Editorial | May 20,2023

Oct 30 , 2022

By

Ethiopia could open the door for foreign bank involvement in the financial sector and reap all the good benefits while enacting laws and implementing them more stringently to curb or minimize the potential downfalls of accepting them, writes Senay Lemma, Regional Human Capital Manager for Eastern Africa in an International Business Company can be reached at (senaylemma2@gmail.com).

Ethiopia's Council of Ministers has passed a bill allowing foreign investment in the financial sector. It is the first step towards reforming the sector and bringing the efficiency of domestic banks to speed. However, foreign banks could also undermine the banks in business; the sector may face crises.

Ethiopia has a long history of modernising banks beginning in the 1930s. The reign of Emperor Menelik was notable in marking the country's initial attempt to introduce banking. The short-lived presence of foreign bank ownership focused more on developing the financial sector than growing the economy. Despite criticisms due to low contribution to national development, the foreign banks continued until the mid-1970s.

Nationalisation following the 1974 revolution, a few domestic banks operated with a stringent regulatory mechanism constraining development.

Two decades after the regime change, the government introduced reforms to speed up national development. As the financial sector was one of the primary focuses, the government had attempted to bring structural improvements since the mid-1990s when private financial institutions were re-established. Once again, the market saw the explosion of private banks from a handful to many with several branches.

The Prime Minister recently said that liberalising the financial sector and realising economic growth and development would be the top of his administration's priorities. It is a move that could take local and foreign interest groups by surprise.

Notwithstanding the government's efforts, the financial sector remains closed and underdeveloped. International financial and trade institutions have recommended their liberalisation further, pushing for the entry of foreign banks into the industry. But many resisted the push arguing that the industry is too young and fragile to compete with advanced overseas banks. There have been understandable concerns about the negative impacts of liberalisation on the nation's economic and social development. This has been done without considering factors contributing to the adverse effects of the reform.

A sustainable and thriving financial system is vital for economic growth and the betterment of citizens. It makes the relationship between the financial sector's performance, such as banks, and a country's development crucial. The correlation inspires policymakers to take thoughtful steps towards strengthening the sector. For years, governments have been attempting to leverage efforts to bring various structural transformations that include reforming domestic structures and extending financial services. These are interwoven processes aimed at developing an efficient and competitive financial system that spurs economic growth.

The closed banking system is depicted by the absence of foreign participation, evidence of a non-competitive market structure, and strong capital controls. State-owned banks are inefficient relative to private banks. Successive governments' political orientation has long constrained foreign banks' entry. The financial sector remains one of the most closed and weak in sub-Saharan Africa because the state dominates the sector.

While the government's concerns about financial liberalisation are understandable, a compelling case can be made for pursuing liberalisation. Financial sector liberalisation may positively affect the efficiency of the banking sector in the host market. Domestic banks can be compelled to compete with foreign banks to improve their lot.

The government's concern fails to recognise the potential benefits of liberalising the financial sector. It has never made a comparative analysis to balance what the impacts would be if it were implemented under the appropriate macroeconomic and regulatory environment as well as institutional setup. Compared to Kenya, Uganda and South Africa, the Ethiopian financial sector's performance is on the footing. It is overwhelmed by the quasi-monopolistic state-owned Commercial Bank of Ethiopia.

Millions of Ethiopians remained underserved as financial institutions such as commercial banks, insurance firms, and microfinance institutions are highly concentrated in the urban and semi-urban areas where less than 10pc of the population resides. The only bond market is the treasury bill issued by the government. Capital markets are nonexistent, and the central bank determines the foreign exchange rates.

The country has been wasting opportunities, limiting entry by foreign financial institutions. They could have brought not only loans and credit facilities; technology, a skilled workforce, capital, and an inflow of foreign currency have been lost. The influx of banks is directly proportional to the benefits that could have been brought early.

An initial condition towards foreign banks' entry could be implemented to avoid the risks.

The risk to financial sector liberalisation for developing countries like Ethiopia can be traced to growing fragility and deterioration in economic performance. As countries in South East Asia had experienced during the financial crisis in the late 1990s, financial liberalisation can amass into a full-blown social turmoil.

Financial sector liberalisation tends to create wider inequalities in society. This is closely linked to the financial sector's basic logic; economic activities within the financial sector mainly base themselves on money and follow business logic. Liberalisation tends to promote the intensity of money circulation towards places where it can easily be accumulated. It downgrades the capacity of states to defend national integrity and sovereignty.

However, the Ethiopian authorities could be pragmatic in their policy choices. They can open the doors for foreign banks to take advantage of the benefits while fostering regulatory capabilities. Regulated foreign banks have much to offer.

The regulatory authorities should exalt the quality and increase the size of their staff to enforce regulations aligned with the macroeconomic goals.

PUBLISHED ON

Oct 30,2022 [ VOL

23 , NO

1174]

Fortune News | Jul 12,2021

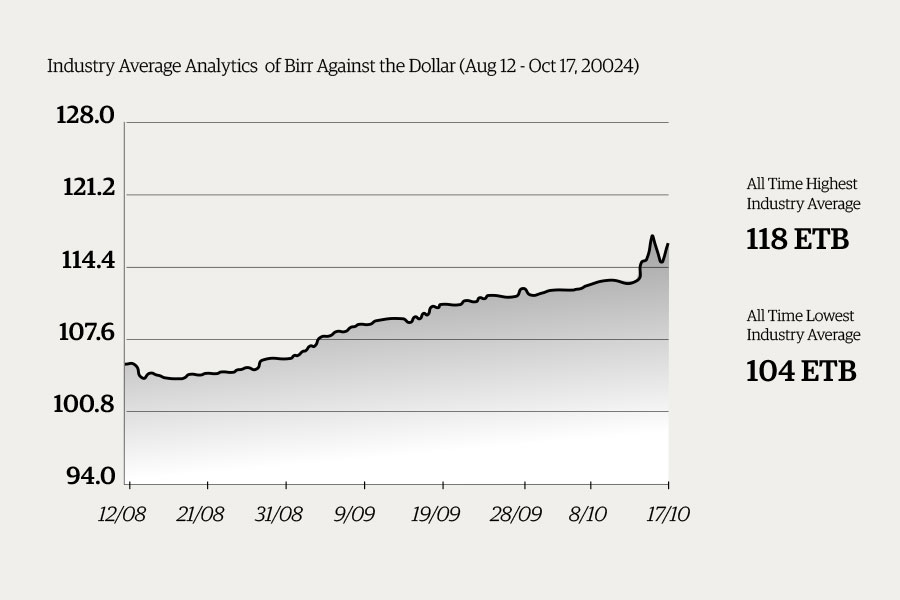

Money Market Watch | Oct 20,2024

Fortune News | Oct 13,2024

News Analysis | Sep 26,2021

Commentaries | Dec 07,2019

My Opinion | 132038 Views | Aug 14,2021

My Opinion | 128435 Views | Aug 21,2021

My Opinion | 126362 Views | Sep 10,2021

My Opinion | 123981 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jul 13 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Revenue Bureau has introduced a new directive set to reshape how...

Jul 13 , 2025 . By BEZAWIT HULUAGER

Addis Abeba has approved a record 350 billion Br budget for the 2025/26 fiscal year,...

Jul 13 , 2025 . By RUTH BERHANU

The Addis Abeba Revenue Bureau has scrapped a value-added tax (VAT) on unprocessed ve...

Jul 13 , 2025 . By NAHOM AYELE

Federal lawmakers have finally brought closure to a protracted and contentious tax de...