Radar | May 02,2020

Nov 9 , 2024

By Kidist Yidnekachew

Digital services have become integral to our daily lives, offering unparalleled convenience and efficiency. From mobile banking to online shopping, these platforms have revolutionised the way we manage our finances, access services, and interact with businesses. Mobile financial services like Telebirr have emerged as key players in this digital transformation, providing people with easy access to financial tools that were once out of reach.

For many, services like Telebirr are not just convenient, but essential — whether it is for quick payments, loans, or everyday transactions. However, as with any service, there are areas where improvements could enhance the user experience.

Telebirr has become a fixture in my daily life, offering both convenience and a financial cushion when funds run low. Like many others, I have leaned on its loans to bridge gaps until payday, to the point where managing an entire month without borrowing has become a small victory. However, the facilitation fees — particularly for the two-month option — feel disproportionately high. With interest already applied to the loan, these additional charges seem burdensome, especially for users who rely on them regularly.

The "Spin to Win" feature is another mixed experience. I remember the excitement of the Ethiopian New Year campaign, where the goal was to collect all the letters in "ENKUTATASH 2017." It became a collective pursuit, with friends and acquaintances exchanging strategies to find that elusive "17." Each spin brought a surge of hope, only to be followed by disappointment when the "17" failed to appear. I spent small amounts — even one birr at a time — hoping for that lucky break, but it never came.

Then came the "130 Game" to celebrate Ethio telecom’s anniversary. I eagerly participated, gathering gold points and silver coins, even subscribing to a premium package at three Birr a day. I kept spinning, accumulating points but never winning prizes, not even a modest internet package. In the end, the points felt like empty gestures, and the initial thrill faded.

What started as a fun feature began to feel like a perpetual cycle of spins and purchases. The relentless notifications with every transaction add to this impression, urging me to play each time I send or receive funds. While I understand the intent to promote these features, the constant reminders feel invasive when all I want is a quick transaction.

Beyond games and promotions, the transaction fees themselves present another frustration, particularly with bank transfers. Moving my own money from Telebirr to a bank account incurs fees that seem excessive, especially with VAT added on top. Paying over one birr for transferring a few hundred birr quickly adds up, impacting everyday users like me.

Telebirr has created a platform that is integrated into the daily lives of over 47.5 million subscribers which represents 45.7pc of all mobile money users in Ethiopia. It is an achievement that reflects the rapid adoption of digital financial services in the country. But, as more users turn to these platforms, the expectation for transparency, affordability, and user-centred design also grows. Ultimately, a truly successful service supports users.

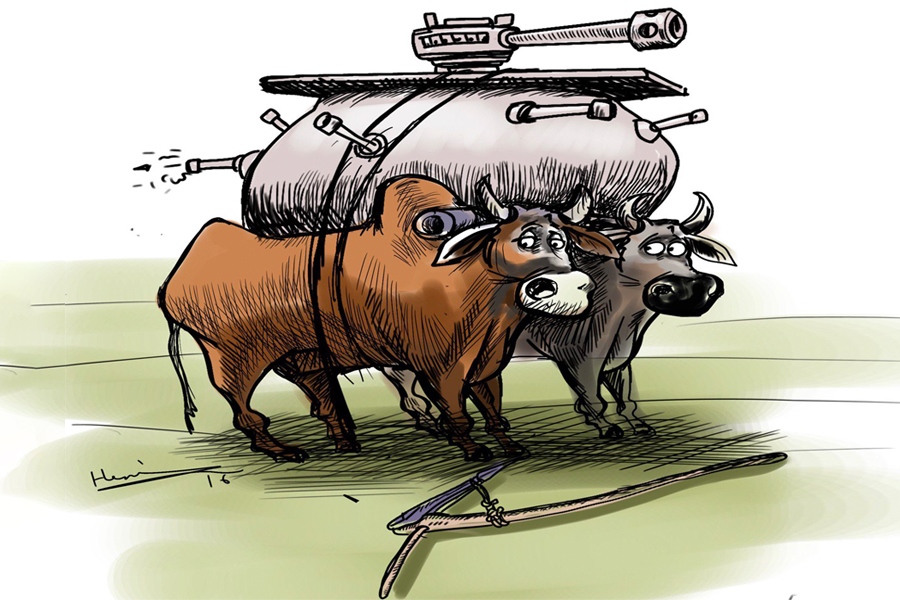

The bigger picture, however, goes beyond just the features and fees of digital platforms. It speaks to a larger challenge facing digital financial services in Ethiopia: balancing accessibility and affordability with sustainable revenue models. As digital wallets and mobile payment solutions continue to reshape how people handle money, they must also consider the financial strain placed on users who rely on them. Features may drive engagement, but they also reveal the underlying tension between providing entertainment and adding value.

PUBLISHED ON

Nov 09,2024 [ VOL

25 , NO

1280]

Radar | May 02,2020

Fortune News | Feb 27,2020

Radar | May 24,2025

Radar | Oct 23,2023

Commentaries | Sep 19,2020

Editorial | Jun 22,2024

Fortune News | Aug 23,2025

Radar | Oct 15,2022

Agenda | Aug 23,2025

Fortune News | Apr 27,2025

Photo Gallery | 180535 Views | May 06,2019

Photo Gallery | 170728 Views | Apr 26,2019

Photo Gallery | 161806 Views | Oct 06,2021

My Opinion | 137291 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Nov 2 , 2025

The National Bank of Ethiopia (NBE) has scrapped the credit-growth ceiling that had s...

Nov 2 , 2025 . By SURAFEL MULUGETA

The burgeoning data mining industry is struggling with mounting concerns following th...

Nov 2 , 2025 . By YITBAREK GETACHEW

Berhan Bank has chosen a different route in its pursuit of a new headquarters, opting for a transitional building instea...

Nov 2 , 2025 . By BEZAWIT HULUAGER

Nib International Bank S.C. has found itself at the epicentre of a severe governance...