Commentaries | Jun 25,2022

Jun 4 , 2022

By Joseph E. Stiglitz

It was clear at this year's gathering of business and political elites in Davos that the longstanding vision of a world without borders is no longer credible. Unfortunately, it was also clear that recognizing this basic truth is not the same as reckoning fully with past mistakes, writes Joseph E. Stiglitz, a Nobel laureate in economics and professor at Columbia University.

The World Economic Forum’s first meeting in more than two years was markedly different from the many previous Davos conferences that I have attended since 1995. It was not just that the bright snow and clear skies of January were replaced by bare ski slopes and a gloomy May drizzle. Rather, it was that a forum traditionally committed to championing globalisation was primarily concerned with its failures: broken supply chains, food- and energy-price inflation, and an intellectual-property (IP) regime that left billions without COVID-19 vaccines just so that a few drug companies could earn billions in extra profits.

Among the proposed responses to these problems are to “reshore” or “friend-shore” production and to enact “industrial policies to increase country capacities to produce.” Gone are the days when everyone seemed to be working for a world without borders; suddenly, everyone recognises that at least some national borders are key to economic development and security.

For one-time advocates of unfettered globalisation, this volte face has resulted in cognitive dissonance, because the new suite of policy proposals implies that longstanding rules of the international trading system will be bent or broken. Unable to reconcile friend-shoring with the principle of free and non-discriminatory trade, most of the business and political leaders at Davos resorted to platitudes. There was little soul searching about how and why things have gone so wrong, or about the flawed, hyper-optimistic reasoning that prevailed during globalisation’s heyday.

Of course, the problem is not just globalisation. Our entire market economy has shown a lack of resilience. We essentially built cars without spare tires – knocking a few dollars off the price today while paying little mind to future exigencies. Just-in-time inventory systems were marvellous innovations as long as the economy faced only minor perturbations; but they were a disaster in the face of COVID-19 shutdowns, creating supply-shortage cascades (such as when a dearth of microchips led to a dearth of new cars).

As I warned in my 2006 book, "Making Globalization Work," markets do a terrible job of “pricing” risk (for the same reason that they do not price carbon dioxide emissions). Consider Germany, which chose to make its economy dependent on gas deliveries from Russia, an obviously unreliable trading partner. Now, it is facing consequences that were both predictable and predicted.

As Adam Smith recognised in the eighteenth century, capitalism is not a self-sustaining system, because there is a natural tendency toward monopoly. However, since US President Ronald Reagan and British Prime Minister Margaret Thatcher ushered in an era of “deregulation,” increasing market concentration has become the norm, and not just in high-profile sectors like e-commerce and social media. The disastrous shortage of baby formula in the United States this spring was itself the result of monopolisation. After Abbott was forced to suspend production over safety concerns, Americans soon realised that just one company accounts for almost half of the US supply.

The political ramifications of globalisation’s failures were also on full display at Davos this year. When Russia invaded Ukraine, the Kremlin was immediately and almost universally condemned. But three months later, emerging markets and developing countries (EMDCs) have adopted more ambiguous positions. Many point to America’s hypocrisy in demanding accountability for Russia’s aggression, even though it invaded Iraq under false pretences in 2003.

EMDCs also emphasize the more recent history of vaccine nationalism by Europe and the US, which has been sustained through World Trade Organisation (WTO) IP provisions that were foisted on them 30 years ago. And it is EMDCs that are now bearing the brunt of higher food and energy prices. Combined with historical injustices, these recent developments have discredited Western advocacy of democracy and international rule of law.

To be sure, many countries that refuse to support America’s defence of democracy are not democratic anyway. But other countries are, and America’s standing to lead that fight has been undermined by its own failures – from systemic racism and the Trump administration’s flirtation with authoritarians to the Republican Party’s persistent attempts to suppress voting and divert attention from the January 6, 2021, insurrection at the US Capitol.

The best way forward for the US would be to show greater solidarity with EMDCs by helping them to manage the surging costs of food and energy. This could be done by reallocating rich countries’ special drawing rights (the International Monetary Fund’s reserve asset), and by supporting a strong COVID-19 IP waiver at the WTO.

Moreover, high food and energy prices are likely to cause debt crises in many poor countries, further compounding the tragic inequities of the pandemic. If the US and Europe want to show real global leadership, they will stop siding with the big banks and creditors that enticed countries to take on more debt than they could bear.

After four decades of championing globalisation, it is clear that the Davos crowd mismanaged things. It promised prosperity for developed and developing countries alike. But while corporate giants in the Global North grew rich, processes that could have made everyone better off instead made enemies everywhere. “Trickle-down economics,” the claim that enriching the wealthy would automatically benefit all, was a swindle – an idea that had neither theory nor evidence behind it.

This year’s Davos meeting was a missed opportunity. It could have been an occasion for serious reflection on the decisions and policies that brought the world to where it is today. Now that globalisation has peaked, we can only hope that we do better at managing its decline than we did at managing its rise.

PUBLISHED ON

Jun 04,2022 [ VOL

23 , NO

1153]

Commentaries | Jun 25,2022

Radar |

Fortune News | Dec 05,2018

Fortune News | Dec 11,2021

Commentaries | Feb 11,2023

Viewpoints | Jul 13,2019

Viewpoints | Dec 28,2019

Viewpoints | Oct 30,2021

Commentaries | Sep 04,2021

Viewpoints | Mar 21,2020

My Opinion | 108813 Views | Aug 14,2021

My Opinion | 105210 Views | Aug 21,2021

My Opinion | 104020 Views | Sep 10,2021

My Opinion | 103320 Views | Aug 07,2021

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transportin...

Jul 13 , 2024 . By MUNIR SHEMSU

The cracks in Ethiopia's higher education system were laid bare during a synthesis re...

Jul 13 , 2024 . By AKSAH ITALO

Construction authorities have unveiled a price adjustment implementation manual for s...

Jul 13 , 2024

The banking industry is experiencing a transformative period under the oversight of N...

Jul 20 , 2024

In a volatile economic environment, sudden policy reversals leave businesses reeling...

Jul 13 , 2024

Policymakers are walking a tightrope, struggling to generate growth and create millio...

Jul 7 , 2024

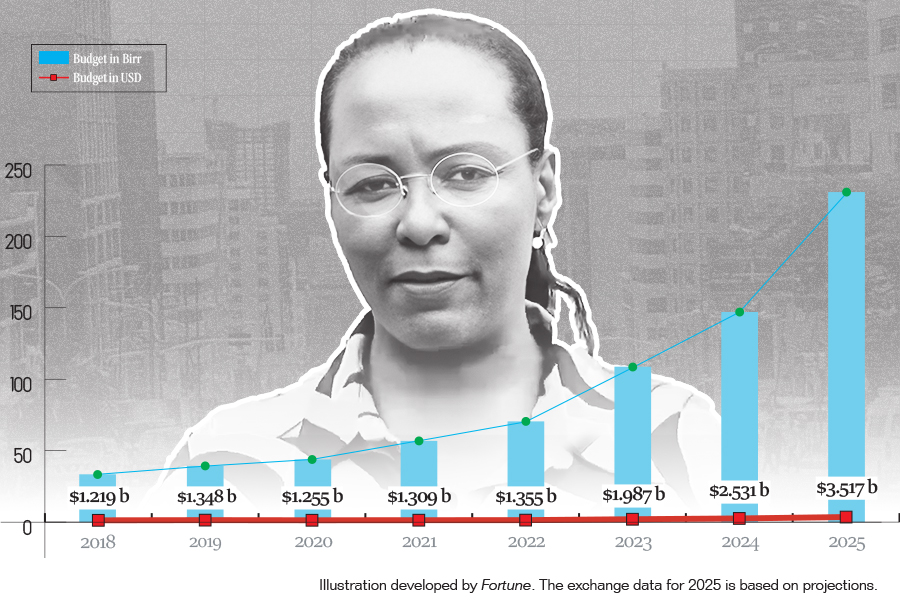

The federal budget has crossed a symbolic threshold, approaching the one trillion Bir...

Jun 29 , 2024

In a spirited bid for autonomy, the National Bank of Ethiopia (NBE), under its younge...

Jul 21 , 2024 . By TIZITA SHEWAFERAW

Mayor Adanech Abebie's Administration faced an audit report that unveiled a startling...

Jul 21 , 2024 . By AKSAH ITALO

Brook Taye (PhD), director general of the Ethiopian Capital Market Authority, has tak...

Jul 21 , 2024 . By AKSAH ITALO

Ethiopia's horticulture, a major source of foreign currency and employment, is facing...

Jul 21 , 2024 . By AKSAH ITALO

Commercial banks are now permitted to acquire equity shares in capital market service...