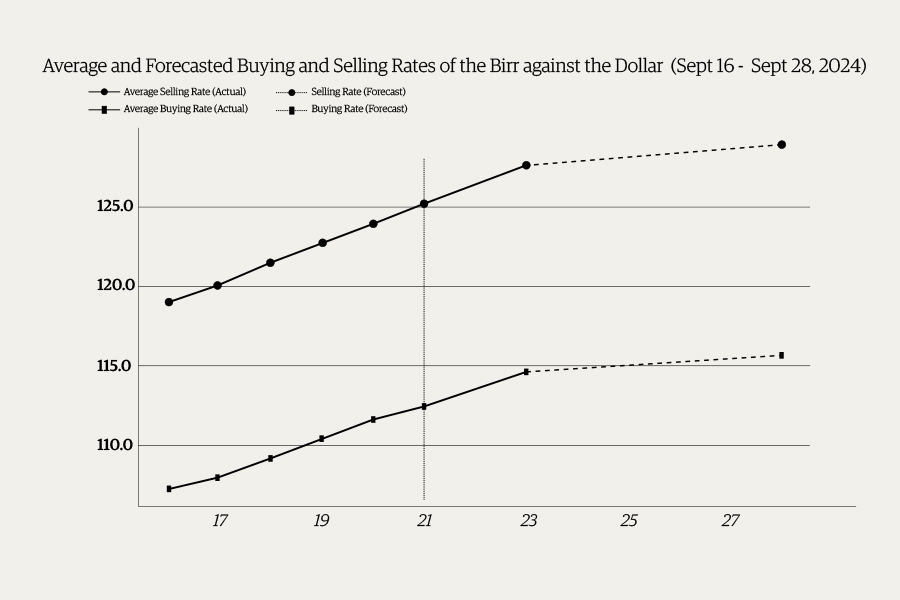

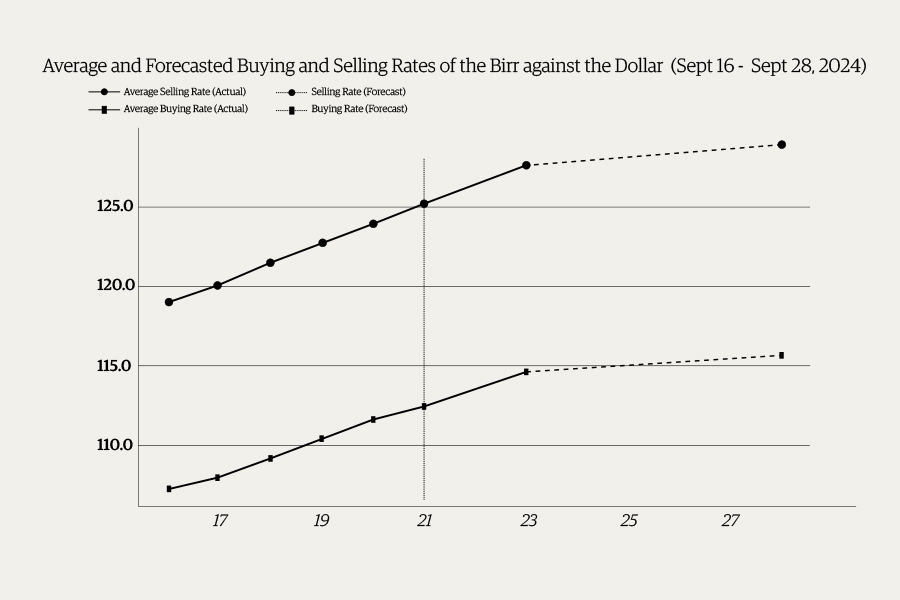

Money Market Watch | Sep 22,2024

May 15 , 2024

By AKSAH ITALO ( FORTUNE STAFF WRITER )

Manufacturers of biscuits, noodles, and animal feed are sounding the alarm, urging policymakers to intervene on the impacts of escalating wheat prices. VAT requirements, soaring production costs, and plummeting sales were cited as struggles in the plea submitted to the Ministry of Finance months ago, shedding light on the broader manufacturing woes.

The Ethiopian Millers Association has issued a warning, stressing that the survival of many of its 200 members hangs in the balance without prompt action. Tedla HaileGiorgis, president of the Association and head of Chilalo Food Complex, argues that biscuits and noodles constitute an essential source of daily sustenance for a significant portion of the community.

"They are not luxury items", he told Fortune.

The "Ok" brand biscuit and noodle manufacturer said the crippling effect of skyrocketing input prices is evident, particularly for wheat. He warns that the tax burden could spell widespread closures for many factories, with some already teetering on the edge.

Nearly 30 biscuit manufacturers and three major noodle manufacturers are struggling. Notable companies like Sawaya Food Manufacturing Plc with known brands like "Indomi" and Prima Food Processing Plc with "Prima Biscuit" are among those faced with the price hike.

Khalid Omer, CEO of Omer Biscuits, based in Sheggar City, has been tirelessly advocating for VAT reduction, citing the doubling of essential input costs like flour to 8,000 Br a quintal since last year, alongside rising sugar prices. His company, boasting a daily production capacity of 800 cartons of biscuits, relies heavily on markets in Amhara and Oromia regional states, both of which are grappling with security issues.

"Rising costs and security issues are squeezing our profits," he told Fortune.

These urgent calls for intervention coincide with the government's revision of the two-decade-old Value Added Tax (VAT) proclamation, which last year included 15pc tax exemptions on previously taxed products like wheat flour, spaghetti, and macaroni to combat inflation. The proclamation made its way to parliament a month ago after receiving a nod from the Council of Ministers, while exemptions on the three items were ushered in through a letter last year.

However, officials from the Ministry of Finance question whether previous tax exemptions have effectively mitigated inflationary pressures. Zelalem Abate, a public relations expert at the Ministry, underscores the need for a careful assessment of the manufacturers' concerns to avoid unnecessary burdens on consumers.

Meanwhile, the Ministry of Industry acknowledges some concerns raised by noodle manufacturers. Habtamu Taye, head of the Ministry's Food & Beverage Desk, argues that noodles are a vital food staple for many low-income households, contrary to being perceived as a luxury item.

"We're prepared to present our assessments," Habtamu told Fortune.

However, he contends that biscuits lack sufficient justification for VAT reduction, citing their less essential economic contribution.

The animal feed sector, reliant on wheat byproducts, faces its own taxes following VAT waivers last year. Despite assurances of refunds, Abraham Negash, general manager of Dina Animal Feed Processing, said the burden on production capacities amid wheat shortages and price hikes was impactful.

"The taxes have only complicated matters," Abraham told Fortune.

Martha Zewdu, a senior tax expert at the Revenues Ministry, defends the receivables mechanism, cautioning against potential tax evasion loopholes.

Ethiopia's federal government is aiming to raise close to 477.7 billion Br in domestic revenue this year, with a revised VAT proclamation and expanded excise taxes forming a key part of the strategy. However, concerns have been raised about the potential impact on consumers and businesses.

Tax experts like Ketema Adane question the wisdom of relying heavily on VAT, which can disproportionately burden consumers. He argues for a more thorough analysis of the potential impact of tax policies. Another concern for Ketema is the government's focus on taxing manufacturers, while sectors like digital marketplaces remain largely untouched. He said this, coupled with a low tax-to-GDP ratio, has led some to believe that Ethiopia lacks a strategic collection plan while widespread corruption and economic difficulties further complicate the situation.

The shortage and high price of wheat hovering around 8,000 Br a quintal exemplify the economic headwinds businesses face. For instance, Lume Adama Flour Factory is operating at a fraction of its capacity due to these factors. It has struggled to adjust to a fifth of its capacity while doubling wheat prices from 3,000 Br a quintal exacerbated the issue, according to Mesfin Eshete, general manager of the plant in Mojo Town, Oromia Regional State.

"This is despite sourcing from 64,000 farmers in a cooperative union," he said. "Wheat exports might also have something to do with it."

Wheat production amounted to 164 million quintals last year, with an ambitious target to increase the figure to 200 million this year. Bale Zone in Oromia Regional State has nearly 36,000 farmers busily engaged in wheat production this year on a staggering half a million hectares of land after losing 11pc of the 16 million quintal harvest to untimely rainfall.

Aluye Mohammed, head of the Bale Agriculture Bureau, said heavy rainfall destroyed a share of their hard work last year despite managing to produce half a million quintals for exports. He believes price increments for chemicals and seeds by as much as 30pc have raised the price of wheat.

"Illicit trades to Sudan are also a factor," he told Fortune.

Farmers such as Mohammed Amin, 45, plough on 10hct plot in Bale Zone and produced 700qtl of wheat last year. He said shortages of agricultural inputs like pesticide chemicals and fertiliser have impacted this year's harvest by at least 200 quintals. Mohammed also pointed to an increase in the number of pests due to unseasonal rainfall patterns this year.

Officials are optimistic. Esayas Lemma, head of Crop Development at the Agricultural Ministry, said intermediaries and security problems are the only ones disrupting the market chain.

However, economists like Atlaw Alemu (PhD) question the wheat self-sufficiency narrative. He said the observable shortages the manufacturers face tell a completely different story. Atlaw considers the wheat export ambition to be predicated on more political goals rather than sensible economic objectives in a country where millions are on the verge of hunger.

"The country should not be exporting wheat while putting industries at risk," he told Fortune.

PUBLISHED ON

May 15,2024 [ VOL

25 , NO

1255]

Money Market Watch | Sep 22,2024

Radar | Apr 13,2025

Radar | Jun 22,2024

Radar | Nov 03,2024

Fortune News | Jul 25,2020

Radar | Nov 24,2024

Fortune News | Aug 21,2021

Agenda | Nov 09,2024

Fortune News | Jul 13,2020

Viewpoints | Apr 22,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...