Fortune News | Sep 21,2025

Feb 5 , 2022

By Austine Sequeira

One of India's oldest public sector companies, the national flag carrier was recently privatised. Air India, wholly owned by the government, was sold to Tata Group, an Indian industrial conglomerate that initially set up Air India in 1932. The airline was nationalised in 1953 and since then accumulated losses amounted to 10 billion dollars, all of it funded by taxpayers. While this is not a rare case, it has ignited the debate on what the government should own and do and how it can efficiently put to use the taxpayer’s money.

Documented industrial revolutions occurred in the 19th century, mostly in Britain and later between the mid-19th and early 20th centuries in Europe and North America. Later, the urge to develop industries locally increased in other parts of the world, especially in countries that won their freedom from colonial rule. Successive governments invested scarce resources to set up businesses citing lack of private investment, equality of ownership and abolition of private profit-making. Private industries set up by the colonisers were casualties of nationalisation as well. Bailouts in the name of social cost was the other shade of nationalisation. Overall, the nationalisation process killed efficient use of capital, public accountability, and private investment.

The beginning of the 21st century has largely seen the end of transition economies, including economies based on socialism and communism, simply because of a growing need to use scarce public resources efficiently. Deficit financing is the order of the day, with public debt contributing over 50pc of gross domestic resources in many countries. There is a growing requirement for optimal allocation of public resources. In the African context, financing poverty-related subsidies and millennium development goals (MDGs) through public funds is more relevant than investment in industries and financing bailouts.

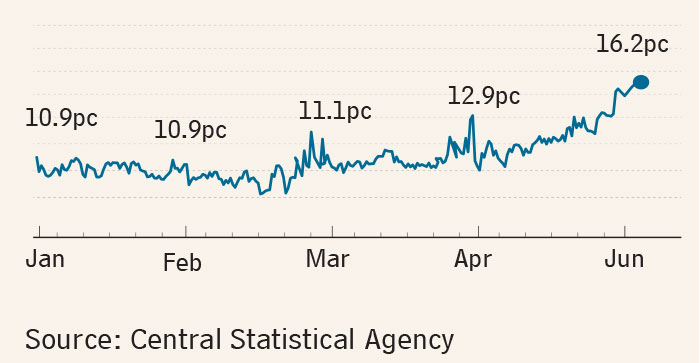

Developing economies in Africa have huge funds locked up in an inefficient public sector. Take Ethiopia. State-owned enterprises (SOEs) owed the equivalent of 40pc of total public debt, according to the 2021 Ethiopian Public Sector Debt Statistical Bulletin.

Imagine the transformation of the economy if a fraction of this amount was spent annually on infrastructure development, health, and education over the past decade. It is a sure case of lost opportunity due to inefficient allocation of resources. The quality of these SOEs, barring a few enterprises, is fragile and undoubtedly, their contribution to the national economy is negative. The country is now staring at the social cost of liquidating SOEs.

Historically, Ethiopian SOEs were born out of adopting the developmental-state economic model, which saw a need to fill the investment gaps due to a lack of private sector investment and capacity. The government set up large enterprises in every sector, unfortunately deploying borrowed funds. The trend continued during successive Growth & Transformation Plans (GTPs) until the last decade, wherein state-owned sugar enterprises were set up through borrowings.

Now, privatisation is a rolling agenda item for the government. However, attracting FDI for privatisation is a herculean task given the lack of sectoral autonomous supervisory authorities and clarity on tax laws, including compliance. Additionally, setting up new enterprises could be technologically and financially gainful for the private sector compared to participating in government privatisation programs. Ethiopia has recently set up the Liability & Asset Management Corporation, with some ambitious objectives to liquidate public enterprises. Broadly, this can be considered a political solution rather than an economic one. It is still a welcome development.

Like poverty, investment in the public sector is also a vicious circle as the exit cost is high. Inefficiency and resultant operating losses need continuous investment. Disinvesting public funds from state-owned enterprises have a social cost, especially if such firms are highly leveraged through public debt. A step to reducing social costs is to unleash economic reforms that define rules to attract foreign investment and encourage domestic investors to invest in medium and large industries. Productive re-deployment of dis-invested funds is also a challenge. Public debt management is a continuous process linked to GDP and developing countries like Ethiopia need continuous funds for economic expansion. Retirement of old debt is a common but rudimentary approach that increases social costs.

Ethiopia, therefore, needs a robust program to recover at least half of all public debt in the near term and redeploy them for productive economic development.

PUBLISHED ON

Feb 05,2022 [ VOL

22 , NO

1136]

Commentaries | Apr 28,2024

Fortune News | Jun 23,2019

Commentaries | Oct 07,2023

Commentaries | Jul 30,2022

Commentaries | Jan 07,2024

Photo Gallery | 178724 Views | May 06,2019

Photo Gallery | 168920 Views | Apr 26,2019

Photo Gallery | 159761 Views | Oct 06,2021

My Opinion | 137107 Views | Aug 14,2021

Commentaries | Oct 25,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Oct 25 , 2025 . By YITBAREK GETACHEW

Officials of the Addis Abeba's Education Bureau have embarked on an ambitious experim...

Oct 26 , 2025 . By YITBAREK GETACHEW

The federal government is making a landmark shift in its investment incentive regime...

Oct 29 , 2025 . By NAHOM AYELE

The National Bank of Ethiopia (NBE) is preparing to issue a directive that will funda...

Oct 26 , 2025 . By SURAFEL MULUGETA

A community of booksellers shadowing the Ethiopian National Theatre has been jolted b...