Jul 8 , 2023.

The halls of the Ethiopian Parliament echoed with spirited debate last week, a scenario seldom observed. The discourse was heavily imbued with nostalgia for the era of collective security and economic opportunities enjoyed under the Revolutionary Democrats' regime.

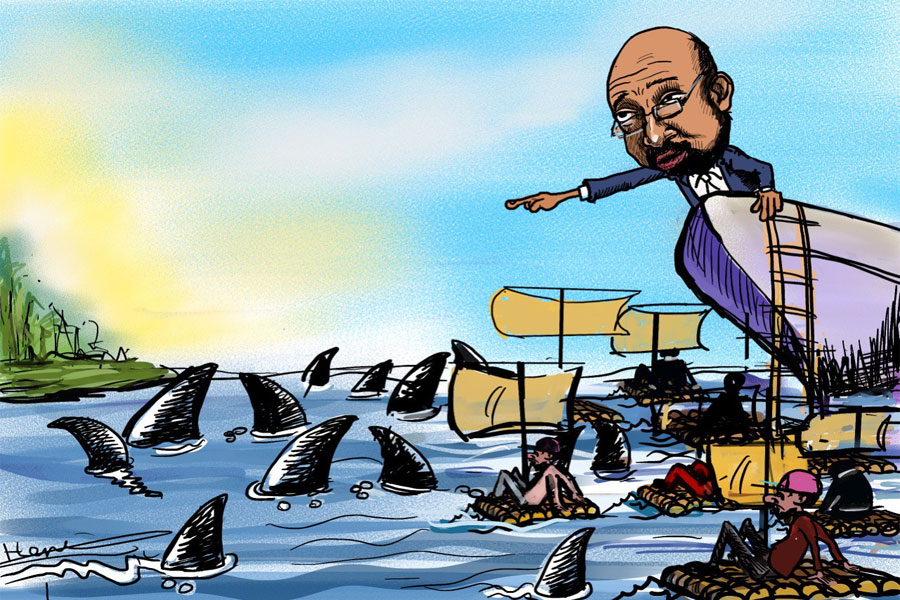

The federal government’s apparent inability to safeguard life and property across the country, coupled with the rising cost of living amid stagnant wages, dominated the conversation.

In a rare moment of concession to the legislative displeasure - where, interestingly, representatives from his own party hold sway - Prime Minister Abiy Ahmed (PhD) admitted that inflation and unemployment remain the sharpest nettles in his administration’s side.

Yet, these troubles are mere symptoms of a deeper malaise: profound structural imbalances in the national economy.

Ethiopia’s fiscal situation, exacerbated by soaring overdue receivables, burgeoning budget deficits, and relentless inflation, highlights the urgent need for disciplined fiscal stewardship and sagacious economic governance. As Ethiopians bid adieu to the fiscal year 2022/23, the budget irregularities laid bare in the federal Auditor General’s report should be a cause for grave concern.

The report, unveiled to the Parliament a week prior to the ratification of the budget bill for 2023/24, revealed a startling trend. Overdue receivables had reached a staggering 15 billion Br, marking a 15pc increase from the preceding year, and a whopping 114pc increase from a few years ago.

This bleak outlook, shaped by the prospect of consequential fallout of debt default, rings alarm bells in a country banking on taxation and foreign largess as its golden road to prosperity. The startling figures underscore the critical need for improved fiscal discipline and effective financial management.

The report’s revelations should prompt Ethiopians to ponder the impact of fiscal waywardness, appreciate the importance of audits, and delve into the potential of various policy tools.

Ethiopia's fiscal predicament may mirror the dilemma confronting numerous developing countries: a dire need to fuel growth and alleviate poverty, with the backdrop of a limited revenue base and surging public expenditure. In such circumstances, fiscal discipline should not be seen as a luxury — it must be essential.

Federal auditors have long been Ethiopia’s fiscal guardians, spotlighting issues of underused budgets, illicit procurements, and unaccounted-for expenses. A transparent and credible audit system does more than enforce accountability and efficiency; it serves as a course correction mechanism for public sector financial management.

Successive federal auditors have displayed commendable bravery in presenting uncomfortable truths to the powers that be, undeterred by the inherent risks. It is heartening to see Meseret Damtie uphold this legacy, fearlessly bringing stunning revelations of public finance to light.

These revelations underscore the eternal conflict between expansive economic policy - favoured by successive administrations - and the imperative need for stringent fiscal discipline. Striking a balance between nurturing growth, alleviating poverty, and maintaining economic stability is a complex challenge.

Looking back at Ethiopia’s fiscal journey offers illuminating insights.

Although total revenue (including grants) ballooned by 2,574pc between 2003 and 2021, tax revenue as a proportion of GDP declined by 13.4pc. Despite a similar revenue surge, total expenditure as a proportion of GDP fell by a significant 42.3pc.

These figures lay bare the limitations of the federal government’s excessive dependence on taxation. They also underscore the importance of fostering an ecosystem that promotes economic growth, rather than merely broadening the tax net.

This serves as an important reminder that an effective and judicious economic development model should strive to create an environment conducive to flourishing businesses, job creation, and growth. Taxation is an indispensable tool for revenue mobilisation, but it should not be the only strategy for fiscal sustainability.

There should be a dichotomy of monetary and fiscal policies, which, while interlinked, often require differing responses.

Fiscal policies, dealing with government revenues and expenditures, are essential for managing budget deficits and ensuring macroeconomic stability. Despite substantial increases in revenues and domestic credit, the persistent rise in Ethiopia's budget deficit suggests a structural imbalance that requires a more comprehensive approach, one that goes beyond mere fiscal measures.

Monetary policies, which concern the management of money supply and interest rates, can be used to curb inflation and stimulate economic growth. Ethiopia’s significant increase of the broad money supply by approximately 3,792pc between 2003 and 2021 serves as an example.

Monetary policy can be a double-edged sword, potentially stoking the fires of inflation, as seen in Ethiopia’s escalating inflation rates, thereby undermining the purchasing power of the Birr and engendering economic uncertainty.

However, policymakers must re-evaluate their approach to managing inflation, which has consistently remained high, peaking at an average annual rate of 20.2pc in 2020/21, and 33pc in 2022/23.

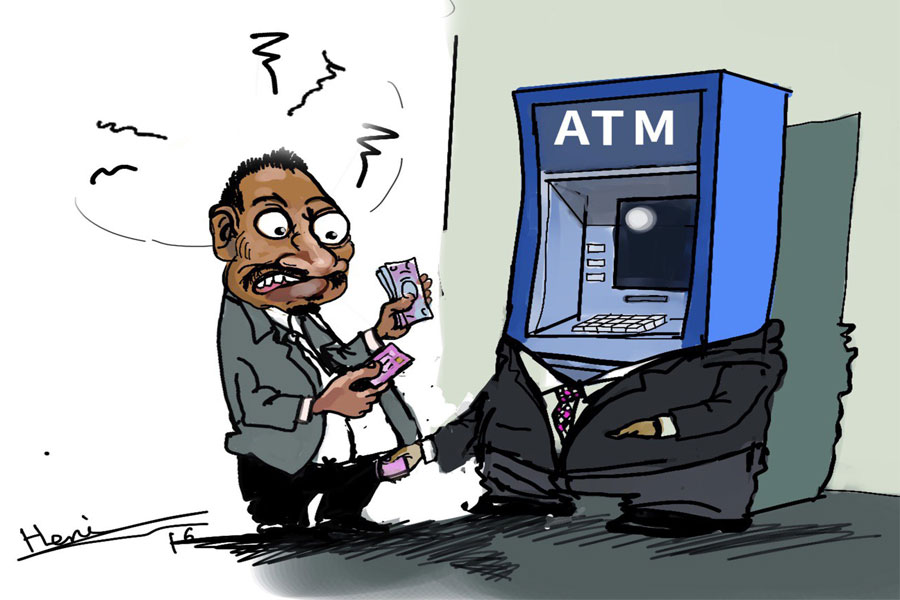

The key challenge lies in generating revenue. While tax revenues are growing in absolute terms, they are shrinking as a proportion of GDP, signalling a strained tax base. The government is thus left with two options: extract more revenue from an already overburdened populace, or broaden the tax base. The latter is more favourable, and this is where the federal government’s efforts must be directed.

Prime Minister Ahmed emphasised the country’s underwhelming tax-to-GDP ratio in his parliament address last week, noting that it was less than half the 16pc average for sub-Saharan Africa. Ethiopians should brace themselves for a government desperate to make up a budget deficit exceeding 90 billion Br by squeezing every penny from its citizens and businesses next year.

However, burdening society with heavier taxation during periods of economic hardship is unlikely to solve the problem. Instead, tax policies should stimulate growth and inclusivity. Lowering tax rates for small-to-medium enterprises, promoting entrepreneurship, and generating jobs should be on the agenda.

Enhancing tax administration, tackling tax evasion, and extending the tax net to the informal sector can improve revenue without burdening existing taxpayers.

A diversified economy can yield a broader tax base and more stable revenue. Ethiopia’s economy relies heavily on agriculture. Investing in sectors like manufacturing and technology could diversify the economy, bolster its resilience to shocks, and create new revenue sources.

While austerity measures may be necessary to restore fiscal balance, they must be implemented judiciously. Indiscriminate budget cuts can have severe social implications and hinder development. Instead, spending should be made more efficient, necessitating evidence-based budgeting, where resources are allocated to sectors and projects promising the highest return on investment.

Ethiopia has the potential to build a robust and sustainable economy. However, this requires a renewed commitment to fiscal discipline, a willingness to embrace transparency, and the courage to innovate in policy design and implementation. If Ethiopia can successfully navigate these challenges, it could turn its fiscal plight into a story of resilience and growth, setting an inspiring example for other developing countries.

The jury is out for Prime Minister Abiy and the monetary and fiscal policy advisors that surround him.

PUBLISHED ON

Jul 08,2023 [ VOL

24 , NO

1210]

Sunday with Eden | Sep 04,2021

My Opinion | Dec 19,2020

Editorial | Apr 22,2023

Editorial | Jun 21,2025

Fineline | Jun 22,2019

Editorial | Oct 28,2023

Commentaries | Jun 03,2023

Commentaries | Oct 12,2019

My Opinion | Dec 16,2023

Commentaries | Oct 19,2019

Photo Gallery | 176623 Views | May 06,2019

Photo Gallery | 166834 Views | Apr 26,2019

Photo Gallery | 157375 Views | Oct 06,2021

My Opinion | 136926 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025 . By NAHOM AYELE

In a sweeping reform that upends nearly a decade of uniform health insurance contribu...

A bill that could transform the nutritional state sits in a limbo, even as the countr...

Oct 18 , 2025 . By SURAFEL MULUGETA

A long-planned directive to curb carbon emissions from fossil-fuel-powered vehicles h...

Oct 18 , 2025 . By BEZAWIT HULUAGER

Transaction advisors working with companies that hold over a quarter of a billion Bir...