Radar | Jan 18,2020

Local breweries have increased wholesale beer prices for the third time in three years as galloping inflation and a global economy in recession take their toll.

The price of a crate has shown a 10pc rise as distributors received their latest delivery with an 85 Br increase from 690 Br. Many local bars in the capital are holding off retail price increments until they ran out of inventory.

The price of beer has risen globally due to several factors, including higher costs of fertilisers and chemicals, the impact of the Covid-19 pandemic, and recent wars.

In December, Heineken's CEO, Dolf van den Brinkhof, announced that the company was planning to apply stricter cost controls, including shutting down seven of its 50 breweries in Europe.

Domestic breweries have also been hit hard during this period, with prices rising by as much as 50pc for local brands. Expanded tax obligations, arising from the amendment of the excise tax laws two years ago, have caused alarm among local liquor manufacturers, who foresee the "sin tax" inevitably eating away at their profits.

Sixty percent excise tax on inputs and the 80pc tax on the finished product were shredding the returns of liquor manufacturers, a report submitted by the Ethiopian Food Beverages & Pharmaceutical Industry Development Institute to the Ministry of Finance last year revealed. The National Alcohol & Liquor Factory, the state-owned enterprise that has 15 brands of liquor under its umbrella, averaging north of 10 million litres a year, recently received a hefty tax bill nearing one billion Birr.

Breweries' dismay was exacerbated after authorities at the Ethiopian Food & Drug Administration Authority (EFDA) ushered in a law in late 2019 banning alcohol promotion in broadcast media outlets. A draft directive that will extend the prohibition of advertisements at all "public gatherings and sporting venues" is in the making. This will have a dire impact on the breweries' marketing drive, hence business, according to an executive of one of the three largest brewers.

While the state-owned liquor bottler offers a host of spirits, beer is the most widely consumed alcoholic beverage, accounting for 98.9pc of formal alcohol consumption, according to data from the Fitch Group, an international credit rating agency based in New York, providing research on global capital markets.

Since the privatisation of St.George Brewery in the late 1990s, multinational corporations have shown interest in the Ethiopian beer industry, enticed by the growing trend of beer consumption. The French-based Groupe Castel was the first entrant through its subsidiary BGI, which had acquired the government's oldest brewery, St.George, for 10 million dollars in 1999. Heineken and Diageo followed suit in the early 2010s. The latter acquired the state-owned Meta Brewery for 225 million dollars, while the former bought Bedele and Harar breweries for 163 million dollars.

With the 96-year-old billionaire Pierre Castel as its major shareholder, BGI Ethiopia, under the French-based company, finalised the acquisition of Meta Abo Brewery from the British-based Diageo in April last year, after receiving the nod from the consumer protection authority, now absorbed by the Ministry of Trade & Regional Integration. The company also acquired local breweries, Zebidar and Raya, consolidating its hold in the Ethiopian brewery market of one billion dollars.

Raya Breweries, which had ceased production for over two years following the civil war in the Tigray Regional State, opened its plant for assessment to resume work about a month ago. Under BGI Ethiopia, the plant is erected in Bohera Mountain south of Maychew town, 667km north of the capital. The technical team is examining the damage and testing machinery, according to Brand Supervisor Baraki Gebremedehin.

BGI is seen aggressively pushing production across its six breweries to 6.4 million hectoliters; its managers hope to solidify and claim half of the market share estimated to have grown by 16pc over the past few years. This move would place it ahead of Heineken, which produces around six million hectoliters despite being regarded as the leading brewery in volume. BGI's acquisition of Meta Abo, which has a capacity of 1.7 million hectoliters, turns the game upside.

The third largest brewer, Dashen Brewery, established in 2000, has an installed capacity of around three million hectoliters between its two plants erected in Gonder and Debre Berhan towns, in the Amhara Regional State.

The industry also accommodates relatively smaller breweries such as United Beverages, co-owned by a local family business and Mauritian firm, which entered the market in 2016. investing 54 million dollars, it launched Anbessa Beer with a capacity of 1.7 million hectoliters. The brand was introduced to the market through a grand marketing scheme plastered across all media formats. Bavaria, a Dutch-based company owning 60pc shares and Ethiopian shareholders, launched Habesha Brewery in 2015 with a capacity of a little less than a million hectoliters. Habesha Beer garnered a robust customer base within a short time, being the exclusive sponsor for one of the veteran sports teams in the capital, Ethiopia Buna.

Amidst the competition, some consumers have started to look for cheaper alternatives.

Abraham Zerihun, the owner of a mobile maintenance business around Ayer Tenna, has shifted from drinking Habesha Beer, which costs around 50 Br in his favourite bar, to drinking Bedele, which costs about the same but offers 200ml more. It is no longer about preferences for Abraham but a matter of getting more for less for the money he spends.

"I might switch to traditional liquor if prices rise further," he told Fortune.

Ermias Wagshuma, the CEO of Mare Brewery, a company that produces traditional alcoholic drinks, had initially planned to launch a business that uses maise as an input to cut costs and compete with the big foreign companies. However, the shortage of foreign currency and the high machinery price have forced the company to switch to producing traditional drinks that have existed for millennia.

Ermias attributes any possible beer price increase to unnecessary reliance on imports. He believes foreign companies seem "uninterested" in developing a local supply chain to source inputs.

"Breweries seem only to source the water and manpower locally," said Ermias reminding himself that beer is made of water, yeast, malt barley, and buckthorn. "They should be forced to integrate into local supply chains."

However, Heineken and Dashen breweries, in partnership with Gonder Malt Factory, have been working on a project to raise malt barley harvest with 35,000 farmers in Amhara and over 70,000 farmers in Oromia regional states. GIZ financially supported the project with a grant of nearly one million euros.

According to Ermias, only three companies have more than a third of the market share, which gives them an unprecedented hold over the industry. He is not surprised at the impending price rise.

The competition in Ethiopia's beer industry is heating up, and with BGI's goal of increasing production, other players in the market will need to find ways to remain competitive. As consumers continue to seek cheaper alternatives, companies may need to consider developing local supply chains to source inputs to keep their prices competitive.

Kassahun Gizaw who owns and manages Bole Microbrewery after nearly three decades of service at BGI factories thinks the rise in costs is most likely tied to the rise in the cost of imported malt. After a decade in his own private small-scale brewery, this level of price increase was a surprise to Kasahun as well.

He studied industrial chemistry before working as a master brewer of St. George beer at BGI, finally opening up Bole Microbrewery with his partner Tesfaye Biftu (PhD) upon retirement. The microbrewery on Cameroon Street (Bole Medhanealem) offers several flavours of homemade beer while customers get to watch it being brewed.

The expert reasoned since locally sourced malt will not meet the demands of the giant beer companies increased costs of imports will translate to price raises. He said the war between Russia and Ukraine has complicated supply chains from Europe, including major chemical manufacturers.

"This is most likely why prices have risen," he said.

PUBLISHED ON

Mar 04,2023 [ VOL

23 , NO

1192]

Viewpoints | Aug 29,2020

Fortune News | Sep 29,2024

Fortune News | Mar 02,2024

Radar | Feb 17,2024

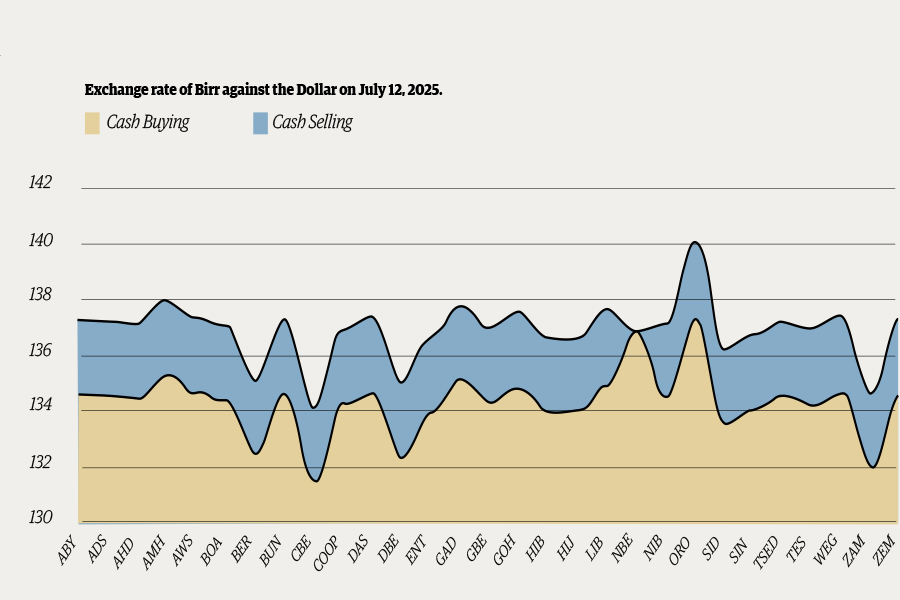

Money Market Watch | Jul 13,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...