Fortune News | Apr 12,2020

Nov 14 , 2020

By Stephany Griffith-Jones , Régis Marodon

With combined assets of more than 11 trillion dollars, public development banks already play a significant role in the global economy. They should now increase their individual and joint activities further in ways that even better aid the green and fair recovery the world urgently needs, write Stephany Griffith-Jones, emeritus fellow at the University of Sussex, and Régis Marodon, special adviser at the French Development Agency.

Major global threats –- including the COVID-19 pandemic, climate change, and rising inequality –- call for large-scale concerted action. The challenge facing policymakers today is to support big structural transformations that can make economies simultaneously more productive, more inclusive, and less carbon-intensive. Public development banks (PDBs) –- at the local, national, subregional, regional or interregional level –- are key to helping governments finance a rapid recovery from the COVID-19 crisis and to ensuring that economies serve people and the planet far better in the long run.

In providing direct public financing and mobilising private finance, PDBs should select and support long-term productive investments, including those that emphasise low-carbon projects, as well as those benefiting poorer regions and populations. And they should base their selection on criteria that put development impact first, with financial returns an important but secondary objective.

The role of PDBs will be the focus of an important research conference on November 9 to 10, 2020, as part of the first Finance in Common Summit. This meeting, which has the backing of French President Emmanuel Macron, United Nations Secretary-General António Guterres, and International Monetary Fund (IMF) Managing Director Kristalina Georgieva, will bring together heads of state and the chief executives of many of the world’s 450 existing PDBs.

At stake is nothing less than changing the way that financial services support the real economy in order to achieve more equitable and sustainable growth. PDBs can be crucial actors in that effort, including by financing the provision of public goods.

The international research prepared for the conference contains numerous recommendations to help decision-makers promote sustainable and inclusive structural transformation. Achieving these aims is a difficult but crucial task, and the researchers highlight several conditions that could enable PDBs to play a vital role.

Primarily, governments should ensure that existing PDBs have sufficient scale to perform their functions. Given the COVID-19 crisis, regional and subregional multilateral development banks in particular urgently need significant new capitalization. National development banks also need additional capital. Countries without a PDB, meanwhile, should seriously consider establishing one.

Next, most PDBs need to improve the analytical tools they use to monitor and evaluate the impacts of their financing. These banks’ safeguards, including on investments’ environmental impact, are valuable. But they must do more to incorporate the imperative of the transition to equitable, low-carbon, and resilient economies into all financing decisions and project stages.

As the saying goes, “What gets measured gets managed.”

Third, PDBs should aim to shape the future, and move from being mere “project-takers” to “project-makers.” Once they have defined goals – climate action, for example – they must play a proactive, first-mover role to help overcome uncertainties and risks, and define missions, programs, and projects.

As a fourth priority, PDBs should do more to combine their resources with those of the private sector and help to mobilise commercial financing for projects that the market alone often will not fund. These include mitigating climate change, promoting innovation, building infrastructure, financing small businesses, and providing affordable housing. Such an approach can bring all actors together to maximise impact in the context of sustainable development objectives.

Fifth, financial regulators should consider tailoring their prudential rules to account for specific features of PDBs’ contributions to development and to encourage investments that mitigate climate change because this will also improve future financial stability.

Sixth, PDBs should build a united, global coalition committed to the transition to equitable and sustainable development and the fulfilment of the Paris climate agreement. It is essential to go beyond isolated initiatives and tackle problems on a global scale. Improved cooperation among multilateral and national development banks is crucial, and will also secure better access to the international system of grants and global funds.

Finally, maximizing PDBs’ effects on development requires them to focus on the real economy and invest in innovative, high-impact projects. Although PDBs mainly extend loans, guarantees may play a useful role in managing financial risk in times of high uncertainty such as now. And for innovative, high-risk technology projects with potentially high development and profit potential, PDBs should consider using more equity instruments in order to capture upside gains.

Policies and counter-cyclical financing to support recovery should be more explicitly aligned with the UN Sustainable Development Goals, with priority given to supporting equitable development and climate-change mitigation and adaptation. Governments should enhance PDBs’ roles in supporting countries and regions that lag behind, by promoting innovation and structural transformation, funding social development, and increasing financial inclusion, adequate infrastructure, and the provision of global public goods.

With combined assets of more than 11 trillion dollars, PDBs already play a significant role in the global economy. They should now increase their individual and joint activities further, in order to finance infrastructure investment and support the provision of global public goods, especially climate mitigation and adaptation. A fair and green global recovery urgently needs all the help we can muster.

PUBLISHED ON

Nov 14,2020 [ VOL

21 , NO

1072]

Fortune News | Apr 12,2020

Commentaries | Apr 15,2023

Commentaries | Jul 23,2022

Commentaries | Aug 14,2021

Agenda | Apr 13,2024

Fortune News | Jul 30,2022

Viewpoints | Dec 17,2022

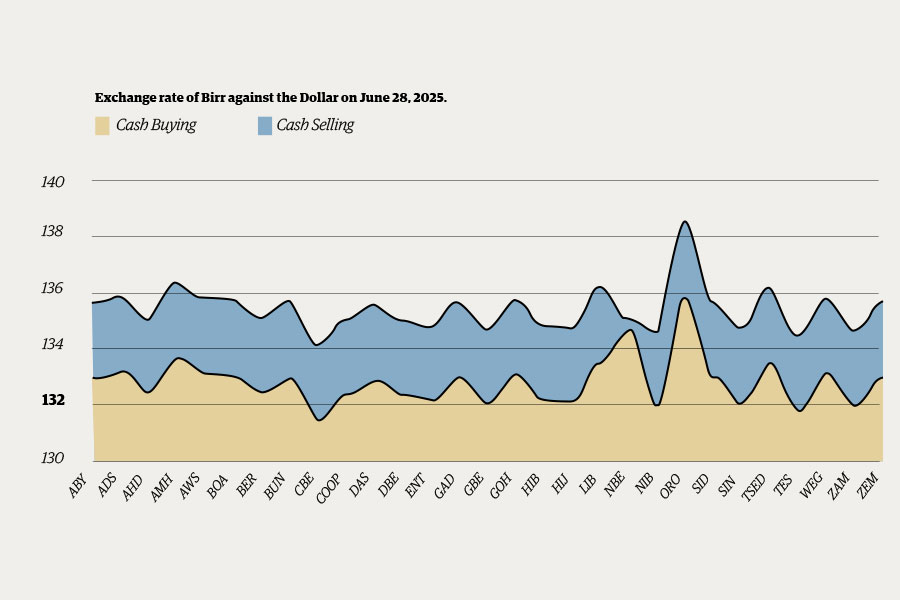

Money Market Watch | Jun 29,2025

Fortune News | Aug 13,2022

Sunday with Eden | Jan 31,2021

My Opinion | 131584 Views | Aug 14,2021

My Opinion | 127940 Views | Aug 21,2021

My Opinion | 125915 Views | Sep 10,2021

My Opinion | 123539 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...