Viewpoints | Mar 16,2024

Sep 10 , 2023

By Koichi Hamada

The earlier forecasts of a global recession were slightly misplaced. Rather than creating an imbalance, COVID-19 introduced a disconnect between supply and demand, marking a divergence from traditional economic patterns, writes Koichi Hamada, professor emeritus at Yale University and a special adviser to former Japanese Prime Minister Abe Shinzo, in this commentary provided by Project Syndicate (PS).

Earlier this year, predictions were rampant that a recession would soon grip the global economy. But, more than halfway through 2023, China is the only major economy that appears to be at significant risk of a prolonged slump. Stock markets are soaring in New York, London, and across Europe. In Tokyo, the Nikkei hit a 33-year high in June. While some economies are struggling, a global recession now appears highly unlikely.

An economic downturn can have many causes.

For example, excessive consumer and investor confidence or very high levels of public spending can drive up aggregate demand to the point that inflation begins to rise, forcing policymakers, especially central banks, to intervene to cool an overheating economy. If they overdo it – say, by raising interest rates, and thus borrowing costs, too aggressively – they can push the economy into recession.

A recession can also arise from the supply side. When a particular sector or the economy as a whole is booming, suppliers ramp up production. But if demand begins to fall, supply can build up, hampering and halting growth.

Neither of these factors is in play today. Though the US Federal Reserve and the European Central Bank have been pursuing monetary tightening, demand has not collapsed, and supply is not piling up. Instead, recent recession forecasts were derived mainly from statistical analyses of past data – analyses that did not adequately account for the impact and legacy of the COVID-19 pandemic.

Under normal circumstances, the aggregate supply and aggregate demand intersection determines the equilibrium price and traded volume, which can be interpreted as the aggregate output. Demand inflation is triggered by the rightward movement of the demand curve, and the upward movement of the supply curve brings about cost-push inflation.

But the movement of aggregate supply and demand curves fails to capture a key feature of the pandemic: trade was highly desirable, on both the supply and demand sides, but less safe. People wanted to dine out, and restaurants wanted to serve them. But neither could do so – at least not to the same extent as usual – because of pandemic risks and restrictions. The same goes for countless other activities and industries, from travel to in-person meetings with business partners and service providers.

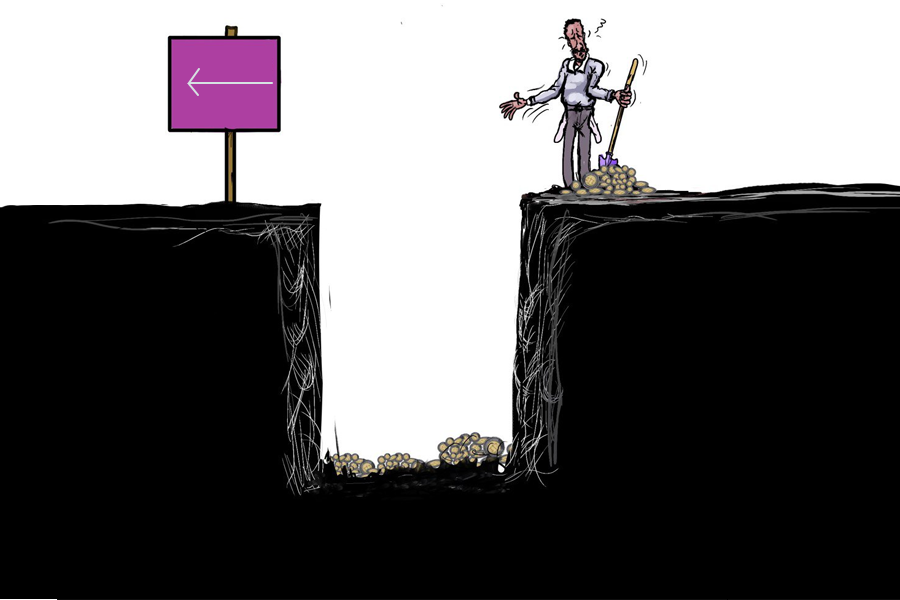

The pandemic did not create an imbalance between supply and demand so much as a disconnect, which forced buyers and sellers to incur extra costs, from wearing masks to moving dining tables farther apart, to make their exchanges possible. These barriers meant that actual output was no longer determined only by the intersection between the demand and supply curves; the size of the trade hurdles also mattered. The higher the barriers, the greater the distance between the demand and supply curves, and the bigger the decline in output.

This drop in output triggered powerful policy responses.

In the United States, for example, President Donald Trump's Administration launched a massive stimulus package, augmented by his successor, Joe Biden, to boost demand – that is, shift the demand curve rightward. The trade hurdles were still there, but the adjusted position of the demand curve meant that they no longer dragged output far below normal, or pre-pandemic, levels. Indeed, thanks to "Bidenomics", US output returned approximately to its original equilibrium point.

The "wedge" created by trade hurdles was eliminated when pandemic restrictions were lifted. But the demand curve remained in its adjusted position. The supply and demand curves thus intersected at a higher equilibrium point, implying more output and – crucially – higher price levels. The Fed's tightening has aimed to counteract these effects, pushing the demand curve closer to its original position.

While the Fed's monetary tightening does increase the risk of a growth slowdown, or even a recession, in the US, recent economic indicators – not least strong employment figures – suggest that a soft landing is perfectly feasible. Both the Biden administration's demand-boosting policies and the Fed's inflation-cooling interventions were entirely appropriate.

Perhaps more importantly, by strengthening the US dollar, higher US interest rates stimulate other economies' exports. This makes the kind of global recession that many predicted even less likely.

PUBLISHED ON

Sep 10,2023 [ VOL

24 , NO

1219]

Viewpoints | Mar 16,2024

Advertorials | Jun 05,2023

Viewpoints | May 24,2025

Agenda | Mar 23,2024

Radar |

Fortune News | Nov 03,2024

Editorial | Mar 18,2023

Fortune News | Dec 25,2021

Radar | Nov 16,2024

Fortune News | May 15,2024

My Opinion | 131497 Views | Aug 14,2021

My Opinion | 127853 Views | Aug 21,2021

My Opinion | 125831 Views | Sep 10,2021

My Opinion | 123461 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...