Editorial | Jan 25,2020

Jan 15 , 2022

By Koichi Hamada

The rigid stances of Modern Monetary Theory’s devotees and detractors have not lent themselves to productive discussion. This is a serious loss for policymakers, because MMT includes both problematic propositions and perfectly reasonable – even highly useful – ones, writes Koichi Hamada, professor emeritus at Yale University and former special adviser to former Japanese Prime Minister Shinzo Abe.

When Democratic Senator Joe Manchin announced that he would not support US President Joe Biden’s Build Back Better Act – effectively dooming the president’s signature legislative initiative – he cited America’s “staggering debt.” His concerns echoed those of Biden’s Republican opponents, who insist that all that spending would expand the deficit and leave future generations groaning under the weight of a heavy tax burden.

But would it?

Proponents of Modern Monetary Theory would beg to differ.

The Build Back Better Act’s detractors subscribe to the conventional Ricardian assumption that, over time, a government must balance its budget, just like a private firm. But MMT holds that, as long as debt is denominated in a country’s own currency, its government cannot default. Excessive government spending can fuel inflation, but as long as prices are stable, governments can spend away, using fiscal deficits – rather than tax revenues – to support employment and finance public goods.

While MMT is not new, it has been gaining traction in recent years. And a significant share of its following nowadays comes across almost as zealots, unwilling to brook any dissent. Meanwhile, mainstream economists largely regard MMT as tantamount to professional heresy, with some avoiding so much as uttering its name.

Needless to say, the rigid stances of MMT’s devotees and detractors have not lent themselves to productive discussion. This is a serious loss for policymakers because MMT includes both problematic propositions and perfectly reasonable – even highly useful – positions.

In the latter category, the idea that stands out is essentially functional finance theory. Proposed by Abba Lerner in 1943, FFT holds that, because governments borrowing in their own currency can always print money to service their debts, but still face inflation risks, they should aim to balance supply and demand at full employment, rather than fret about balancing the budget. In Lerner’s view, well-targeted deficit spending is an effective way for governments to “maintain prosperity.”

FFT supports the case for Build Back Better, which includes spending on goods like education, infrastructure, and the green transition. The Biden administration claims that the act would be financed entirely with tax revenues.

But even if that turned out not to be the case, as his detractors predict, would not inadequate infrastructure, depleted human capital, and a planet ravaged by climate change hurt future generations more?

To be sure, US policymakers broadly recognise the importance of such investments, especially in infrastructure; the US Congress recently passed, with bipartisan support, a one trillion dollar spending plan that aims to advance objectives like overhauling the electricity grid, upgrading railways, and expanding access to high-speed internet. But even some Democrats demanded that the new funds contained in the package be entirely offset by new tax revenue – a development that highlights enduring resistance to the logic of MMT (or FFT).

And yet, as the Wall Street Journal’s James Mackintosh recently argued, this may be largely a “rhetorical” issue. After all, he notes, “the infrastructure act is, in fact, debt-financed anyway.” And it may well be that many of Build Back Better’s supporters are not convinced by Biden’s claims that tax revenues will offset the new spending, but are not that concerned about it.

But MMT and FFT are not synonymous. MMT includes two additional propositions that, in my view, are unsound. The first is that monetary policy should be conducted in such a way that it facilitates fiscal-policy decisions, such as by maintaining a constant (very low) interest rate.

This expresses a crucial feature of post-Keynesian economics: interest rates, rather than money supply, are the key variables. This defies conventional economic thinking, which focuses on the interaction of stock and flow variables and the role of expectations. More important, if interest rates are held constant, and prices start to rise, inflation could snowball. MMT proponents would advocate tax hikes as a way to manage aggregate demand and control inflation. But, given what we know about asset dynamics, this would be a hard sell.

MMT’s second problematic proposition – that governments should provide a job guarantee in order to maintain full employment while mitigating inflationary pressures – is even harder to defend. It simply moves too far in the direction of socialist labour allocation, and enables governments to wield excessive control over workers’ wages.

When I explained MMT to former Japanese Prime Minister Shinzo Abe, he compared it to preparing fugu. If done correctly, the pufferfish is a sublime delicacy. But if the chef makes even a minor mistake, the diner could suffer a rapid and painful death.

It is an apt metaphor. If policymakers adopt the positive elements of MMT – essentially, FFT – they will gain new options for bolstering prosperity for current and future generations. But one wrong cut, and the results could be fatal.

PUBLISHED ON

Jan 15,2022 [ VOL

22 , NO

1133]

Editorial | Jan 25,2020

Obituary | Sep 29,2024

Radar | Dec 11,2021

Radar | Jan 11,2020

Fortune News | May 23,2020

Radar | Nov 19,2022

Agenda | Apr 15,2023

Radar | Aug 28,2021

Radar | Jul 30,2022

Sunday with Eden | May 08,2021

Photo Gallery | 178475 Views | May 06,2019

Photo Gallery | 168673 Views | Apr 26,2019

Photo Gallery | 159480 Views | Oct 06,2021

My Opinion | 137078 Views | Aug 14,2021

Commentaries | Oct 25,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

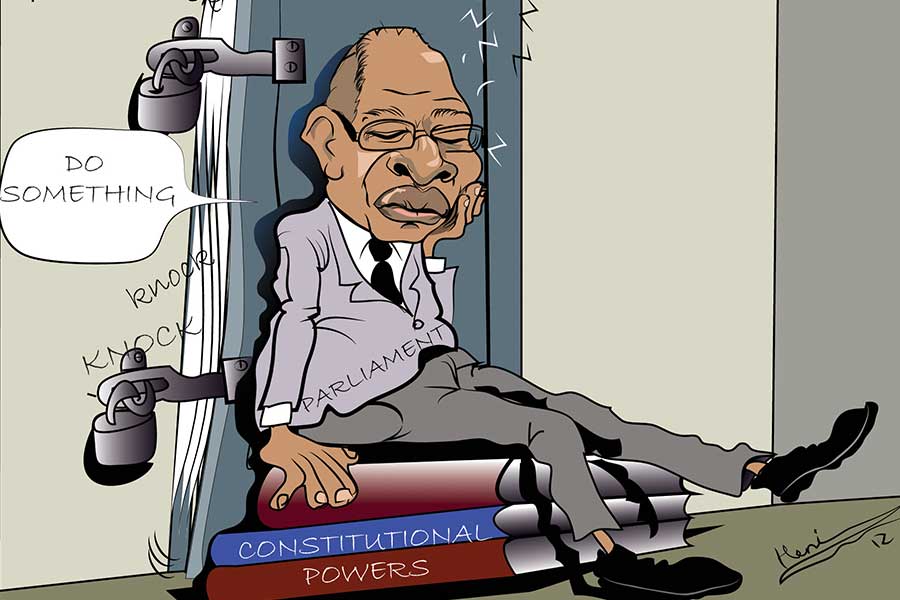

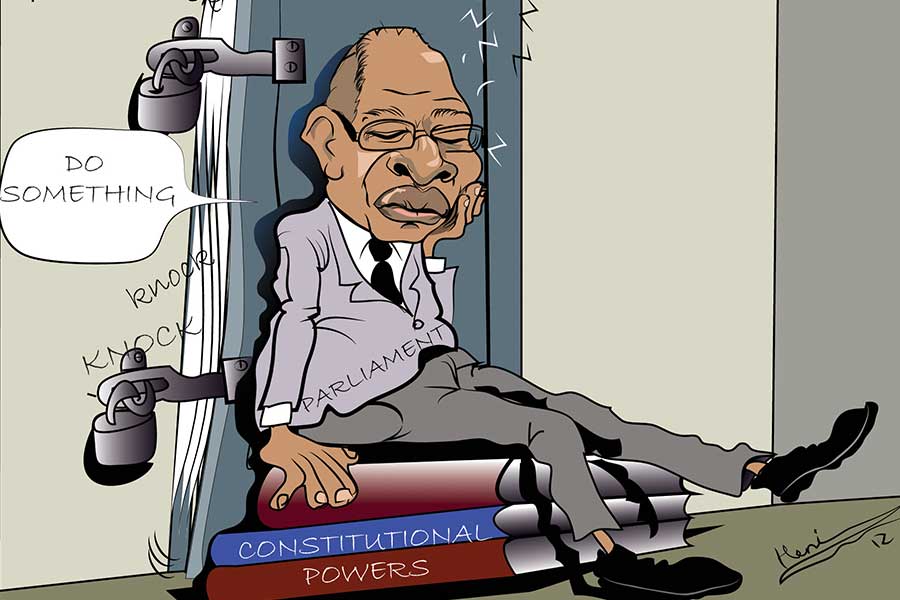

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Oct 25 , 2025 . By YITBAREK GETACHEW

Officials of the Addis Abeba's Education Bureau have embarked on an ambitious experim...

Oct 26 , 2025 . By YITBAREK GETACHEW

The federal government is making a landmark shift in its investment incentive regime...

Oct 29 , 2025 . By NAHOM AYELE

The National Bank of Ethiopia (NBE) is preparing to issue a directive that will funda...

Oct 26 , 2025 . By SURAFEL MULUGETA

A community of booksellers shadowing the Ethiopian National Theatre has been jolted b...