Life Matters | Oct 19,2019

Jan 26 , 2019.

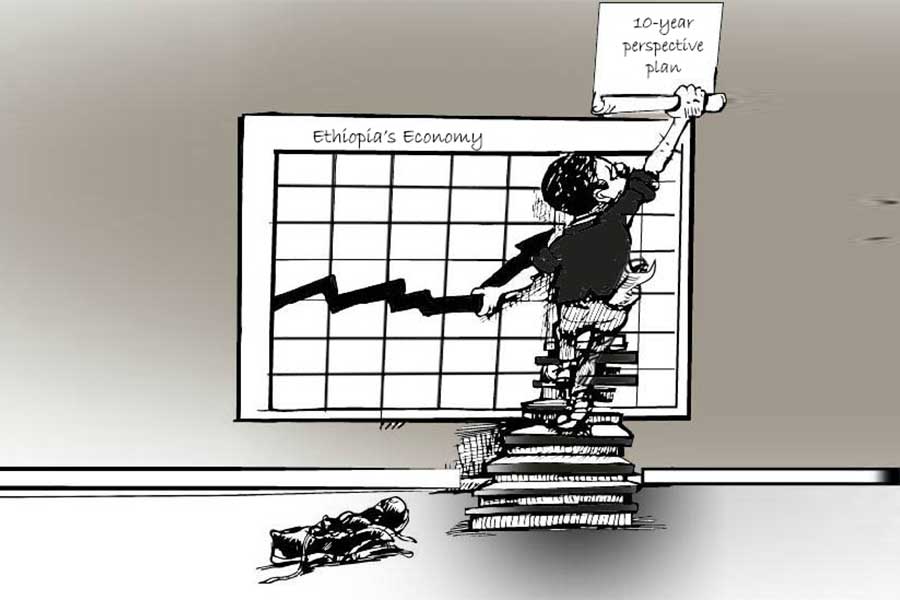

Ethiopia’s growth narrative, validated recently by that bastion of liberalism, the International Monetary Fund, is a story of contradictions.

Just wondering about these: why would an economy expanding by double digits for over 10 years suffer from stagnant exports; mounting external debt; a recurrent forex crunch; declining revenues; galloping inflation; ballooning unemployment; and a worrying slowdown in business transactions? What does the growth in GDP have to show for itself if the structure of the economy remains unchanged?

If searching for answers for these fundamental questions does not lead the administration of Prime Minister Abiy Ahmed to focus on charting out a macroeconomic policy roadmap, it will not be long before the country confronts unpleasant realities of political implosion. As the Chinese have long suspected, mere rhetoric of democracy, equality and justice hardly contain a restless citizenry. Without delivering on the economic front for the majority, successes in security, stability and political inclusivity will only be temporary.

It is a lesson history has illuminated repeatedly, both in democratically mature countries that stumble economically and in emerging markets that are improving the material wellbeing of citizens, which helps to excuse authoritarian rule. Abiy’s administration faces such a dilemma.

It finds itself presented with the demands of a growing population that cannot be made content merely by political reforms. The administration’s focus on the political front, albeit a necessity, is a crucial prerequisite for a more equitable and just state, but without delivering on economic premises, it is bound to remain a thankless effort.

The challenges faced by the country are manifest in the performance of the exports front. The external sector also lays bare the structural flaws that have been inherent to the current economic policies of the nation.

Revenues from exports have been stagnant for the past seven years and have been unable to top three billion dollars for the past three years. And despite arguably unearned enthusiasm from Bretton Woods institutions on Ethiopia’s economy, this fiscal year does not appear to signal a relief either.

Coffee, a commodity that usually makes up for a third of export revenues, earned the country 334 million dollars in foreign currency in the first half of the current fiscal year, 29pc below the government’s target and 48 million dollars short of the revenues from the same period the previous year.

This in particular can be attributed to the continuing political crisis in the country, but the general direction the economy has been moving in cannot be explained on similar grounds. The characteristics have been that of an economy that, despite increasing foreign and public investments and double-digit GDP growth, has been unable to impact what matters most, competitiveness on the global stage.

The lack of this crucial ingredient has given way to an economy that cannot keep its balance once the government’s heavy hand begins to slacken off. It is also a challenge that cannot be addressed by tweaking some fiscal policies here and monetary policies there but requires the introduction of an economic roadmap with the chief objective of creating an ecosystem for a thriving private sector. It is an economy of companies that compete among each other and not nations.

The basis for a new economic policy needs to be based on an understanding and careful reading of the achievements and flaws of what is currently in place, the developmental state model. While it is the EPRDFites less than enthusiastic notion of private enterprise that gets the most attention, and thus the acutest criticism, their insistence for state-led development was not without its merits. The problem arose only after political institutions failed to become inclusive as the economy grew and the state was unable to recognize its excesses.

The developmental state model had to increase the provision of critical services and infrastructure spending to stimulate the economy at its heart, a strategy that had had many successes. There has been a leap in the growth of the construction and service sectors, poverty reduction, access to education and healthcare and financial inclusion that cannot be dismissed out of hand. It was a pragmatic policy for a nation with an economy that needed to be jump started and a population that required infrastructure, capital, and know-how to meet its full potential.

Above all it was meant to jump start a structural transformation of the economy from a subsistant agricultural based to urban and industrial society. It was thought the massive public investments made in the expansion of infrastrcurure and the manufacturing sector would bear fruit fast enough to generate sufficient capital to finance the next stage of transformation.

Unfortunately, policymakers forgot to foresee the length of the transition before the private sector could take over the mantle. There was a scarcity of strategies to ready businesses for the responsibility they should assume, setting up an enabling legal, policy and institutional environment. This was incentivized by an ideological aversion that sidelined private capital as a potential ally for growth, if not due to an insatiable appetite to strengthen the hands of the state.

The initial objective of stimulating growth, primarily through infrastructure financing, which required access to capital, was only justifiable as long as it was carried out in moderation, and without crwoding out the private sector. Not surprisingly, what followed was the usual bottlenecks that await such policies down the road. Ethiopia did not have the competent and professional bureaucracy as almost a class unto itself that Singapore does. Suffice the feebleness evident in the central bank - in the case of monetary policies - and the finance ministry - in the case of fiscal policies.

Neither does Ethiopia have the necessary checks and balances that keep political favouratism and partisan interests from becoming indistinguishable from the responsibilities of the state to society. The outcome was not only a waste to public resources through corruption and inefficiency but a policy that gave way to the misguided allocations of labour and capital in the economy. The incapacitation of a fair and equitable allocation of resources into sectors and businesses that are productive meant the inefficient distribution of wealth. This led to inequlity in society, hence resentment now felt by many.

Addressing this problem should be the primary objective of Abiy’s administration. There is a need for an economic policy formulation that tasks itself with the business of creating wealth and ensuring its redistributive mechanism in a just manner. It should be an effort to reorient the state towards what should be its core competence: creating the legal, institutional and policy environment within which businesses operate; the provisions of basic services; and the protection of the most disadvantaged in society.

The state’s resources should be geared toward protecting private property, enforcing contracts, mediating fairly and improving the professionalism of its bureaucracy. Political reform cannot be divorced from righting the economic policies either. The private sector can do the rest. If the ecosystem under which labor, capital and information can managed fairly well, competence would be left as the only judge of the destination of resources, opening the path towards productivity and global competitiveness.

However, without the inclusiveness of political institutions alongside that of the economic ones, thinking of economic policy reforms only through the prism of improving employment, reducing inflation and bolstering the foreign currency reserve will be short-termist at best.

PUBLISHED ON

Jan 26,2019 [ VOL

19 , NO

978]

Life Matters | Oct 19,2019

My Opinion | Aug 29,2020

Viewpoints | Dec 23,2023

Commentaries | Mar 26,2022

Viewpoints | Aug 18,2024

Sunday with Eden | May 23,2021

Fortune News | Apr 19,2025

Fortune News | Sep 22,2024

Editorial | Dec 26,2020

Radar | Jun 15,2024

My Opinion | 131970 Views | Aug 14,2021

My Opinion | 128359 Views | Aug 21,2021

My Opinion | 126297 Views | Sep 10,2021

My Opinion | 123913 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 6 , 2025 . By BEZAWIT HULUAGER

The federal legislature gave Prime Minister Abiy Ahmed (PhD) what he wanted: a 1.9 tr...

Jul 6 , 2025 . By YITBAREK GETACHEW

In a city rising skyward at breakneck speed, a reckoning has arrived. Authorities in...

Jul 6 , 2025 . By NAHOM AYELE

A landmark directive from the Ministry of Finance signals a paradigm shift in the cou...

Jul 6 , 2025 . By NAHOM AYELE

Awash Bank has announced plans to establish a dedicated investment banking subsidiary...