Fortune News | Apr 06,2024

Feb 1 , 2019

By Asseged G. Medhin

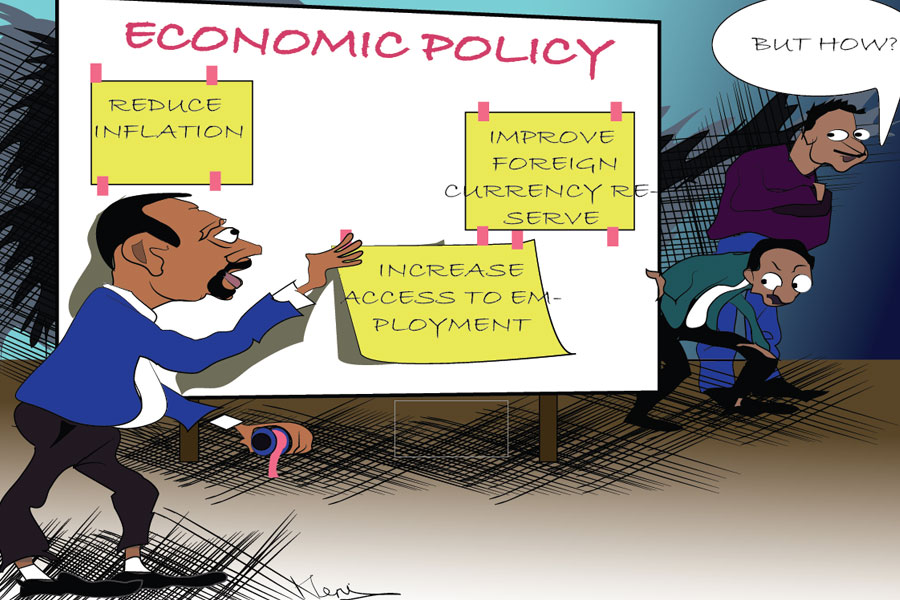

Ethiopia’s economy is at a crossroads. The same old advice will not save it, but a pragmatic economic prescription should not be overshadowed by ideology and politics, Asseged G. Medhin (kolass799728@yahoo.com), deputy CEO of operations at the National Insurance Company of Ethiopia (NICE).

The image Ethiopia has been radiating for the past few years was bound to create certain assumptions that rational investors could not have found acceptable. Regulatory capacity and access to capital, inputs and infrastructure were never up to scruff to have ensured long-term profitability to begin with.

These were efforts carried out by a government that wanted to have the best of two worlds. There was some pragmatism in the assertion that some industries needed protection, but closed door policies across the board meant that know-how and competition would be lacking.

Considering the macroeconomic predicaments the nation is in, from inflation to declining export revenues, it is time political leaders take stock of the reality on the ground and rethink long-held economic policies.

The incumbents' fear of the unknown is understandable, but what is holding back the country mostly is their insistence on attaining short-term goals. As with most decisions that will have short- and medium-term impacts, policies that are geared toward achieving competitiveness in the long term are placed at a distance. Opening the capital account, liberalising the service sector and reducing public investment have consequences that few who hold power are willing to pay for politically.

Indeed, competition between players with vastly different experiences, capital and networks might have a lethal effect on local businesses in the outset. But it should also not be forgotten that such gradual and selective liberalisation opens the door toward new specialisations. There has been a dynamic response to globalisation in that entrepreneurs will be able to be a part of emerging industries, becoming a necessary investment for the future.

We have done an excellent job of holding onto, not just our cultures and traditions, but treasures we hold closely to our heart. But it has come at the expense of the dynamism current enterprises would have attained or the emergence of new businesses, markets or industries.

The double-digit gross domestic product (GDP) growth rate of the country has helped to sustain optimism at the economic direction the nation has taken. But there is debate lacking on the part of opposition parties, international institutions and the Ethiopian intelligentsia on how such growth can be justified in the face of rising inflation, falling export revenues and stagnant domestic revenue.

It is crucial that the nation recognise that few things will be achievable if different courses are not taken whenever the current one is evidently losing its balance. It would be even harder to protect the nation’s treasure if progress in the ventures of the 21st century are not made.

The argument for a localised approach to economic growth only works as long as the domestic market can offer the same opportunities the global one can, a falsity more true in Ethiopia than almost every other country in the world.

It is fortunate that, although not conclusively, we are seeing movement from the government in this regard. There is no clear roadmap for the way forward, but there are more forward-looking views than has been the case before on privatisation and liberalisation. Prime Minister Abiy Ahmed’s (PhD) administration has a more positive view of the private sector than any in the past four decades.

Capital markets, mergers and acquisitions, deregulation and accession into the World Trade Organisation are more inevitable today than ever. These could be outcomes of a macroeconomic crisis that is making it hard for the government to do anything else except acquiesce to the demands of creditors. But initiatives being taken to improve the business environment and to slightly smooth out foreign currency administration should give some room to assume that there are improvements in outlook.

If the administration keeps up the momentum while also improving the regulatory capacity of government, it can make a success of the economic reform. The nation will benefit by making use of the advantages that will come from the outside and the potential at home.

There are more international negotiators, advisors, financial engineers and economic analysts with a competitive advantage here in Ethiopia than the country gets credit for. Most importantly, our human power can compete on the world stage if only it gains the know-how attained through experience and competition. Liberalisation will also bring necessary funds into the economy, which is indispensable to new ventures and expansion.

PUBLISHED ON

Feb 01,2019 [ VOL

19 , NO

979]

Fortune News | Apr 06,2024

Viewpoints | May 23,2021

Viewpoints | Apr 06,2024

Viewpoints | Oct 24,2020

Radar | Apr 30,2022

Viewpoints | Jan 25,2020

Fortune News | Sep 01,2024

Editorial | Jan 26,2019

Viewpoints | Dec 04,2020

My Opinion | Aug 29,2020

My Opinion | 132112 Views | Aug 14,2021

My Opinion | 128515 Views | Aug 21,2021

My Opinion | 126442 Views | Sep 10,2021

My Opinion | 124053 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jul 13 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Revenue Bureau has introduced a new directive set to reshape how...

Jul 13 , 2025 . By BEZAWIT HULUAGER

Addis Abeba has approved a record 350 billion Br budget for the 2025/26 fiscal year,...

Jul 13 , 2025 . By RUTH BERHANU

The Addis Abeba Revenue Bureau has scrapped a value-added tax (VAT) on unprocessed ve...

Jul 13 , 2025 . By NAHOM AYELE

Federal lawmakers have finally brought closure to a protracted and contentious tax de...