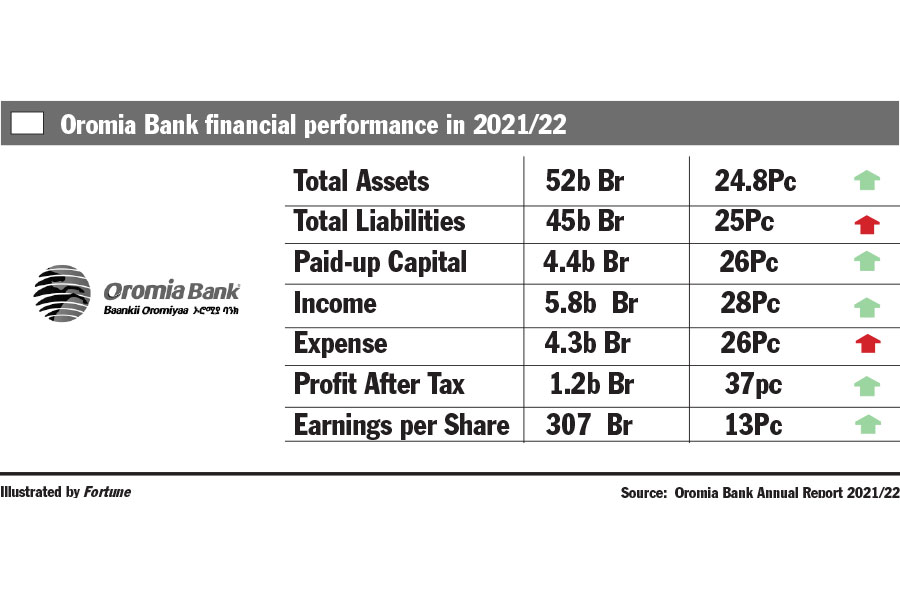

Oromia Bank has emerged as a noteworthy player in a highly competitive industry, carving out a steady growth path, as evidenced by its recent financial results.

Its profit surged by 600 million Br to 1.58 billion Br, a 31.7pc growth, a trend its leaders credited to operational efficiency and strategic planning. Although the earnings per share (EPS) were much lower than posted in 2018 (525 Br), they have grown by 5.5pc from last year to 324 Br. However, the Bank's robust performance is overshadowed by its peers, such as the Cooperative Bank of Oromia (Coop) and Hibret Bank, which have netted significantly higher profits.

Assefa Seme (PhD), the board chairman, attributed this growth to implementing a three-year strategic plan to transform the Bank's operations.

"The strategic focus is not just on growth," said Assefa. "It's also on managing the Bank's expense profile, a critical factor in sustaining long-term profitability."

Teferi Mekonnen, president of Oromia Bank, echoes this sentiment, emphasising the importance of cautious expansion and prudent staff hiring.

Oromia Bank's income growth was noteworthy, particularly in its primary revenue streams. The Bank saw a 44.3pc increase in income from interest on loans, advances, and investments in treasury bills and bonds. Income from interest-free financing, fees, and commission also showed significant increases, rising by 44.3pc and 52pc, respectively.

However, this revenue growth has been accompanied by a corresponding expense increase.

The total expenses of Oromia Bank rose to 6.3 billion Br, with interest expenses and distributions to interest-free depositors climbing by 46.3pc. These numbers, while substantial, are still less than half of what the Cooperative Bank of Oromia has reported. Oromia Bank's wage and benefits expenses, reflecting an industry-wide trend, increased by 51.3pc, and general administration expenses grew by 53.9pc.

The spike in expenses has drawn the attention of industry experts like Abdulmenan Mohammed (PhD), who caution vigilance in managing expense growth to sustain profitability.

The management has noticed it. Reducing expenses has been amongst Oromia Bank's strategies, particularly on administrative expenses and time deposits, according to Teferi.

"We’ll be mindful over opening new branches and hiring staff," said Teferi.

Oromia Bank has shown prudence in its expansion efforts. In the fiscal year 2022/23, the Bank inaugurated 103 new branches, taking its total count to 503. However, the expansion has been tempered with heedfulness as Teferi disclosed the Bank's restrained approach towards opening new branches and hiring new staff.

Dechassa Fanta, a branch manager in the Mexico area, recalled the "unfair competition" the Bank faced, particularly in the construction sector's downturn and the consequent liquidity crunch. Despite these hurdles, he expressed confidence in the Bank's ability to manage liquidity effectively, citing its robust Real-Time Gross Settlements (RTGS) capabilities.

Experts commend Oromia Bank's approach to risk management, particularly in loan provisioning. The Bank's provision for impairment of loans and other assets stood at a reasonable 70.2 million Br, significantly lower than its peers. This can be attributed to the Bank's lower non-performing loan (NPL) ratio of 1.6pc, which is three-fold lower than the industry average.

Teferi's leadership has been instrumental in guiding Oromia Bank through these challenging times. With a banking career spanning 25 years, including a 13-year tenure at Oromia Bank, his experience and strategic vision have been crucial. Under his leadership, the Bank has achieved a historic high in foreign currency generation, with a 33pc surge to 371 million dollars.

Oromia Bank's journey in the Ethiopian banking sector began in 2008, with a paid-up capital of 91 million Br raised from 5,000 founding shareholders. Today, the Bank's paid-up capital has grown to 5.37 billion Br, a 22.9pc increase from the previous year. Although its capital adequacy ratio has declined to 17.2pc from 21.3pc, it remains robust, especially compared to its peers.

One of its 15,000 shareholders, Tilahun Girma, holding shares valued at 150,000 Br, emphasised the importance of financial inclusivity and the need to focus on the unbanked segment of the population.

“Financial inclusivity is important,” he told Fortune.

It is a perspective crucial in an environment marked by relentless inflationary pressures and the impending entry of foreign banks into the market.

Ranked seventh among 15 banks in total assets, Oromia Bank holds its own in a sector dominated by giants like Awash Bank (183.3 billion Br) and Abyssinia Bank (149.4 billion Br). While not leading the sector, the Bank's Return on Assets (RoA) of 2.3pc and the 17.7pc Return on Equity (RoE) are competitive. The industry's leaders in RoA - Zemen (4.3pc) and Addis International (3.9pc) - set a benchmark, with the industry average trailing slightly behind.

Oromia Bank operates in a sector where EPS ranges from 57pc to 15.6pc. However, the sector's top performers - Awash (25.8pc) and Abyssinia (24.7pc) - have much larger returns on equity compared to its 17.7pc. The average for the 15 private banks was 19.8pc.

Oromia Bank's total assets have expanded by 25.7pc to 65.41 billion Br. Its loans, advances, and interest-free financing have increased by 32.9pc to 41.56 billion Br. The Bank's deposit base also grew by 24.8pc to 54.27 billion Br. While these figures are impressive, they are still overshadowed by its peers like Cooperative Bank of Oromia (116 billion Br) and Hibret Bank's 64 billion Br. The loan-to-deposit ratio of Oromia Bank, which stands at 76.6pc, indicates potential for further lending.

Contests the President: “It [the ratio] is healthy and meets the regulatory standard.”

Oromia Bank has seen a relative decline in its liquidity level in relative terms, despite an absolute increase in cash and bank balances. Cash and bank balances increased by 12.1pc to 10.99 billion Br. It is a bit higher when compared to Hibret Bank (9.23 billion Br) and Wegagen Bank (9.06 billion Br). Cash and bank balances to total assets ratio decreased three percentage points, and cash and bank balances to total liabilities declined to 19.4pc from 21.7pc. Hibret Bank stands at 11.2pc while Wegagen Bank’s is far higher at 16.9pc.

However, its loan-to-deposits ratio increased by 4.6 percentage points to 76.6pc, signalling room for more lending, according to Abdulmenan. The Bank's investment in government securities, amounting to 5.25 billion Br, represents a significant portion of its total assets.

Oromia Bank's future strategy appears to be focused on enhancing its market position, especially in comparison to larger rivals. Improving operational efficiency is likely to be a key focus, given the varied cost-to-income ratios across the industry.

Though not at the forefront, Oromia Bank maintains a considerable market presence. Its competitive strategy could be geared towards enhancing its market position, especially in light of larger rivals like Awash and Abyssinia. Improving operational efficiency might be critical, given the varied cost-to-income ratios across the sector, a key factor experts see for sustaining growth.

"This strategic approach will be crucial for sustaining profitability in a competitive banking environment," said Abdulemenan.

Editors' Note: The article was updated from its original form on February 2, 2024.

PUBLISHED ON

[ VOL

, NO

]

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transportin...

Jul 13 , 2024 . By MUNIR SHEMSU

The cracks in Ethiopia's higher education system were laid bare during a synthesis re...

Jul 13 , 2024 . By AKSAH ITALO

Construction authorities have unveiled a price adjustment implementation manual for s...

Jul 13 , 2024

The banking industry is experiencing a transformative period under the oversight of N...

Jul 20 , 2024

In a volatile economic environment, sudden policy reversals leave businesses reeling...

Jul 13 , 2024

Policymakers are walking a tightrope, struggling to generate growth and create millio...

Jul 7 , 2024

The federal budget has crossed a symbolic threshold, approaching the one trillion Bir...

Jun 29 , 2024

In a spirited bid for autonomy, the National Bank of Ethiopia (NBE), under its younge...