Exclusive Interviews | Nov 06,2021

Jun 26 , 2021

By Asseged G. Medhin

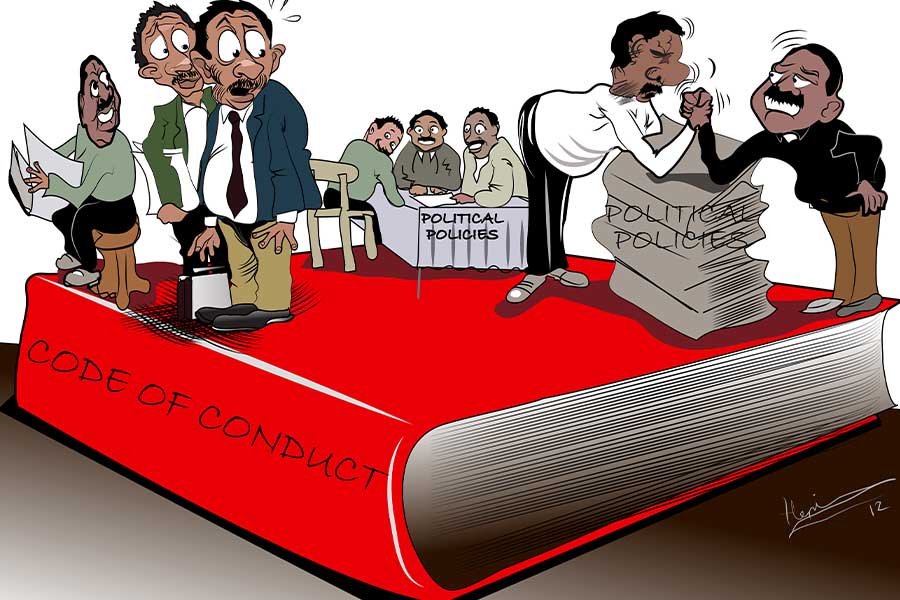

Some business leaders and CEOs argue that they should go for market share against competitors by focusing on a single portfolio. However, 20th-century business performances indicate that new ways ought to be employed. It should be no different in Ethiopia, where an election has just taken place. Change of policies, a mix of the new and the old, or a continuation of what has been should inspire business leaders to be smarter to benefit from the changes in the political system.

When political changes challenge the existing social arrangement, business organisations should balance the persuasive ideological power with conservative traditional goings-about and rethink their growth.

In Ethiopia, in all sectors, moving to enhance market share in the short-term on whatever good or service is the dominant thinking. Now is the time to check it, especially in a post-election period where a new government sets agendas and priorities. Companies react to political adjustments either as a threat or an opportunity to build on. The latter is often a driving force since no other choice but to adjust and be profitable could be offered. As a result, they should raise their telescopes to see beyond the horizon, check the heartbeat of their core business and find a way to build on the opportunities that could be provided.

This concept of growth allows companies to maintain their strategic position, settle their short-term and long-term obligations, and distribute dividends from the net cash income they generate. It is a plus to the business, should they remain in a political and social environment that remains unchanged.

One of these coping mechanisms is the adequacy of capital for a business, as it is for personal finances or a national economy facing the winds of change. With effective strategy, it will help companies thrive through change.

What size of capital is adequate? And to what scale and magnitude should the companies adjust following political changes?

This is a tough assignment that demands them to scrutinise every variable. Whatever contingency plan they already developed, it is not a guarantee in uncertain economies, as the degree of predictability is not at arm’s length. Hence, the special need for capital adequacy as a hedge.

The 21st century and changes in our country require us to “rethink growth” from every business dimension. For instance, we should gain market share without consuming a disproportionate amount of net cash in the form of more inventory or having large account receivables. If not, it is a null and void strategy that will gradually close the business.

The strategy should be based on a conscious, integrated transformational plan, mainly on an inevitable force of external parameters that would affect existing resources. Without it, we fail to exist further as a business.

Look no further for proof of this than the global crises brought on by the COVID-19 pandemic. It has overnight closed economies and nearly mortally wounded sectors such as retail, tourism and entertainment. The burden it has unloaded on businesses globally, for those large firms unable to manage it wisely, has been devastating. Rethinking growth has become the only antidote.

Profitability, increasing market share, and cash efficiency all come from giving value to customers, having an effective business process and integrating ICT and human asset development. In that regard, it is crucial to rethink growth by giving special attention to valuing customers and their actual preference following changes in the political landscape. If businesses, industries and sectors manage their way through it strategically, it could offer a winning cocktail that boosts economic output and unleashes the productive force of the country.

Asseged Gebremedhin is the deputy CEO of Global Insurance.

PUBLISHED ON

Jun 26,2021 [ VOL

22 , NO

1104]

Exclusive Interviews | Nov 06,2021

Radar | Jan 18,2020

Fortune News | Jul 13,2019

Fortune News | Aug 14,2021

Sunday with Eden | Aug 25,2024

Radar | Apr 01,2024

Editorial | Feb 22,2020

Viewpoints | Mar 11,2023

Commentaries | Sep 10,2021

Photo Gallery | 176322 Views | May 06,2019

Photo Gallery | 166539 Views | Apr 26,2019

Photo Gallery | 157025 Views | Oct 06,2021

My Opinion | 136902 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Oct 18 , 2025 . By NAHOM AYELE

In a sweeping reform that upends nearly a decade of uniform health insurance contribu...

A bill that could transform the nutritional state sits in a limbo, even as the countr...

Oct 18 , 2025 . By SURAFEL MULUGETA

A long-planned directive to curb carbon emissions from fossil-fuel-powered vehicles h...

Oct 18 , 2025 . By BEZAWIT HULUAGER

Transaction advisors working with companies that hold over a quarter of a billion Bir...