Aug 14 , 2021

By Abdulmenan M. Hamza

In the face of such mounting inflation, the deafening silence of the National bank of Ethiopia (NBE) is puzzling. It should bring to bear direct monetary controls and market-based instruments before the public loses faith in the Birr as a store of value, writes Abdulmenan Mohemmed (abham2010@yahoo.co.uk), a financial analyst with over two decades of experience.

Inflation has been one of the severe economic woes over the past decade and a half. As never before, it has increased in magnitude in the past three years, reaching 26.5pc in July 2021 and making Ethiopia home to one of the top 10 inflationary economies in the world. What is more worrying is the passivity of the National Bank of Ethiopia (NBE) in the face of such persistent high inflation, which has taken a heavy toll on the majority of the population. No easing of this economic malady is in sight; what could happen is consequential.

It may result in distrusting the Birr as a store of value and a means of payment, and the outcome is currency crisis, which could lead to economic and political turmoil.

The recent inflation is mainly aggravated by the fast depreciation of the Birr to correct overvaluation. When this measure interacts with a shortage of foreign currencies in an economic environment which is hit by a decade of severe inflation caused by unbridled borrowing from the central bank, supply-side problems, political instability and the war in Tigray Regional State, the consequence is alarming inflation and price instability. To make things worse, this situation is feeding inflation expectation which encourages flight from money to other assets and foreign currencies, fuelling further inflation.

The overvaluation of the Birr was caused by higher domestic inflation compared to trading countries, ignited mainly by unrestrained money printing for more than a decade to fund the expanding government outlays. Repeated devaluations and the recent fast depreciation have been made to correct the overvaluation, but the government lost the plot.

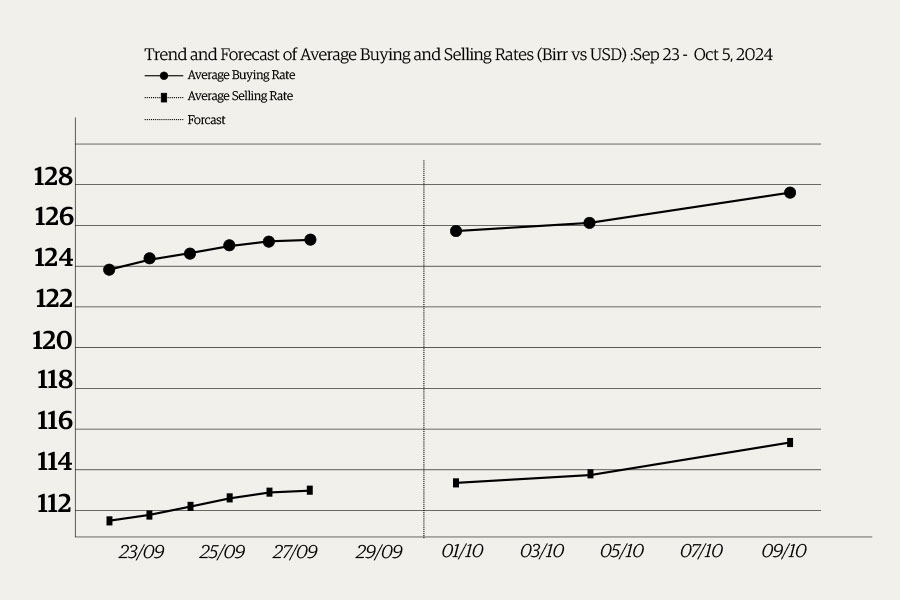

The logic of depreciation and inflation plays out in this way. The more the Birr is depreciated to eliminate overvaluation, the more inflation ravages the economy as the country is import-dependent while export is sticky as it is fraught with supply-side issues. In an environment of severe forex shortages, once this negative feedback loop sets in motion, the depreciation of the Birr worsens the inflation and consequently widens the gap between the official and parallel market exchange rates, providing the impetus for more depreciation. We are in such a precarious situation where small hiccups could cause turmoil as the recent surge in exchange rates in parallel markets has shown.

The cost of inflation is enormous. Apart from making living costs unbearable, volatile inflation makes long-term planning, which is an integral part of investment, difficult. The result is a lower level of productive investment. High inflation brings all interest rates down to negative and causes a considerable distortion in the financial sector. It reduces real savings, incentivises more borrowing, transfers wealth from savers to borrowers, and encourages speculative investments such as real estate.

Moreover, the inflation-induced depreciation of the Birr bloats foreign currency-denominated loans of the government, state-owned enterprises, and other companies, leading to significant financial distress.

In the face of such mounting inflation, the deafening silence of the central bank is puzzling. As its primary responsibility is to maintain price stability, it should fight inflation tooth and nail. The fight should employ every tool on its hands with tenacity, coordination, and foresight. The fight should start from understanding the root cause of current inflation as it helps us select the best instrument to fix it. Dismissing the problem as a supply-side issue or malpractices of some saboteurs is underestimating its magnitude and an excuse to do nothing in the sphere of monetary policy.

The main culprit for the uncontrollable inflation is the fast depreciation of the Birr. Such a policy, which was implemented during the late 1980s as part of the Structural Adjustment Programme (SAP), wrought havoc in several Sub-Saharan African countries. It did to Egypt recently as well. The damage it is causing in Ethiopia is glaringly visible while the promised benefits in improving export have remained somewhat of a pie in the sky. Hence, the central bank should seriously consider halting the depreciation of the currency.

Furthermore, it is essential to pursue a tight monetary policy proactively. We can cite several deflationary and inflationary episodes during which the central bank showed some proactiveness to dampen their impacts. In 2001, when the economy was hit by deflation, the NBE pursued a loose monetary policy by slashing the minimum saving interest rate to three percent from six percent to lower lending rates and encourage more borrowing.

The banks did not take time to react. They reduced the minimum lending rate to 7.5pc from 10.5pc, pushing the average growth of loans and advances at private banks by close to 30pc in the four years leading to 2005. Three years later, in a fight against surging inflation to more than 60pc, the central bank took a combination of measures, including raising the minimum savings rates to four percent and increasing liquidity requirement from 15pc to a quarter of their assets in early April 2008. The lending caps in 2009, and the minimum saving rates increase in 2011 and 2017 are also notable examples.

Within the current monetary policy framework (despite its problems), the NBE may use a number of the tools in its armoury to tighten monetary expansion. Direct controls could be putting a ceiling on bank lending, the use of reserve and liquidity requirements and interest rate control. Market-based instruments such as open market operation through purchase and sale of government securities, intervention in the foreign exchanges market, and moral suasion are available as well.

In the current situation, completely stopping the NBE’s lending to the government and financing budget deficits by the sale of treasury bills are a good place to start. Increasing reserve and liquidity requirements to slow down the expansion of credit and progressively increasing saving interest rates to prevent the flight from cash can also be applied in a coordinated and orderly manner. Equally important is the use of effective communication. Providing timely, consistent, and accurate information is essential for the success of the monetary policy.

PUBLISHED ON

Aug 14,2021 [ VOL

22 , NO

1111]

Commentaries | Aug 05,2023

Commentaries | Jul 27,2024

Commentaries | Oct 01,2022

Viewpoints | Apr 09,2022

Money Market Watch | Sep 28,2024

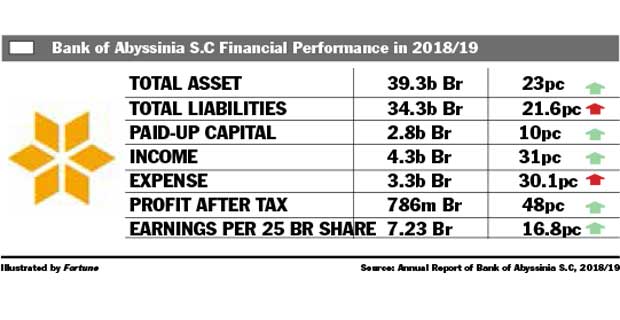

Fortune News | Dec 07,2019

Fortune News | Jun 07,2020

Agenda | Sep 04,2021

Fortune News | Aug 12,2021

Fortune News | Mar 16,2024

My Opinion | 131673 Views | Aug 14,2021

My Opinion | 128039 Views | Aug 21,2021

My Opinion | 126001 Views | Sep 10,2021

My Opinion | 123622 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...