Dec 10 , 2018

By Million Kibret

A retired African businessman planning to spend the remaining days of his life travelling the planet approached a consultant seeking advice on how he could manage his plan without the gruesome procedures of request and approval for visas to different countries.

The consultant’s proposal was simple and effective: buy citizenship of St. Kitts and Nevis - a small island country smart enough to monetize endowments. With a St. Kitts and Nevis passport, one can visit about 150 countries across the globe without the hustle of prior approval of visas. A non-refundable contribution of 150,000 dollars to an economic growth fund can enable one to obtain the passport of this island nation.

The small Caribbean island is not alone in graciously granting citizenship for money. The beautiful island of Mauritius grants permanent residence for the purchase of real estate property amounting to half a million dollars or more.

Larger and much wealthier countries also exercise similar schemes to boost their foreign currency reserves. Spain’s golden visa program, which can lead to citizenship, asks for 500,000 Euros in real estate investment.

This is not to mention global superpowers. Investment of at least half a million dollars in selected areas of the United States can be the way for conditional residence, which can trigger the much-coveted US passport. That commercial enterprise should be able to benefit the country’s economy and create at least 10 permanent job opportunities.

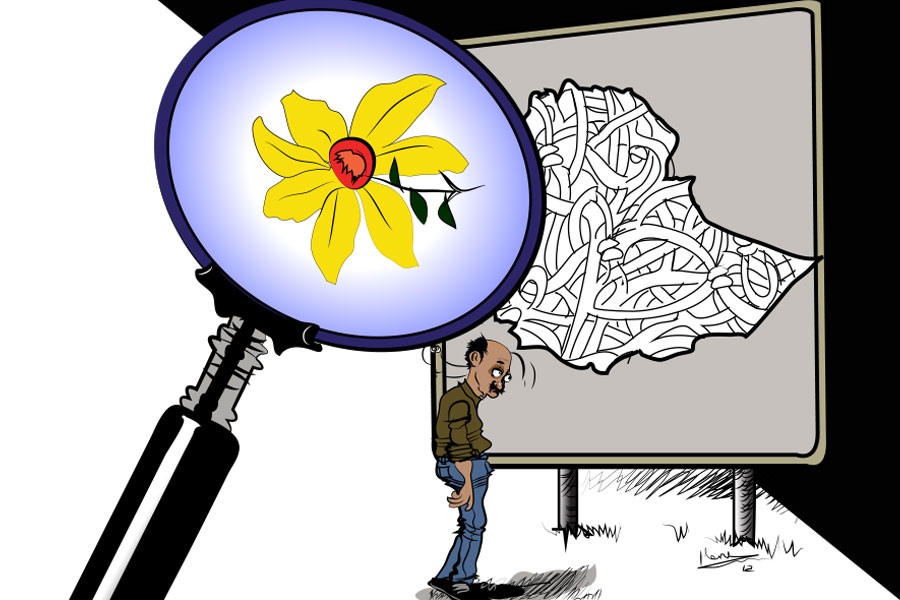

Ethiopia’s government should consider similar schemes to boost scarce forex reserves. One simple option would be permission for the acquisition of residential properties by non-nationals of non-Ethiopian origin.

The current regulation in Ethiopia prevents non-national individuals from acquiring residential homes for their private use. This can be modified to address global high net worth individuals who can acquire luxury homes north of a certain threshold, perhaps 300,000 dollars. This is easier to control as property buying non-nationals can be required to present proof of transfer of the foreign currencies for the acquisition of the properties.

Pumping in foreign currencies for the acquisition of property is just one major advantage in this scheme. The practice can encourage global high net worth individuals to consider our nation as one of the destinations for their leisure and pleasure, thereby encouraging their peers to follow.

The cosmopolitan vibe of a city is among the major attractions of a country. The day-to-day spending of these wealthy individuals can also significantly increase the velocity of the economy, which, in turn, can create job opportunities for Ethiopians.

Such initiatives should be met by driving forward with initiatives to encourage remittances. As a quietly performing child may not attract as much attention of the parents like her loud and rambunctious sibling, this quietly, high-performing sector in terms of generating foreign currency for the country, personal transfers, has not attracted the government's attention in terms of incentives and investment.

This is compared to the loud sibling, the manufacturing industry, which the government has consistently given incentives but continues to perform under expectations, contributing just five percent to the last fiscal year’s gross domestic product (GDP) growth rate.

Having generated over five billion dollars last year, remittances finance about a third of the nation’s entire cost of imports in goods, which signifies its vitality and importance.

Remittances can thus further be enhanced by increasing the sources to include non-nationals of non-Ethiopian origin in addition to our people in foreign lands. With non-nationals having permanent residences here comes their increased engagement on our soil, resulting in much more money spent in Ethiopia.

Selling residential properties for personal use to high net worth individuals can, therefore, play its role in boosting our forex reserves, as it is doing for other countries.

PUBLISHED ON

Dec 10,2018 [ VOL

19 , NO

972]

News Analysis | Jan 01,2022

Fortune News | Dec 14,2019

Viewpoints | Feb 20,2021

Radar | Nov 30,2019

Editorial | Sep 11,2020

Editorial | May 06,2023

Viewpoints | Jul 30,2022

Fortune News | Feb 23,2019

Viewpoints | Aug 16,2020

Radar | Aug 05,2023

My Opinion | 131451 Views | Aug 14,2021

My Opinion | 127803 Views | Aug 21,2021

My Opinion | 125784 Views | Sep 10,2021

My Opinion | 123419 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...

Jun 29 , 2025

Addis Abeba's first rains have coincided with a sweeping rise in private school tuition, prompting the city's education...

Jun 29 , 2025 . By BEZAWIT HULUAGER

Central Bank Governor Mamo Mihretu claimed a bold reconfiguration of monetary policy...

Jun 29 , 2025 . By BEZAWIT HULUAGER

The federal government is betting on a sweeping overhaul of the driver licensing regi...

Jun 29 , 2025 . By NAHOM AYELE

Gadaa Bank has listed 1.2 million shares on the Ethiopian Securities Exchange (ESX),...