.3 billion Br, an increase of 43pc. Its loan-to-deposit ratio rose by eight percentage points to 70pc.

The increase in the loan-to-deposit ratio is a result of a surge in lending activity, which was not supported by parallel growth in deposits, according to Abdulmenan.

"Even though an increased loan-to-deposit ratio brings in more income," said Abdulmenan, "it has the adverse effect of causing a liquidity problem."

Liquidity ratios reveal that the liquidity level of Nib remained stagnant in value terms but declined in relative terms.

The amount of cash and bank balances held by the Bank slightly increased by one percent to 3.9 billion Br. The ratio of total cash and bank balances to total assets dropped by three percentage points to 12pc. Total cash and bank balances to total liabilities also fell to 13.2pc from 16.6pc.

The liquidity level of NIB must have declined due to increased lending activities, according to the expert, cautioning the management to take extra caution against a further reduction in liquidity, as it can cause operational problems.

"We're using our cash properly and invested it based on what we planned, and liquidity was controlled as much as possible last year," said Genene. "But it could be an issue this year."

Nib's investment in NBE bonds increased by 10pc to Br 6.7 billion. The investment in NBE bonds represents 20pc of the total assets and 24pc of the deposits of the Bank.

The Bank increased its paid-up capital by 28pc to 2.7 billion Br. It has a capital adequacy ratio (CAR) of 20pc. This shows that the Bank is highly capitalised.

The Bank has a plan to increase its capital further to five billion Birr in the next four years, according to the president.

Minassie Wendemagegnehu, a shareholder since the establishment of the Bank, said he was satisfied with the performance of the Bank.

"It made a lot on investments, which will benefit its shareholders on a permanent basis," Minassie said.

Minassie also says that the shareholders of the company understand that there is stiff competition between the Banks and decided to raise the paid-up capital of the Bank to cope with the competition.

PUBLISHED ON

Mar 07,2020 [ VOL

20 , NO

1036]

Commentaries | Mar 16,2024

Radar | Jan 22,2022

Radar | Dec 04,2021

Radar | Aug 17,2019

Agenda | Apr 10,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...