Fortune News | Nov 29,2020

Jul 23 , 2022

By Christian Tesfaye

There is a phrase we hear a lot these days: interest rates. It is a key indicator rocking financial markets worldwide and creating economic havoc through a massive capital flight from emerging markets. It is not surprising. Inflation and interest rates are the opposite sides of the same coin. The Phillips Curve tells us that unemployment and inflation are inversely related. When unemployment is too low, inflation edges higher. The balance can be restored by loosening the labour market.

In highly financialised economies, tight labour markets could be loosened by increasing benchmark interest rates. The less cheap money in circulation, the less credit out there in the economy. With less credit, household and private sector spending falls, slowing business activity and reducing employment. It is an ugly process where everybody is left bleeding. But central banks find it a necessary pain to bear for the bigger evil of inflation. This is how most countries operate.

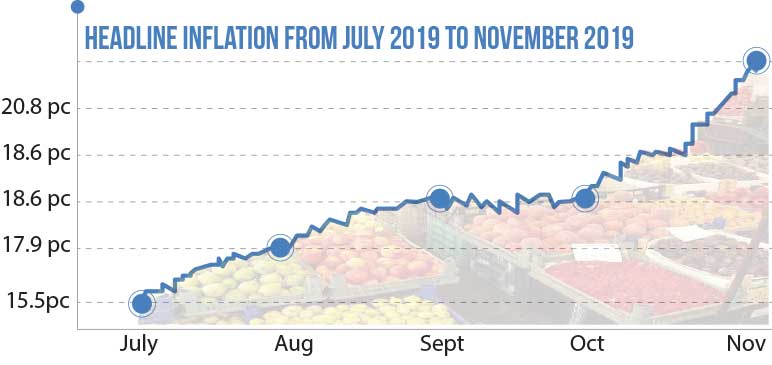

But wait a minute. Ethiopia has been dealing with high inflation for longer than the rest of the world. How come we have not heard talk of interest rates? Why has the key interest rate, savings deposit rate, not been bumped up from its current seven percent?

Inflation hovers in the 30-40pc range. Should savings interest rates not be raised to at least 30pc? It would surely incentivise household saving and discourage spending. Why has the central bank not budged?

Two words: domestic debt. Over the past few years, the federal government has dug deep into a resource that did not use to be as crucial to the budget. Since T-bills have been floated, hundreds of billions of Birr have flown into government coffers to fill budget deficits. This was smart to a point.

For one, double-digit inflation means that a borrower benefits because the real interest rates they pay are negative. The high discount rate makes any amount of Birr now far more valuable than in the future. It is creditors - in this case, banks – that stand to make a loss (do not shed tears for commercial banks; they make the loss back by paying negative interest rates to their depositors).

It is also possible to lean on domestic debt, unlike external financing. Reliance on expansionary fiscal policy by borrowing in the local currency is advocated by proponents of modern monetary theory (MMT). They argue that a government can spend with impunity if it finances deficits with local currency-denominated debt. High debt burden? No problem. Print more money. Sure, the average business or household should worry about its debt, but why should the Ethiopian government, the monopoly issuer of the Birr, be so perturbed?

But what about inflation?

No matter. When it gets out of hand, the government can increase taxes to take money out of the economy. It is a novel way of thinking, and mainstream economists hate it. Nonetheless, it has gained traction in policymaking circles even though no maths back the theory.

Hopefully, this is not something policymakers in Ethiopia use to inform their decisions. Nonetheless, they have allowed domestic borrowing to get out of hand. At this point, the cost of hiking interest rates to fight inflation would hurt a great deal more than it is worth because of domestic debt.

This has to do with expanding treasury bill financing by the government. It is so much that, in the current fiscal year, 278.6 billion Br worth of T-bills will fall due, according to Cepheus Research & Analytics. This is an average of 23 billion Br every month. New borrowing and refinancing are estimated to bump up bond yields by at least two percentage points.

A couple of percentage points rise in saving rates, say to 10pc, will not be catastrophic. But this is unlikely to bring down inflation. With inflationary pressure as sustained and high as that of Ethiopia, and a central bank that has lost credibility, interest rates need to be dialled up all the way to 30pc. Inflation will not know what hit it.

And neither would the federal government. Bond yields will go up and make any more government borrowing to finance deficits impossible. In fact, if it fails to roll over debt - and it will fail at 30pc-plus bond yields - the government will default and take the commercial banks down with it.

More practical solutions are to suspend direct government advances and work to improve rural agricultural productivity. These will have more direct and predictable implications than interest rate hikes.

PUBLISHED ON

Jul 23,2022 [ VOL

23 , NO

1160]

Fortune News | Nov 29,2020

My Opinion | Jun 18,2022

Fortune News | Jul 30,2022

Fortune News | Dec 07,2019

Fortune News | Jun 19,2021

Fortune News | Dec 13,2021

Commentaries | Dec 09,2023

Verbatim | Nov 30,2024

Fortune News | Dec 04,2021

Radar | Jun 21,2025

Photo Gallery | 176418 Views | May 06,2019

Photo Gallery | 166632 Views | Apr 26,2019

Photo Gallery | 157143 Views | Oct 06,2021

My Opinion | 136908 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Oct 18 , 2025 . By NAHOM AYELE

In a sweeping reform that upends nearly a decade of uniform health insurance contribu...

A bill that could transform the nutritional state sits in a limbo, even as the countr...

Oct 18 , 2025 . By SURAFEL MULUGETA

A long-planned directive to curb carbon emissions from fossil-fuel-powered vehicles h...

Oct 18 , 2025 . By BEZAWIT HULUAGER

Transaction advisors working with companies that hold over a quarter of a billion Bir...